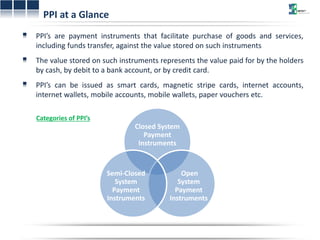

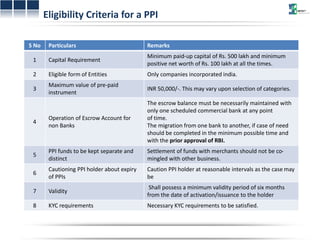

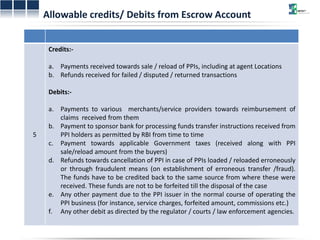

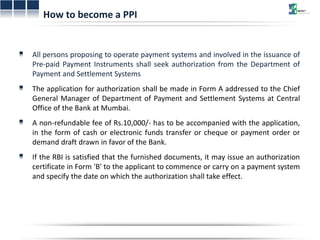

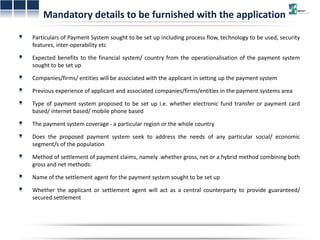

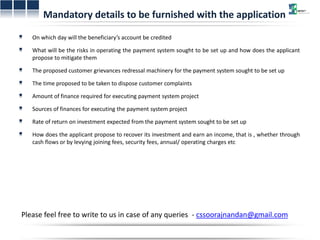

PPIs are payment instruments that allow users to purchase goods and services or transfer funds based on the stored value, which represents amounts paid by cash, debit, or credit. PPIs can be issued as cards, accounts, wallets, or vouchers. Only banks can issue open system PPIs, while non-banks can offer closed or semi-closed system PPIs. Becoming a PPI issuer requires a minimum paid-up capital, maintaining funds in an escrow account, complying with KYI requirements, and obtaining authorization from the RBI. The application process involves submitting details about the proposed payment system and being issued a certificate to operate.