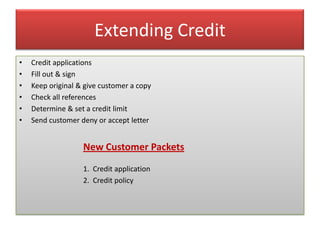

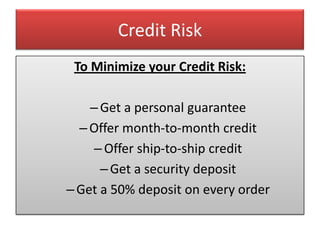

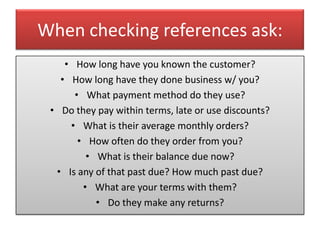

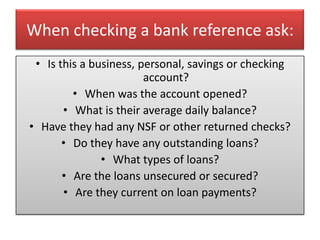

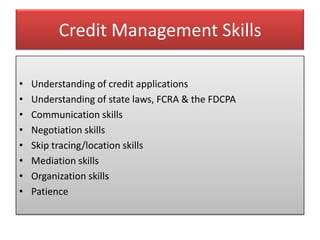

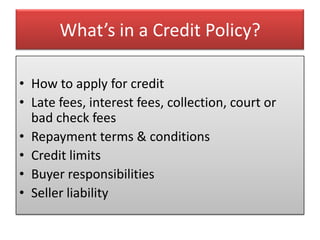

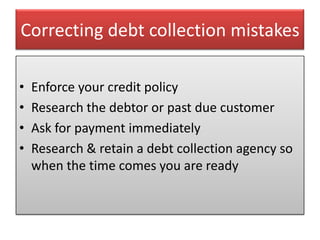

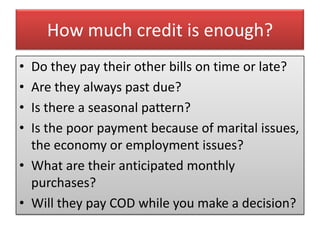

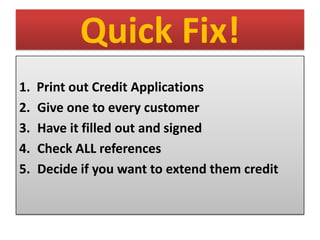

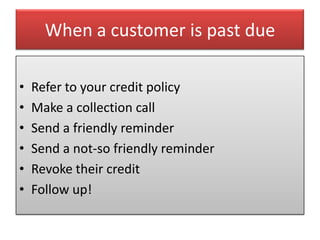

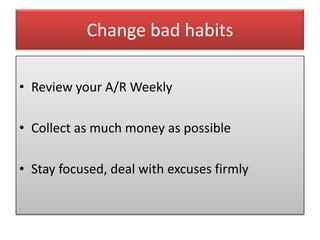

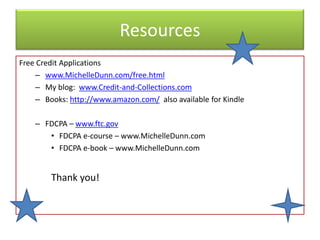

This document provides guidance on effective credit management strategies. It outlines key steps like establishing clear credit policies, checking references for new customers, extending credit judiciously by setting limits, and following up promptly on past due accounts. The objectives of credit management are to minimize risks, eliminate bad debt, and collect money owed by being fair but also enforcing policies. When customers are late on payments, the document advises referring to the credit policy, making collection calls, and potentially revoking their credit if needed. Resources for free credit applications and information on debt collection laws are also referenced.