This document discusses various pricing strategies and methods. It covers:

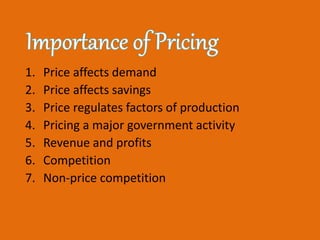

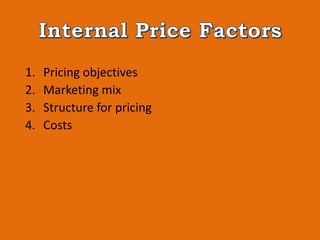

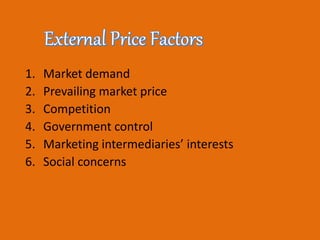

1. Defining price and the factors that affect pricing like costs, demand, competition.

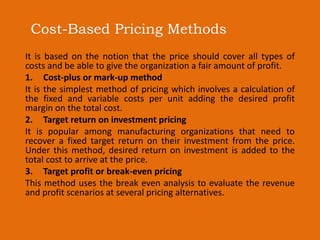

2. Different cost-based pricing methods like cost-plus and target return on investment.

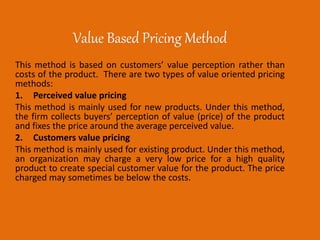

3. Value-based methods like perceived value and customer value pricing.

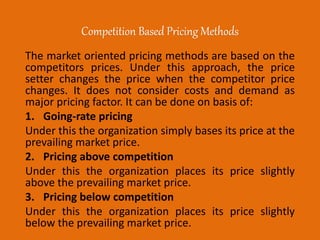

4. Competition-based methods like going-rate, pricing above/below competitors.

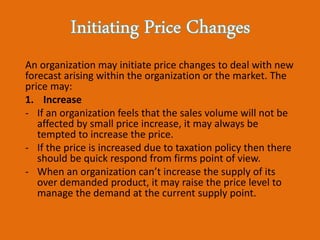

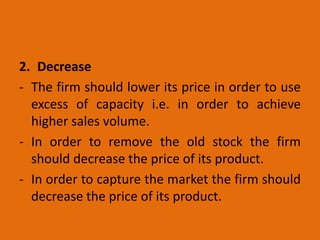

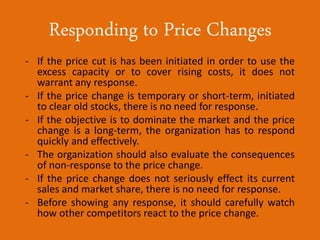

5. Other strategies like price lining, product life cycle pricing, and responding to price changes.