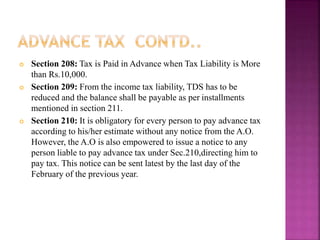

The document discusses various sections of the Indian Income Tax Act pertaining to advance tax payment, including that advance tax is due on current income and must be paid in installments over the course of the fiscal year for taxpayers whose liability exceeds Rs. 10,000. Failure to pay advance tax can result in interest charges and penalties for the taxpayer. The document also outlines applicable interest rates and periods for different scenarios involving tax payments, refunds, and defaults.

![ Adjustment when tax is paid before regular assessment under section 140A :

If before the determination of total income u/s 143(1) or completion of a regular

assessment tax is paid on the basis of self–assessment, the interest shall be

calculated as under :

a) up to the date of payment of tax u/s 140A, interest will be calculated as

mentioned above { i.e. (Tax determined – TDS/TCS-Advance tax) X ( Period

w.e.f. 1st April of A.Y. to the date of payment of tax u/s 140A) X 1%}

b) from the date of payment of tax u/s 140A, interest will be calculated on

the amount by which advance tax and tax paid u/s 140A falls short of assessed tax.

{ i.e. [Tax determined – TDS/TCS-Advance tax- (tax paid u/s 140A – Interest

chargeable u/s 234A, 234C and 234B {as calculated in clause (a) above})] X (

Period w.e.f. date of payment of tax u/s 140A to the date of assessment u/s 143(1)

or regular assessment) X 1%}

If as a result of an order under section 154, 155, 250, 254, 262, 263, 264 and

245D, the interest payable is increased or reduced, as the case may be, the interest

shall be increased/ reduced accordingly.](https://image.slidesharecdn.com/advancetaxinterestprovision-120831135606-phpapp01-140618032353-phpapp01/85/Advancetaxinterestprovision-12-320.jpg)