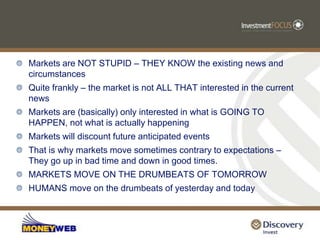

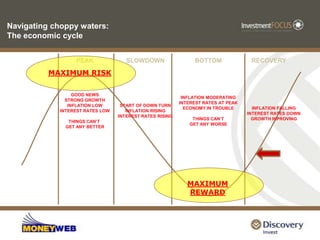

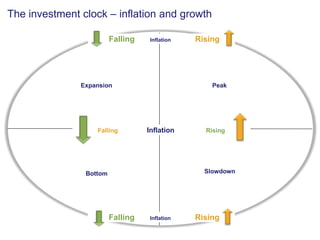

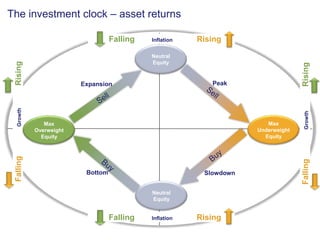

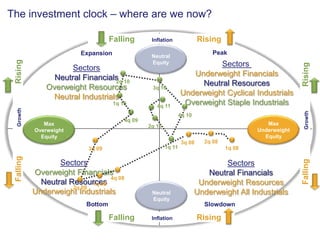

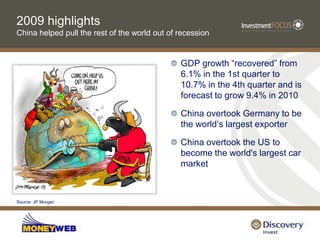

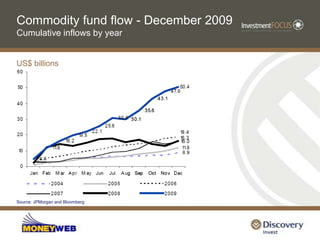

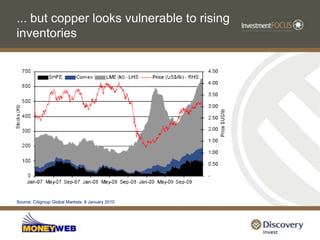

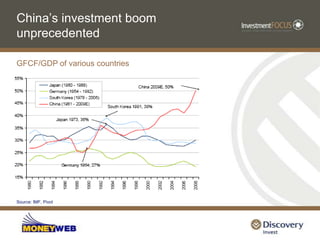

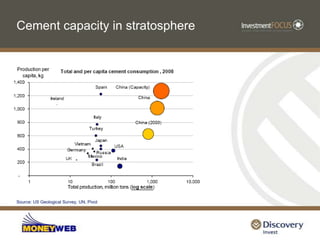

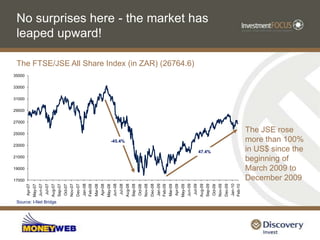

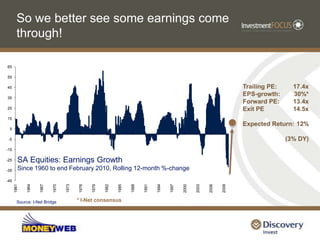

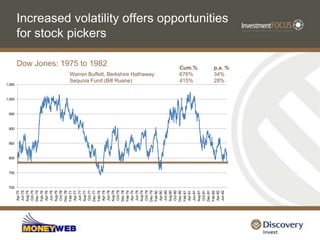

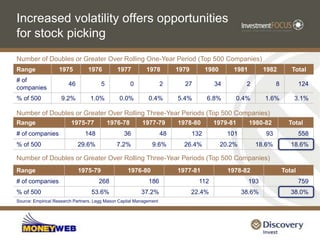

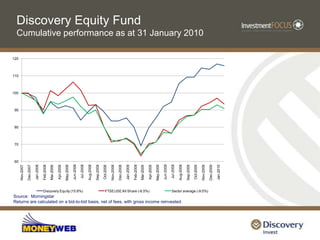

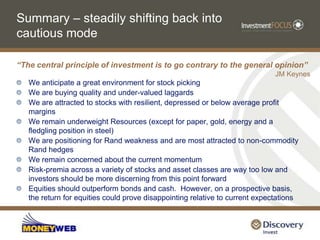

The document analyzes global investment trends from March 2010, outlining key themes such as the backlash against banks, the rise of China, European economic issues, climate change concerns, and increasing interest in Africa as an investment destination. It emphasizes the challenges investors face in navigating market uncertainties and the importance of maintaining a long-term perspective rather than reacting to short-term market fluctuations. The text concludes with investment strategies under the current economic conditions, highlighting the need for caution and selective investment in equities over bonds and cash.