The document provides an overview of the procedures involved in an initial public offering (IPO) and follow-on public offering (FPO). It discusses that an IPO is when a private company first offers shares to the public, transforming into a public company to raise expansion capital. A FPO is a subsequent public offering by an already publicly traded company, which can dilute existing shareholders or allow some to decrease their ownership stakes. The roles of intermediaries like book runners, bankers, and underwriters in pricing and managing the offerings are also outlined.

![Pricing Of Public Issues

Vivaswan Pathak

The report aims at providing an insight into the procedures involved

in a public issue – namely the Initial Public Offer (IPO) and Follow-on

Public Offer (FPO)

CPCFM

Indian Institute of Foreign Trade

Roll Number 13

vivaswan_ocfm1@iift.ac.in

[Pick the date]](https://image.slidesharecdn.com/pricingofpublicissues-140116220320-phpapp02/75/Pricing-of-public-issues-in-India-1-2048.jpg)

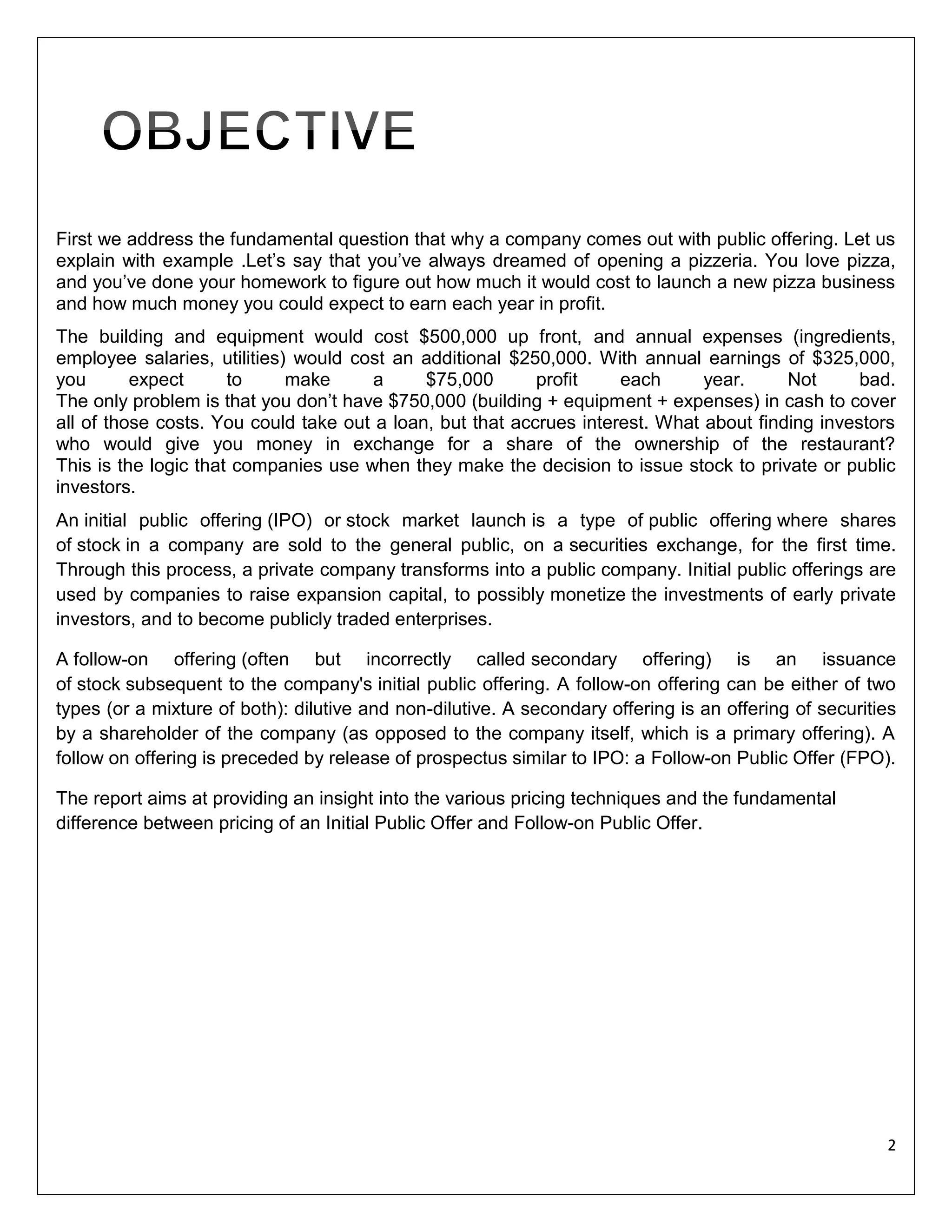

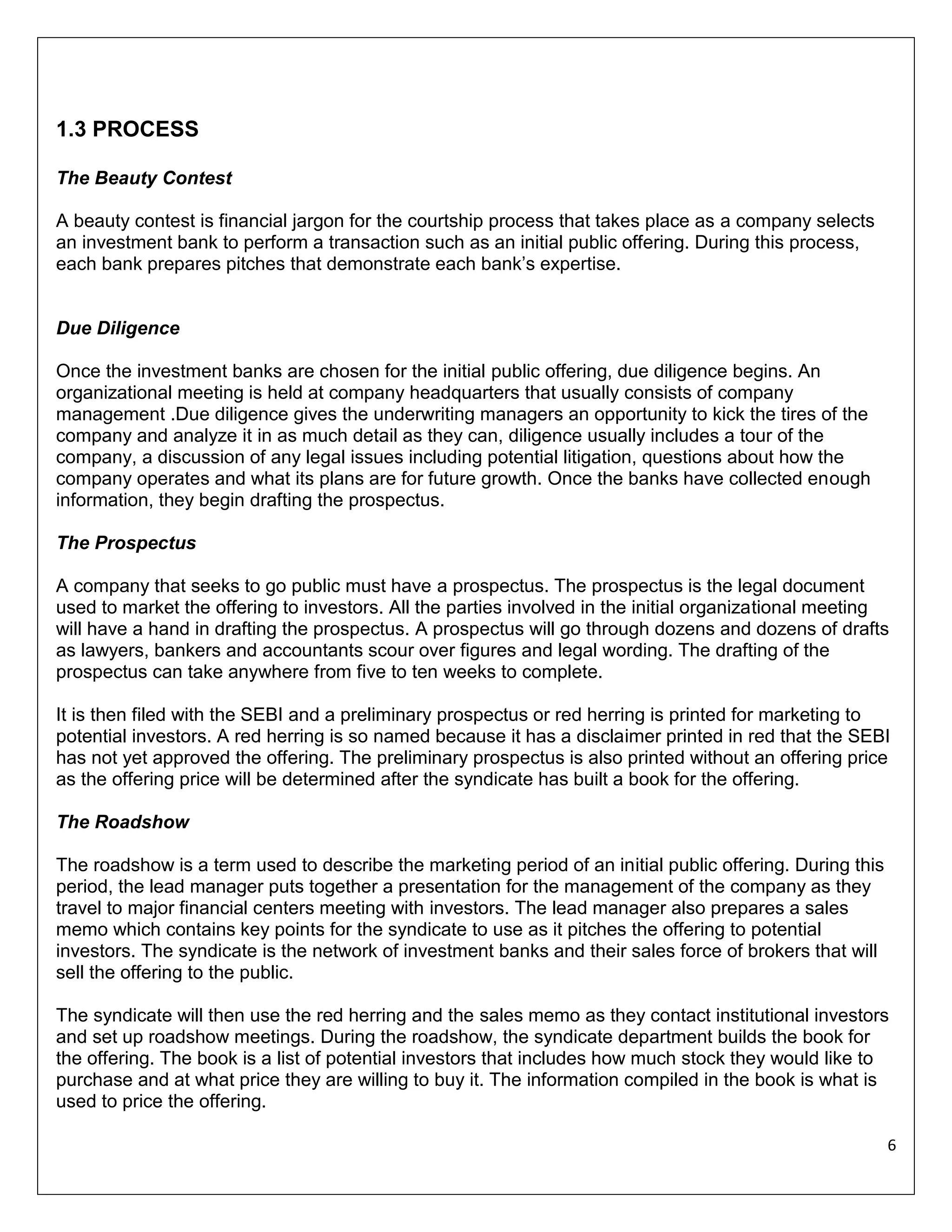

![b) ONGC

Few highlights about ONGC:

1.

2.

3.

4.

ONGC is a Fortune Global 500 company ranked 413.

ONGC is Asia's largest and most active company.

ONGC is at Rank 18th in top Global Energy Company Rankings.

ONGC contribute 77% of India's crude oil production and 81% of India's natural gas

production.

5. Objects of the Issue:

6. The object of the Offer is to carry out the disinvestment of 427,774,504 Equity Shares by the

Selling Shareholder.

7. Issue Detail:

8. »» Issue Open:

»» Issue Type: 100% Book Built Issue FPO

»» Issue Size: 427,774,504 Equity Shares of Rs. 5

»» Issue Size: Rs. [.] Crore

»» Face Value: Rs. 5 Per Equity Share

»» Issue Price: Rs. - Rs. Per Equity Share

»» Market Lot:

»» Minimum Order Quantity:

»» Listing At: BSE, NSE

9. ONGC Pre-FPO and Post-FPO Shareholding Pattern

Percentage of

Shareholding

Name of the Holder(s)

President of India

PreFPO

PostFPO

74.14%

Indian Oil Corporation Ltd.

7.69%

Gas Authority of India Ltd.

2.40%

Life Insurance Corporation of India

3.06%

Public

1.95%

Others

10.76%

Total

100%

16](https://image.slidesharecdn.com/pricingofpublicissues-140116220320-phpapp02/75/Pricing-of-public-issues-in-India-17-2048.jpg)

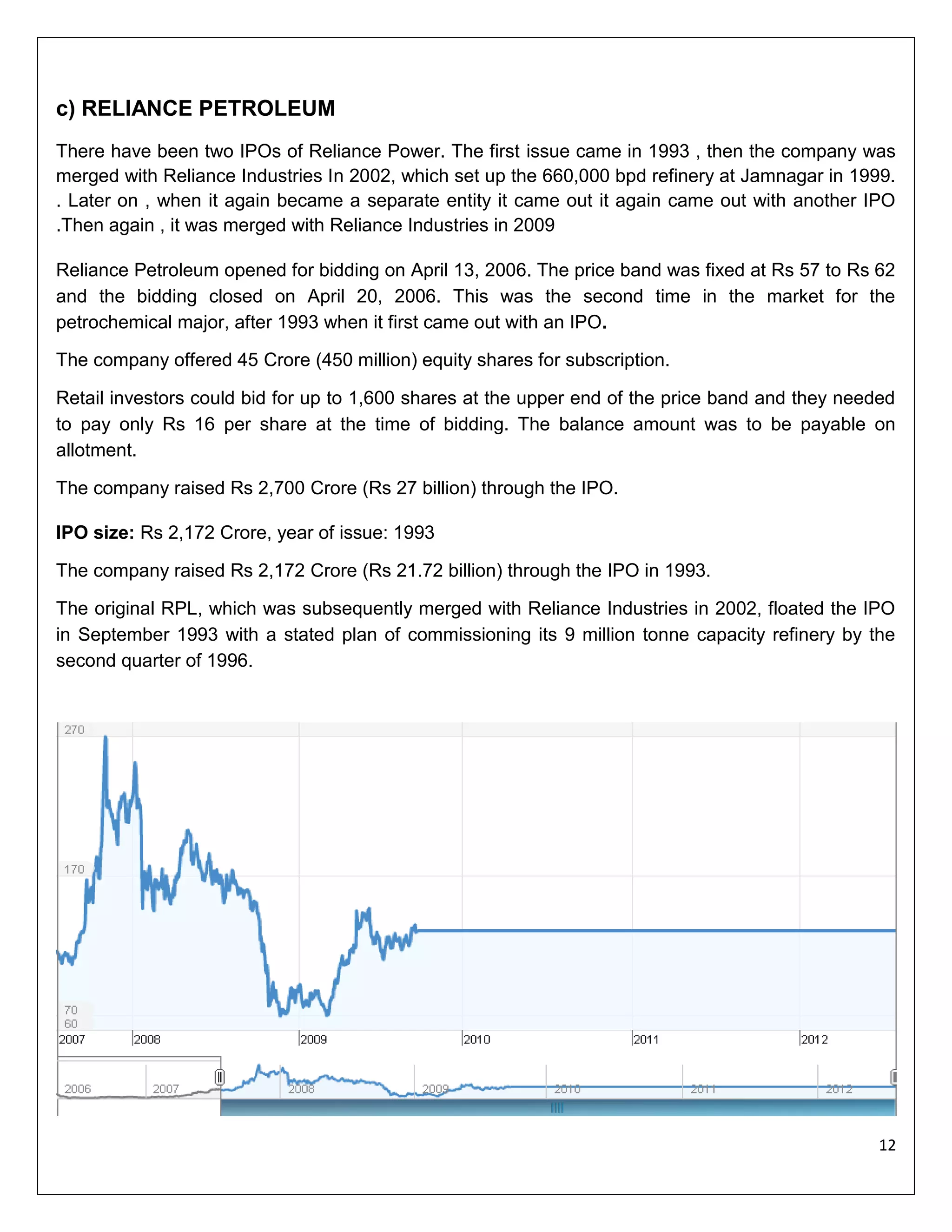

![FACEBOOK IPO

The social networking company Facebook, Inc. held its initial public offering (IPO) on May 18,

2012.[1] The IPO was one of the biggest in technology, and the biggest in Internet history, with a peak

market capitalization of over $104 billion.

There was an estimate cut by the underwriters signaling the weak growth of the company in the

second quarter. The estimate cut, moreover, was followed by three additional pieces of information

that were interpreted negatively by some institutional investors:

1) The price range for the deal was increased, which made the deal even less attractive in light of

the estimate cut,

2) The size of the deal was increased, which meant that more stock would be sold, and

3) Many smart institutional Facebook shareholders like Goldman Sachs decided to sell more

stock on the deal—the "smart money," in other words, was cashing out.

Institutional investors, having digested the news of the underwriter estimate cut, were comfortable

buying Facebook stock at $32 a share.

Retail investors, meanwhile, who were presumably unaware of the estimate cut, were comfortable

buying Facebook at $40 a share.

Knowing that a big percentage of the IPO stock could be sold to retail investors instead of institutional

investors, Facebook and Morgan Stanley decided to price the IPO at $38.

Ultimately underwriters settled on a price of $38 per share, at the top of its target range.

First day

Trading was to begin at 11:00 am Eastern Time on Friday, May 18, 2012. However, trading was

delayed until slightly half an hour due to technical problems with the NASDAQ exchange. Those early

jitters would foretell ongoing problems; the first day of trading was marred by numerous technical

glitches that prevented orders from going through, or even confused investors as to whether or not

their orders were successful.

Initial trading saw the stock shoot up to as much as $45. Yet the early rally was unsustainable. The

stock struggled to stay above the IPO price for most of the day, forcing underwriters to buy back

shares to support the price. Only the aforementioned technical glitches and underwriter support

prevented the stock price from falling below the IPO price on the first day of trading.

21](https://image.slidesharecdn.com/pricingofpublicissues-140116220320-phpapp02/75/Pricing-of-public-issues-in-India-22-2048.jpg)

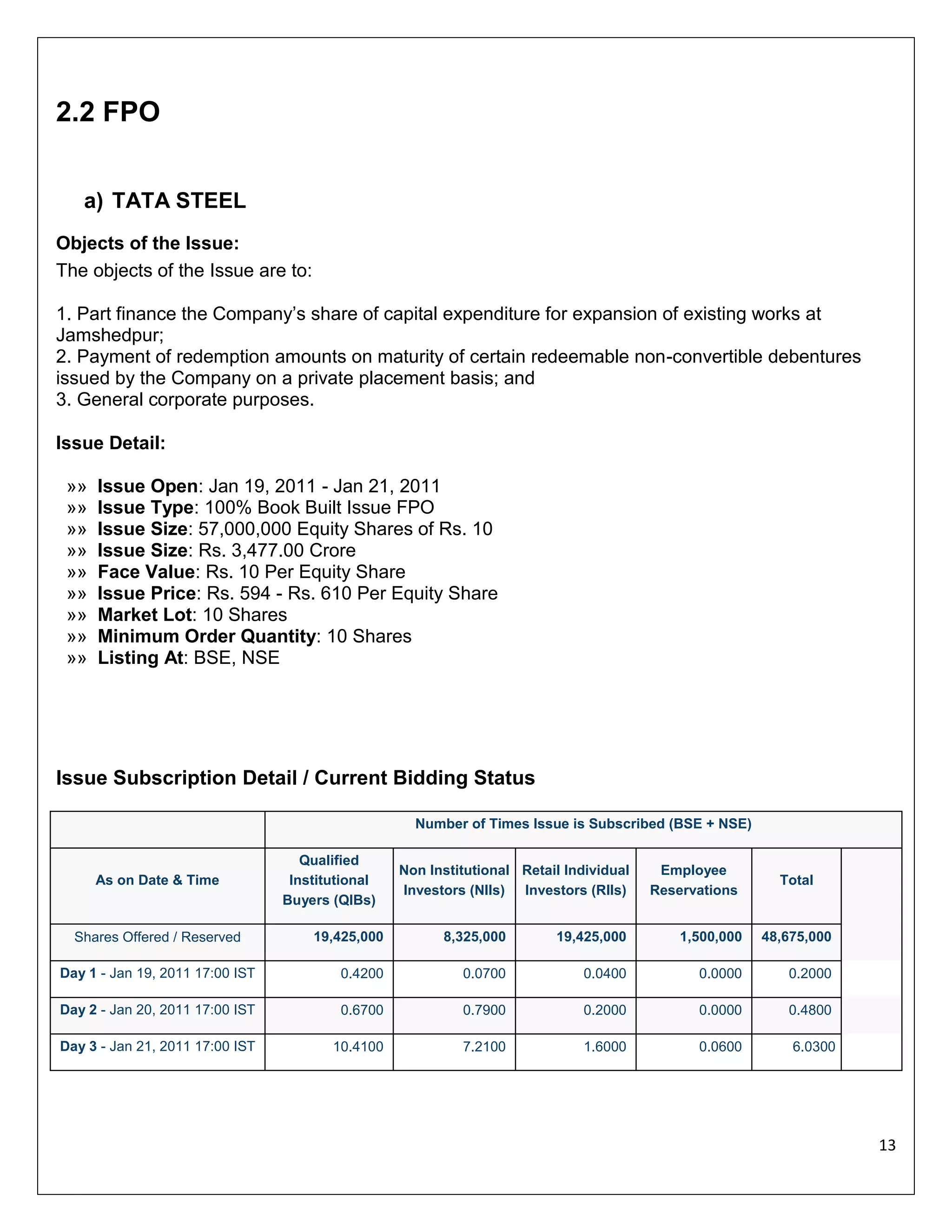

![At closing bell, shares were valued at $38.23, only $0.23 above the IPO price and down $3.82 from

the opening bell value. The opening was widely described by the financial press as a disappointment.

Despite technical problems and a relatively low closing value, the stock set a new record for trading

volume of an IPO (460 million shares). The IPO also ended up raising $16 billion

Aftermath

The IPO had immediate impacts on the stock market. Other technology companies took hits, while

the exchanges as a whole saw dampened prices. Investment firms faced considerable losses due to

technical glitches. Bloomberg estimated that retail investors may have lost approximately $630 million

on Facebook stock since its debut The IPO impacted both Facebook investors and the company

itself. It was said to provide healthy rewards for venture capitalists that finally saw the fruits of their

labor.] In contrast, it was said to negatively affect individual investors such as Facebook employees,

who saw once-valuable shares become less lucrative.[13] More generally, the disappointing IPO was

said to lower interest in the stock by investors. The IPO could jeopardize profits for underwriters who

face investors skeptical of the technology industry. In the long-run, the troubled process "makes it

harder for the next social-media company that wants to go public." Reuters' Alistair Barr reported

that Facebook's lead underwriters, Morgan Stanley (MS), JP Morgan (JPM), and Goldman

Sachs (GS) all cut their earnings forecasts for the company in the middle of the IPO roadshow. ] Some

have filed lawsuits, alleging that an underwriter for Morgan Stanley selectively revealed adjusted

earnings estimates to preferred clients. The remaining underwriters (MS, JPM, and GS) and

Facebook's CEO and board are also facing litigation. It is believed that adjustments to earnings

estimates were communicated to the underwriters by a Facebook financial officer, who in turn used

the information to cash out on their positions while leaving the general public with overpriced shares.

Additionally, a class-action lawsuit is being prepared] due to the trading glitches, which led to botched

orders. Apparently, the glitches prevented a number of investors from selling the stock during the first

day of trading while the stock price was falling - forcing them to incur bigger losses when their trades

finally went through.

In June 2012, Facebook asked for all the lawsuits to be consolidated into one, because of overlap in

their content. Facebook's IPO is now under investigation by SEC and has been compared to pump

and dump schemes. Massachusetts Secretary of State William Galvin subpoenaed Morgan

Stanley over the same issue.

22](https://image.slidesharecdn.com/pricingofpublicissues-140116220320-phpapp02/75/Pricing-of-public-issues-in-India-23-2048.jpg)