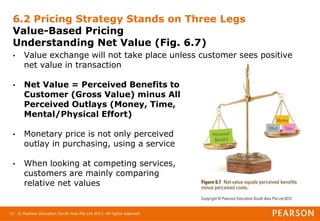

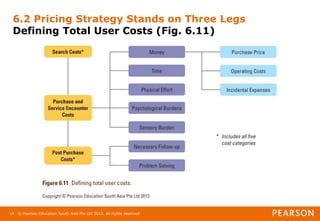

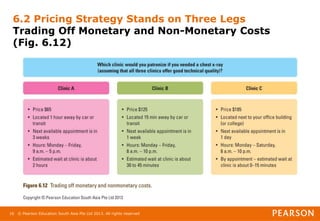

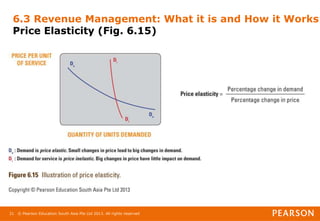

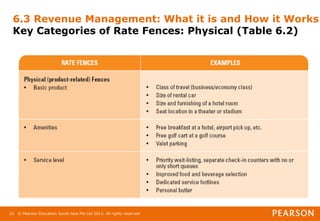

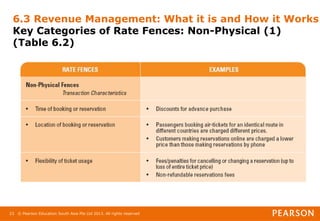

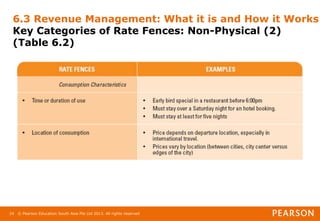

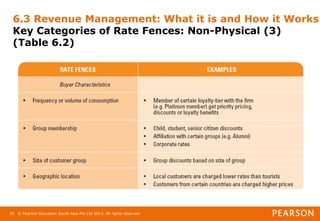

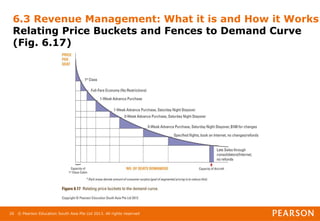

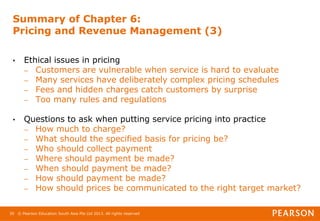

This document outlines chapters from a textbook on service marketing. Chapter 6 discusses setting prices and implementing revenue management for services. It covers effective pricing strategies, using cost-based, value-based, and competition-based approaches. Revenue management aims to maximize revenue by charging different customer segments different prices based on price sensitivity. The chapter also addresses ethical concerns in complex pricing structures and puts pricing strategies into practice.