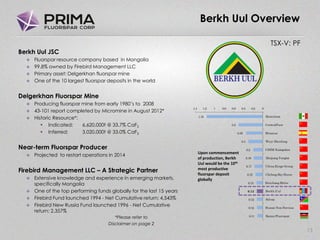

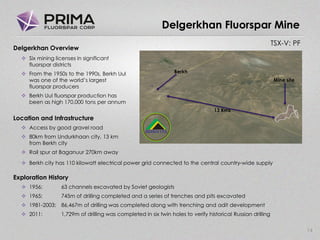

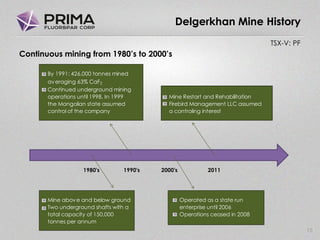

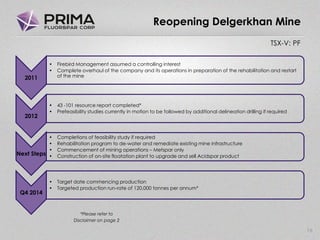

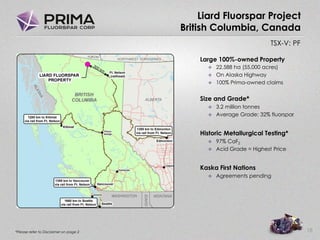

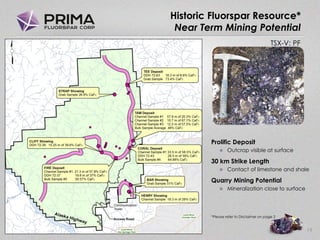

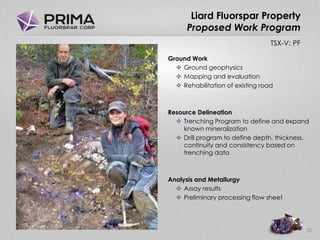

Prima Fluorspar Corp has entered into a non-binding LOI to acquire 99.8% of Berkh Uul JSC, which owns the Delgerkhan fluorspar deposit in Mongolia. A 43-101 technical report from 2012 estimated the Delgerkhan deposit contains 6.6 million tonnes indicated and 3 million tonnes inferred at 33.7% and 33% CaF2 respectively. The acquisition would provide Prima with a near-term producing fluorspar asset, as restart of operations at Delgerkhan is slated for 2014. Prima also owns the Liard fluorspar property in BC with a historical resource of 3.2 million tonnes at 32% CaF