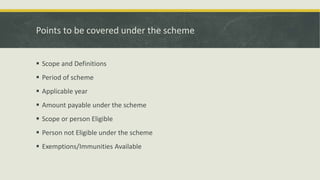

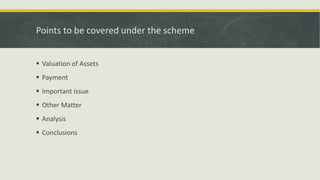

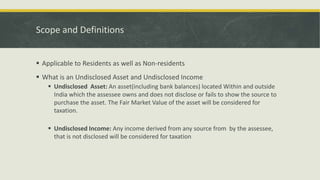

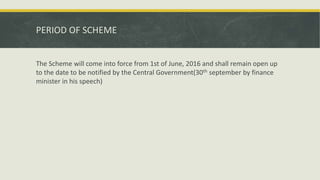

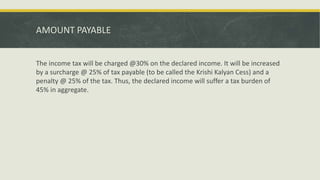

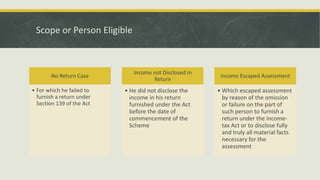

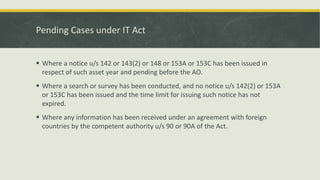

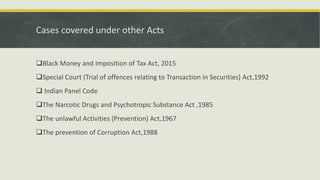

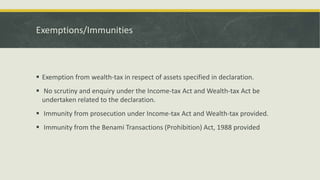

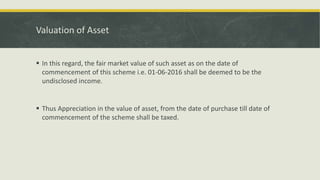

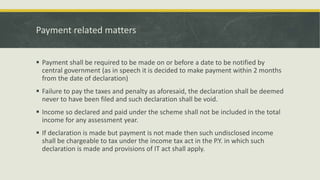

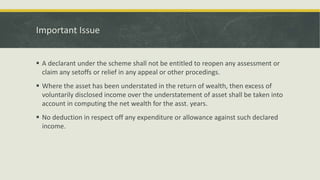

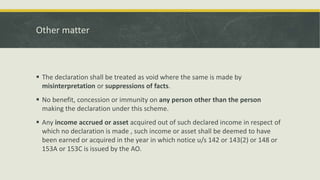

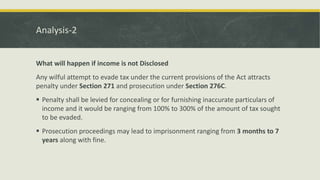

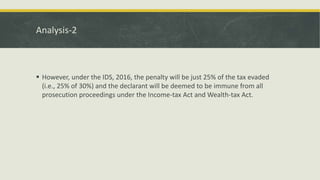

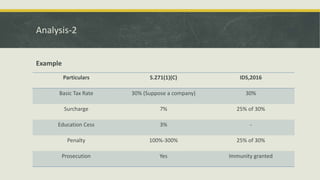

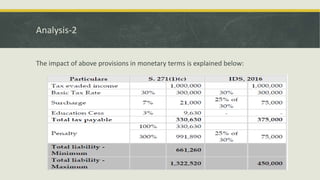

The document discusses India's Income Declaration Scheme 2016, which aims to bring undisclosed foreign income and assets into the tax system. It provides an opportunity for taxpayers to declare undisclosed income and pay taxes at 45%, and gain immunity from prosecution. However, taxpayers cannot take benefit if their case is already under investigation. The scheme is seen as more beneficial than the previous Black Money Act, but failing to disclose under the scheme risks penalties and prosecution under normal tax laws. In conclusion, the scheme provides a chance for tax evaders to clean up their finances through a moderate tax payment.