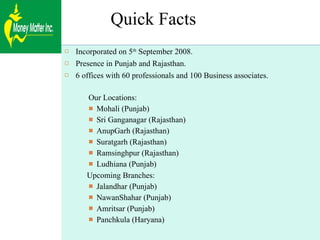

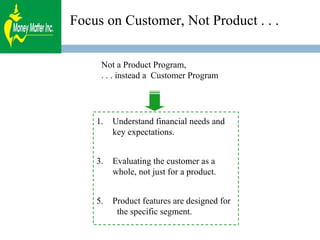

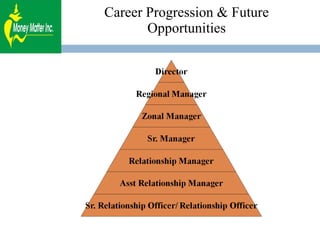

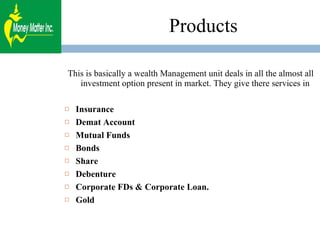

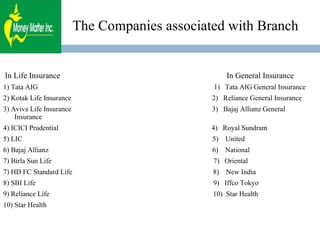

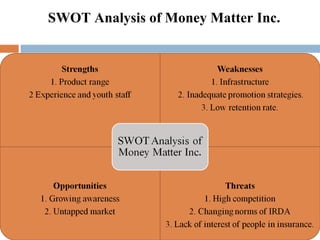

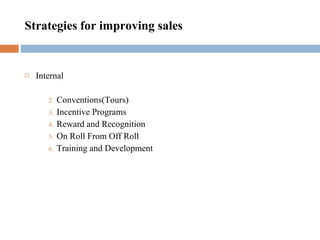

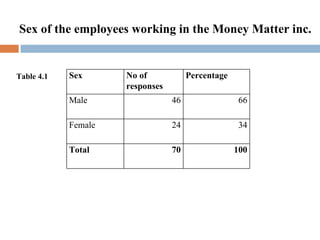

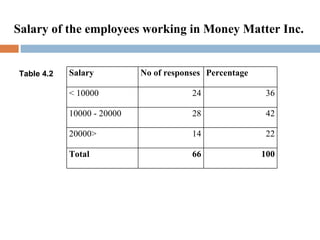

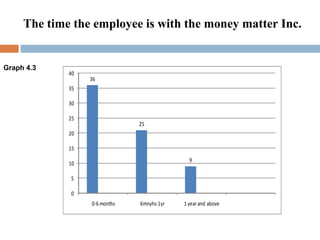

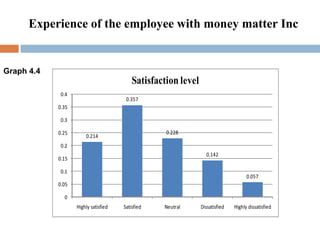

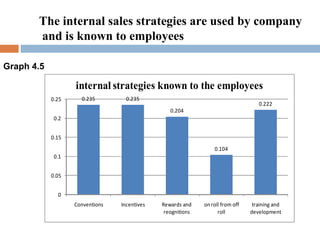

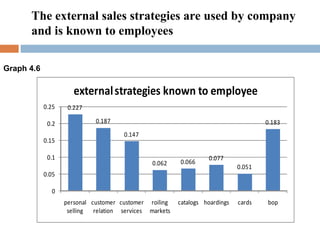

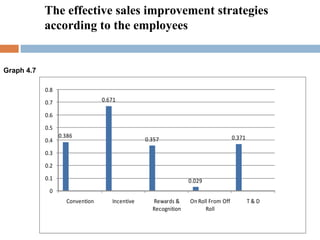

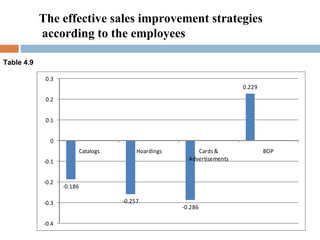

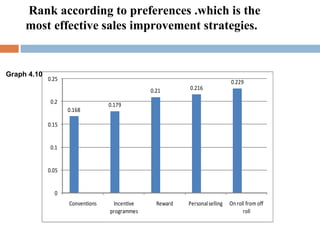

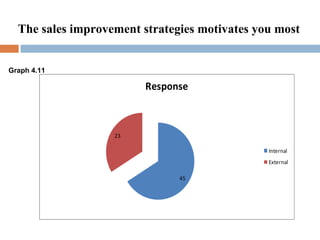

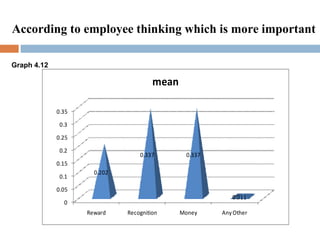

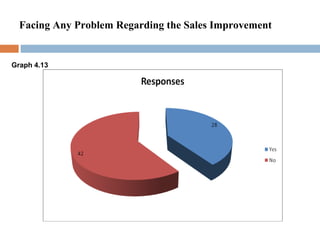

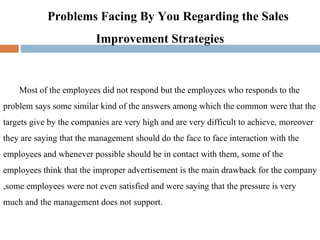

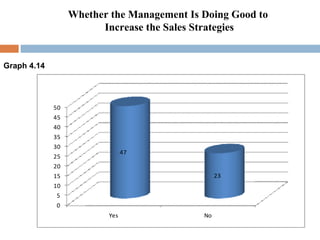

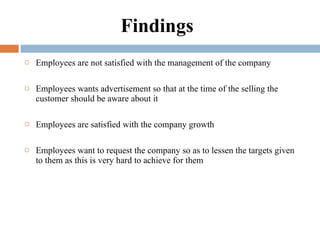

Money Matter Inc. is a wealth management company with branches in Punjab and Rajasthan, India. The document discusses strategies to improve sales at the Ludhiana and Chandigarh branches. It outlines internal strategies like conventions, incentives, and training, and external strategies like personal selling, customer service, and advertising. Employee surveys found that rewards, customer relations, and BOP (business on phone) were most effective. Suggestions to improve included more awareness campaigns, reduced pressure on employees, and better advertisement.