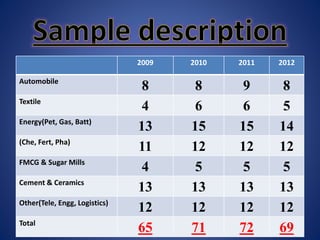

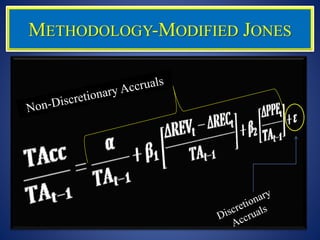

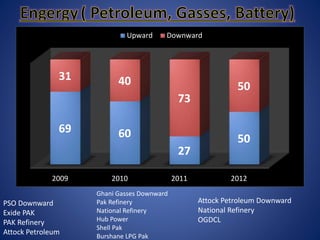

This document discusses research into income smoothing practices among Shariah compliant companies in Pakistan. It provides literature reviewing studies that found evidence of income smoothing, where companies manipulate earnings to avoid reporting losses or small decreases in earnings. The document outlines the objectives of analyzing the quality of earnings reported by Shariah compliant Pakistani companies and comparing practices between high and low market cap firms. It then describes the methodology to use Eckel's Index and modified Jones model to measure income smoothing behavior based on volatility of earnings and sales figures. Results will be analyzed between polished sample and KMI30 index as well as individual sector trends over 2009-2012.