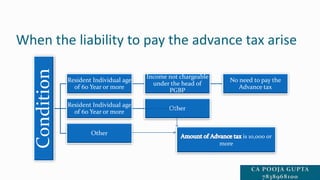

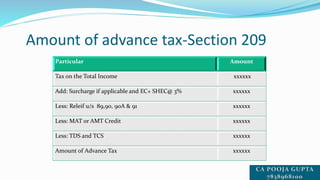

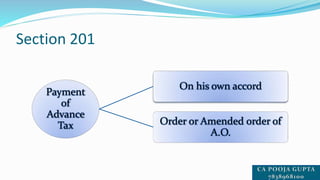

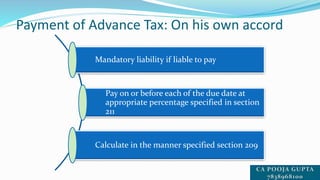

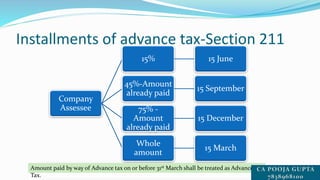

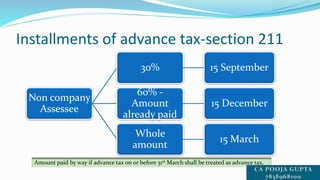

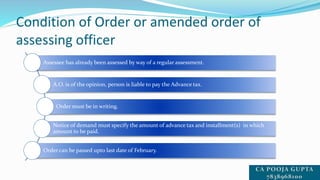

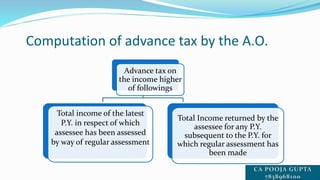

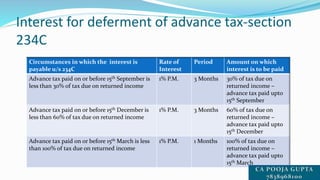

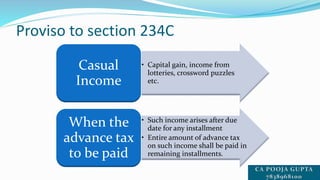

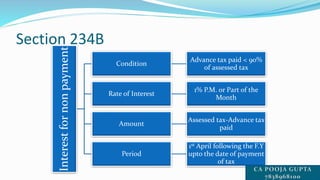

Advance tax is payable by individuals whose estimated total income exceeds ₹10,000 for the year. It is payable in installments by certain due dates each year. The document outlines how to calculate advance tax payable, the due dates for installments, and interest charges for late or non-payment of advance tax. It provides details on the conditions for payment of advance tax, how the assessing officer can order additional advance tax, and exceptions for certain types of casual income.