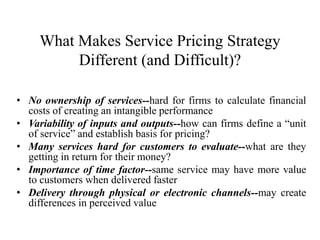

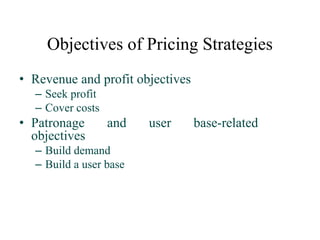

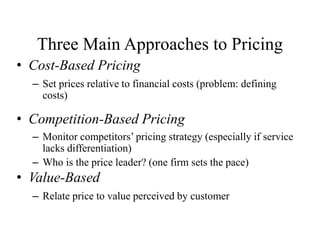

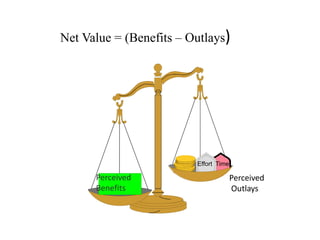

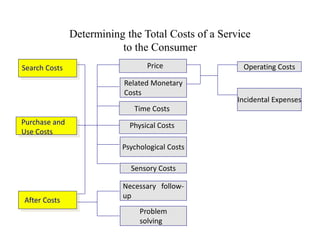

Pricing services presents unique challenges as services are intangible and costs are difficult to define. Three main approaches to pricing are cost-based using activity-based costing, competition-based by monitoring competitors, and value-based by relating price to customer perceived value. Customers consider both financial and non-financial costs in their perception of service value. Effective pricing strategies reduce uncertainty, build relationships through incentives, and convince customers quality is not tied to low price.