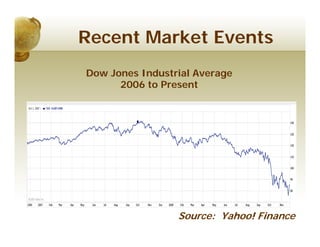

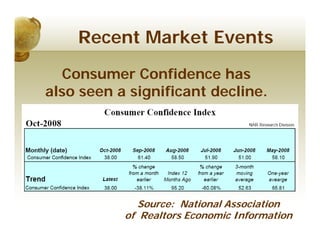

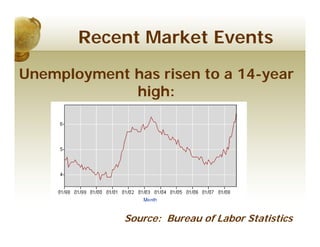

The document discusses the impacts of recent market events and the use of fair value accounting. It notes that major banks had $540 billion in level 3 assets and provides an image to illustrate the scale of that amount. It then discusses how fair value accounting involves assigning market values to assets and liabilities using three levels, and the implications this has for both managers who must reduce costs and risks, and investors who still value historical reporting. The presentation recaps the recent market conditions of falling stock prices, consumer confidence, and new home sales as well as rising unemployment, and suggests additional resources on the topic.