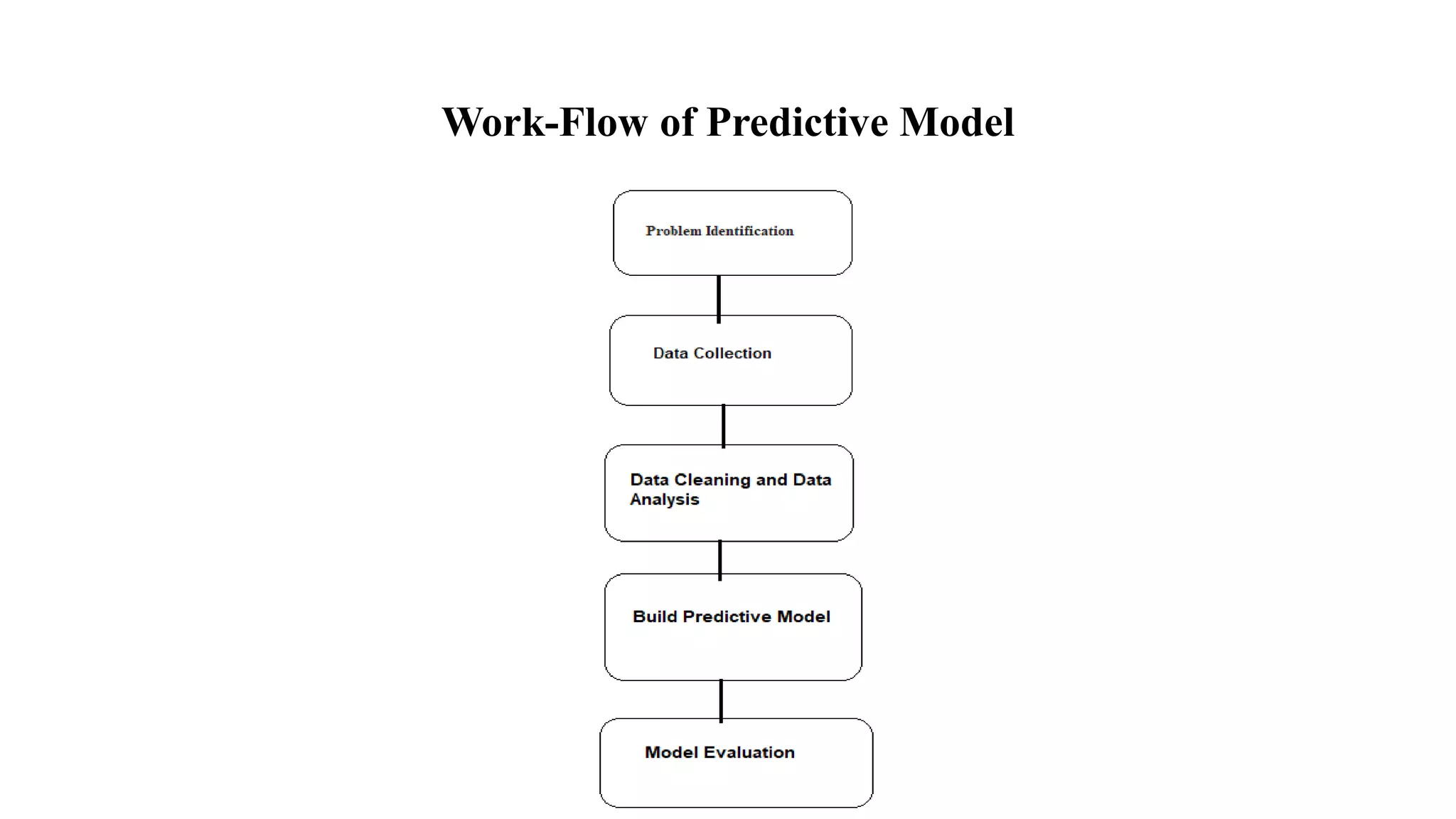

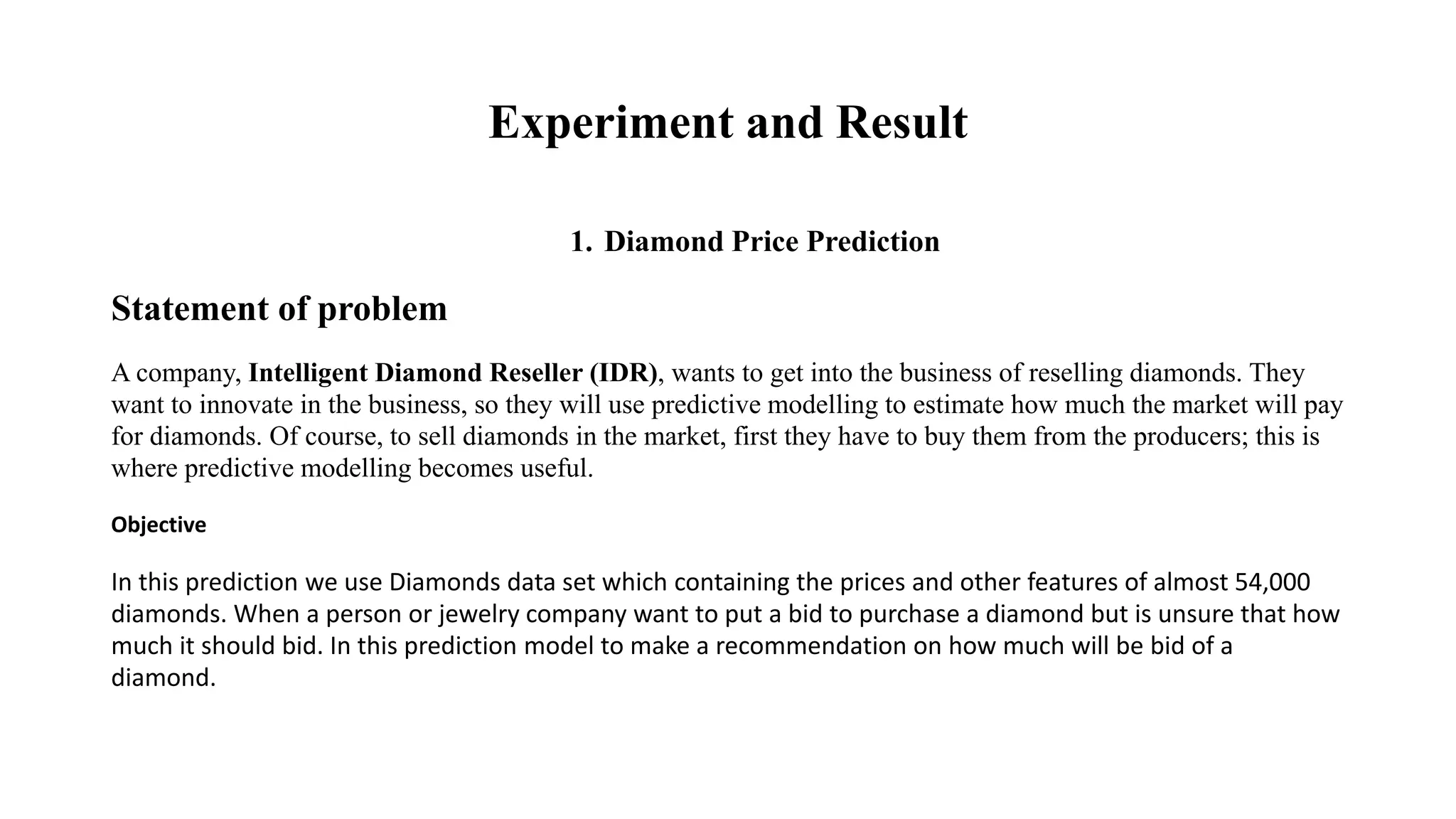

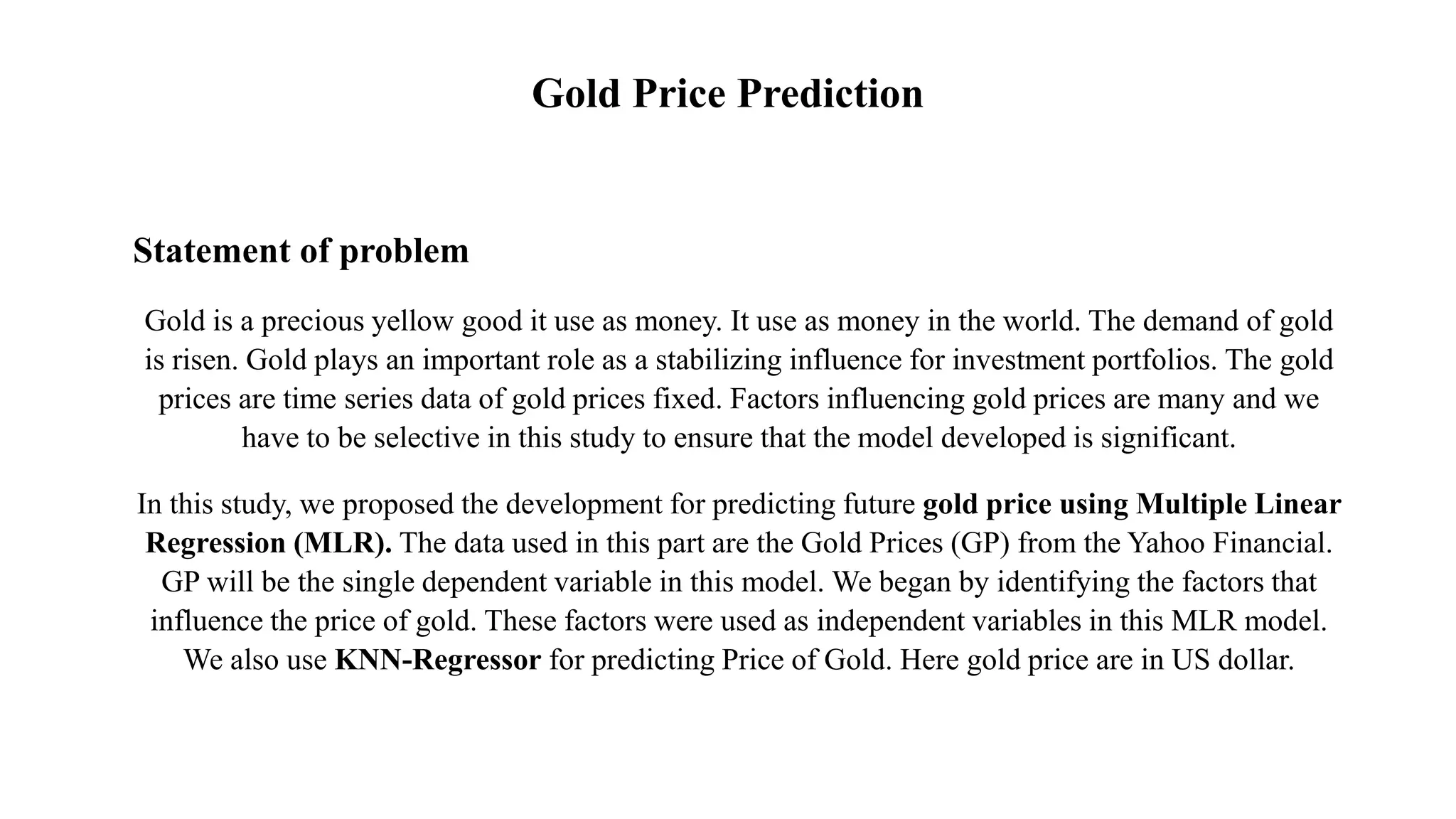

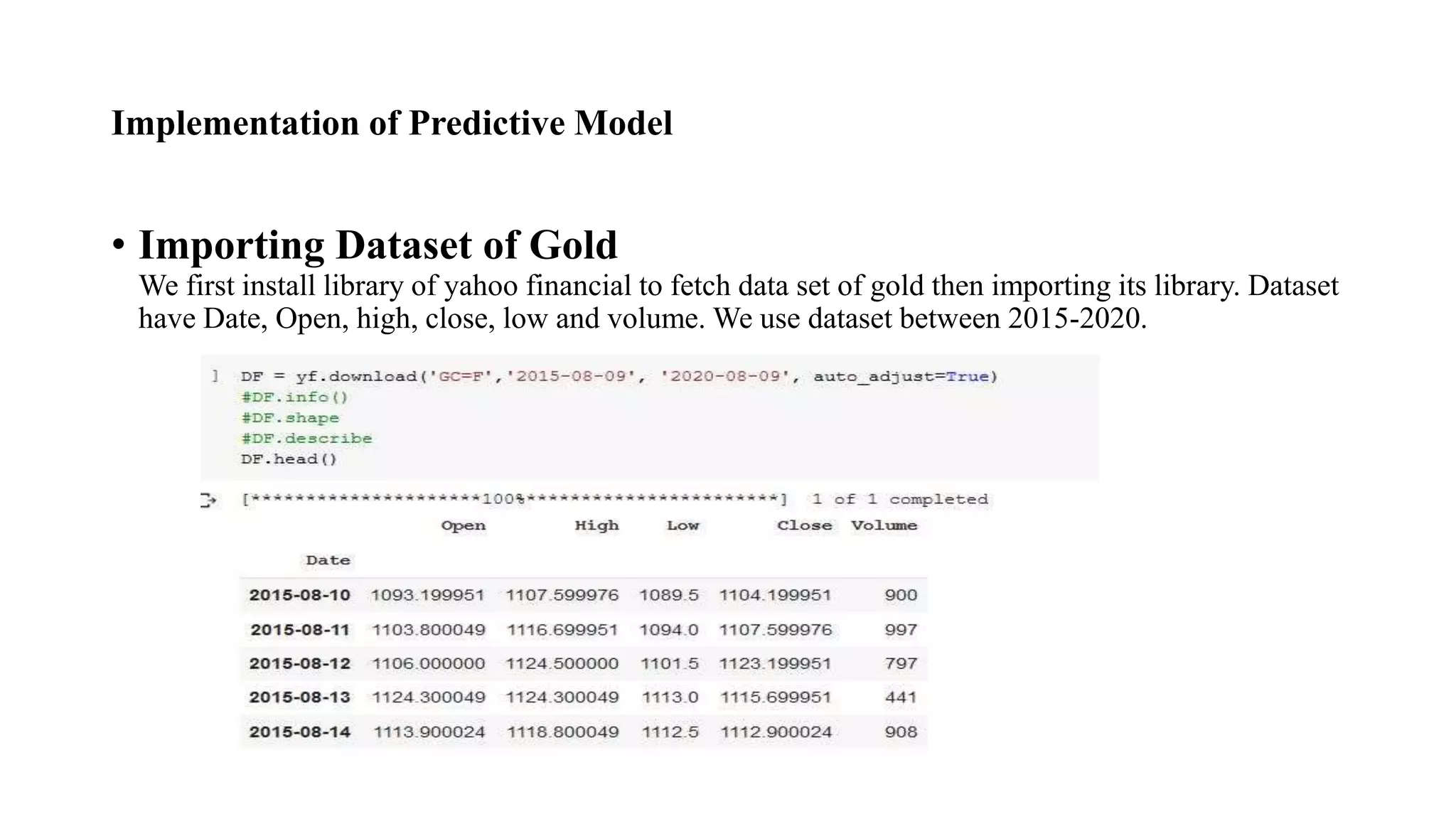

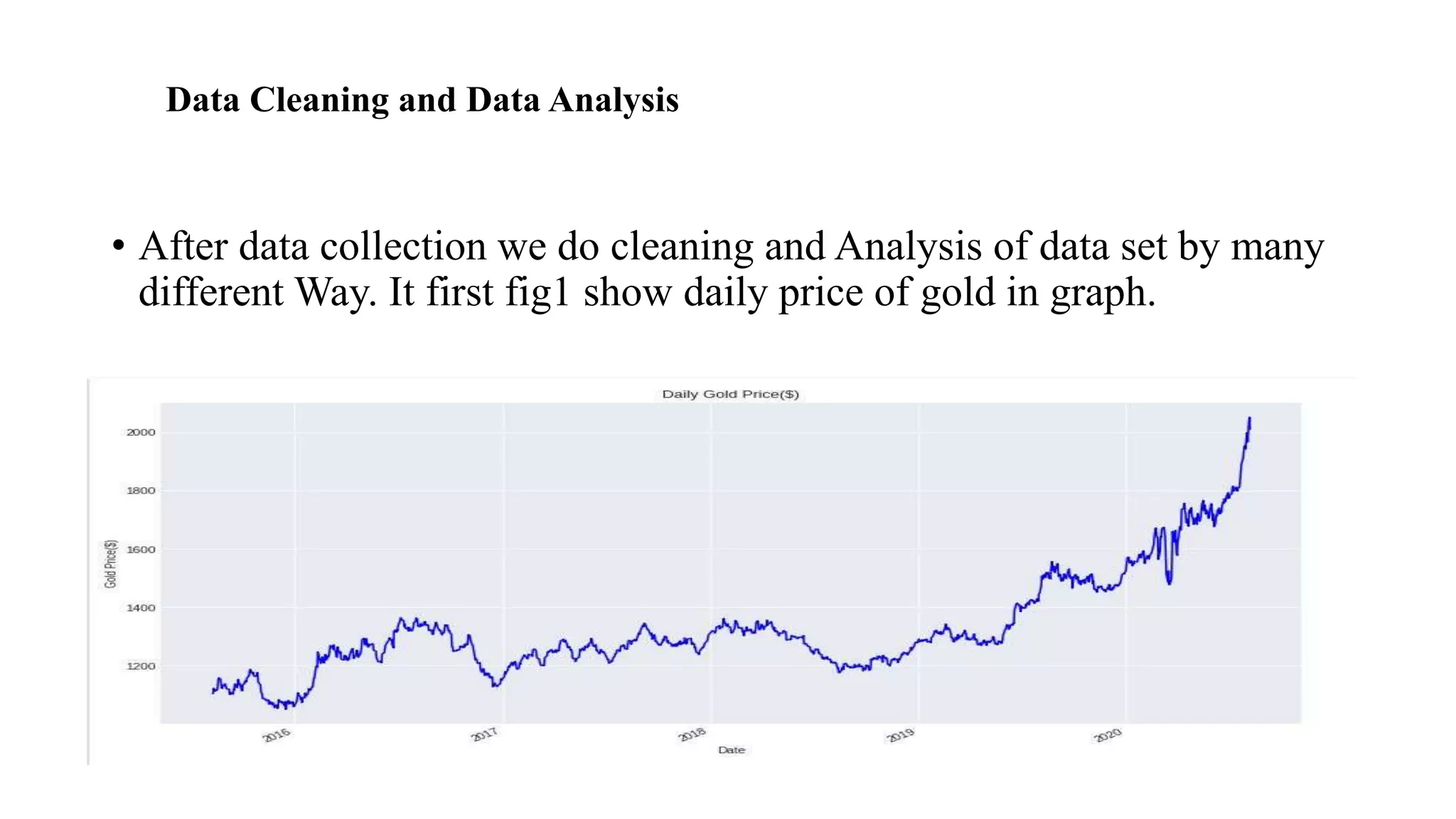

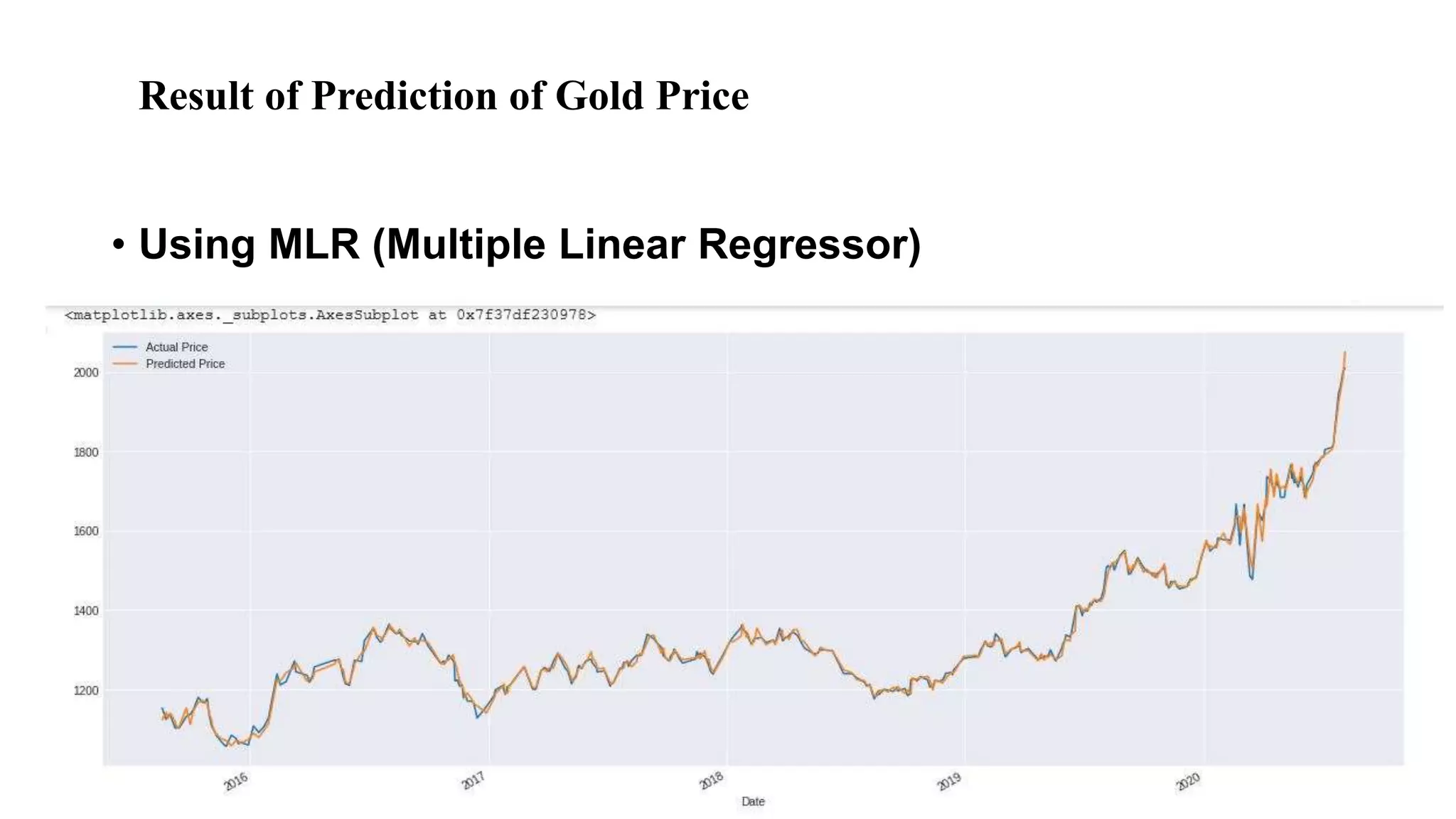

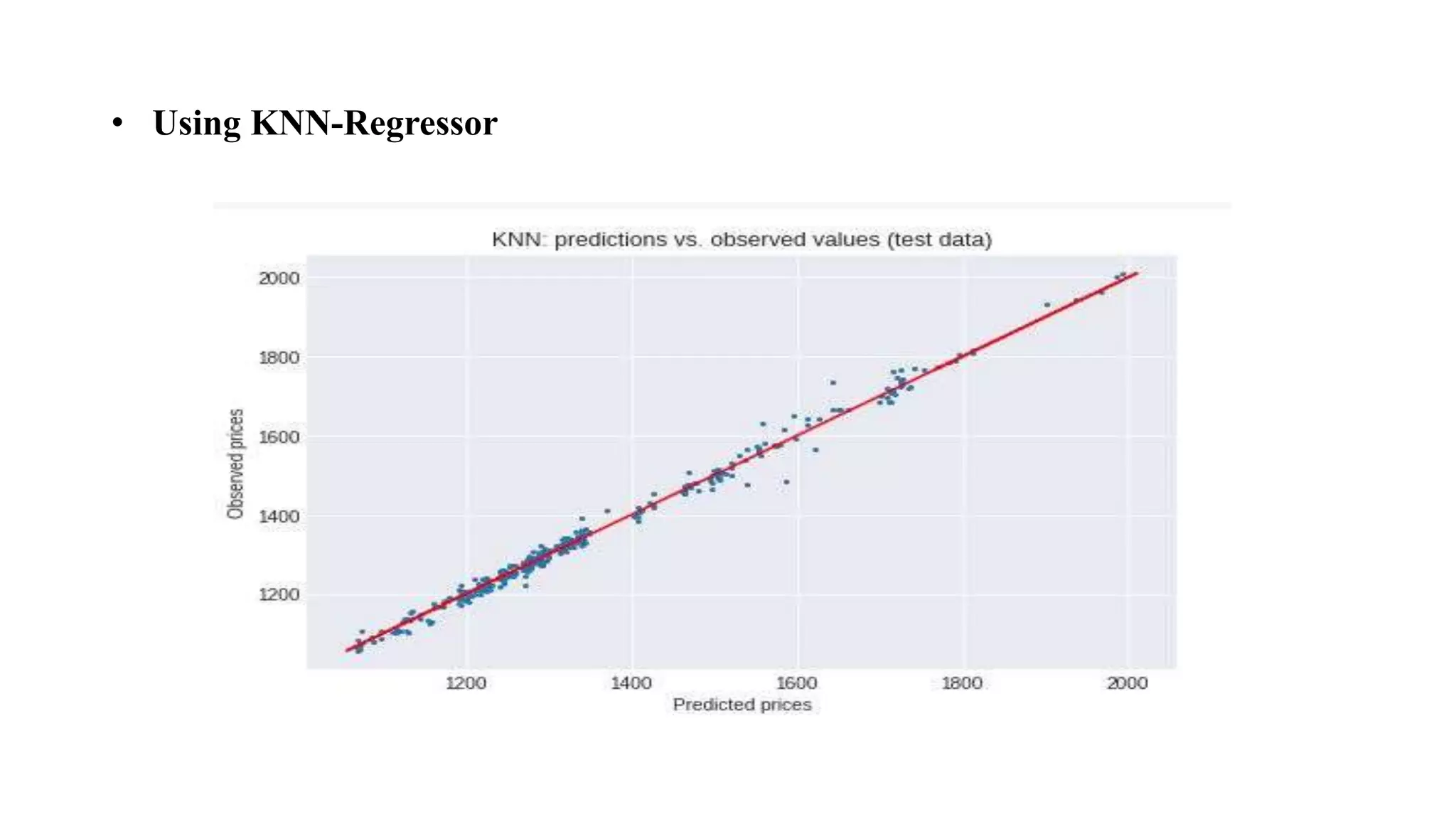

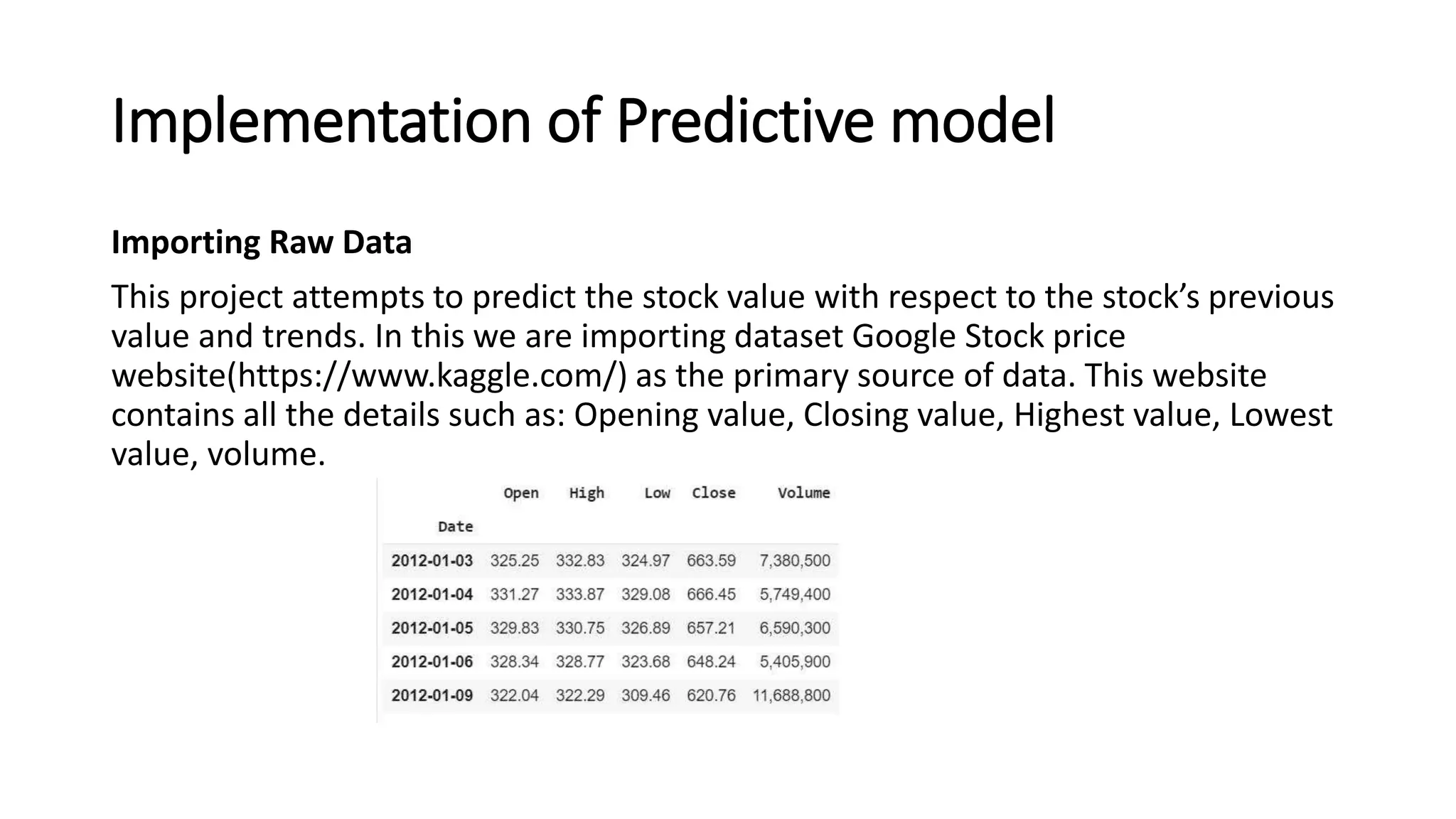

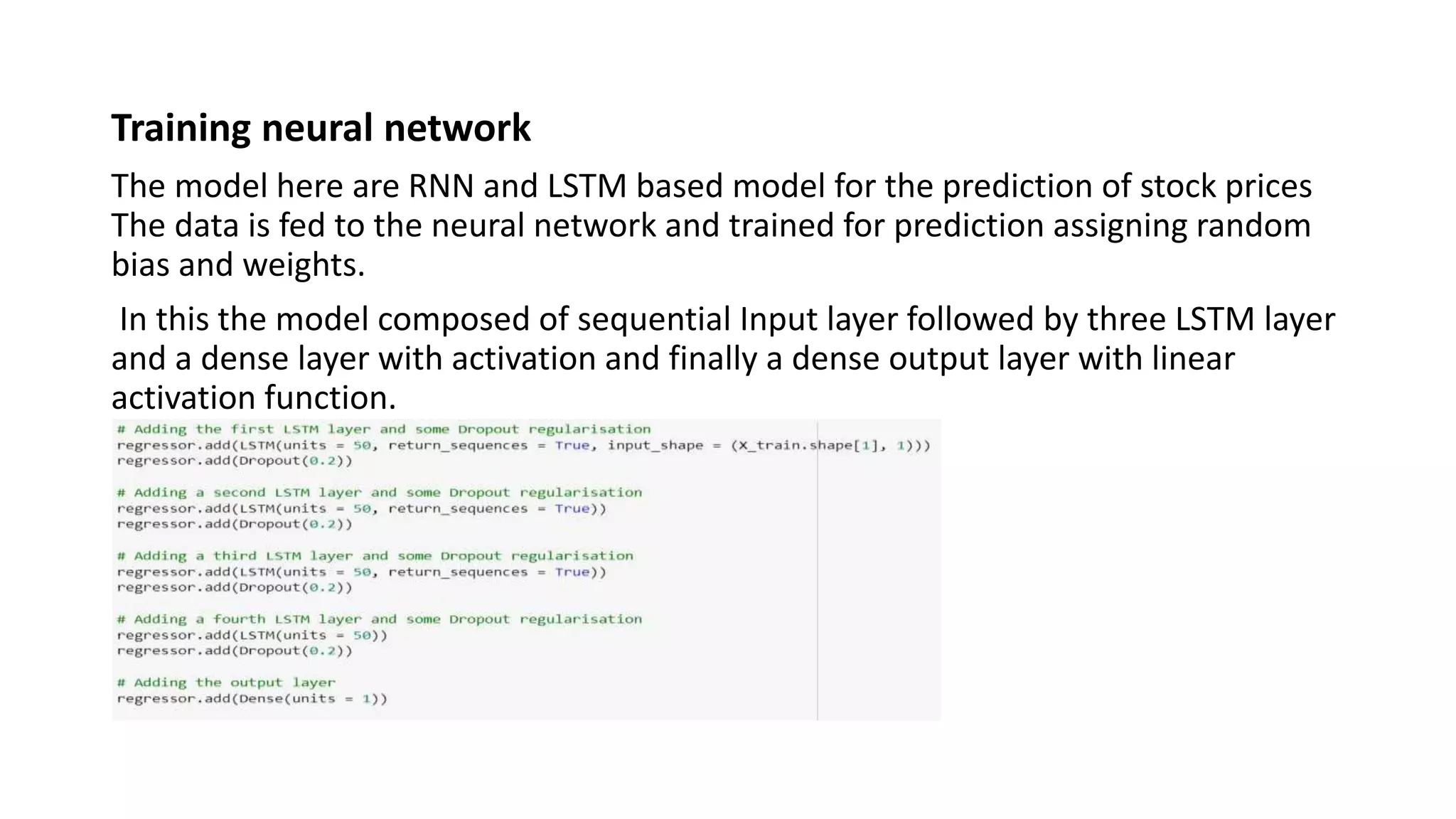

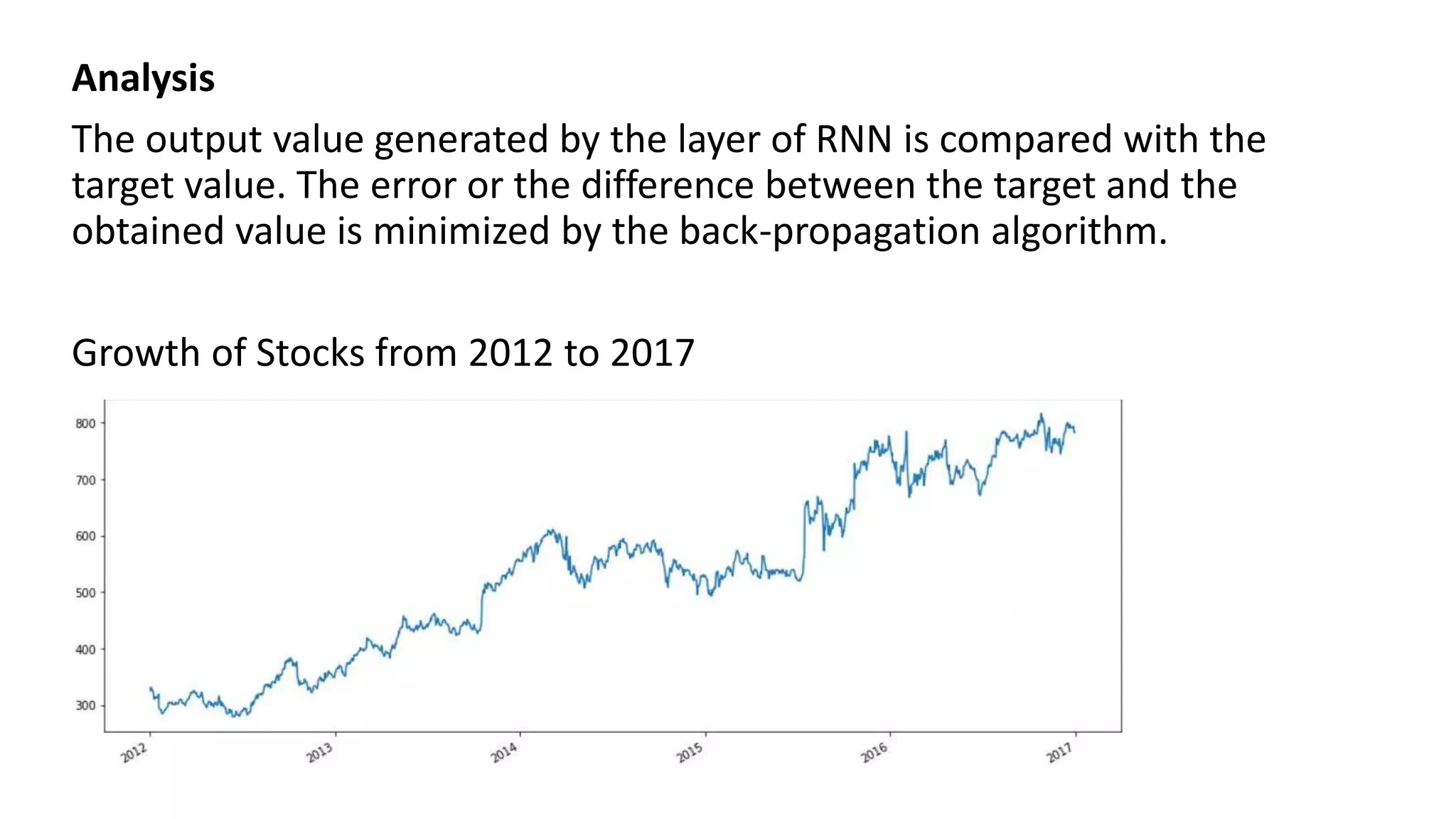

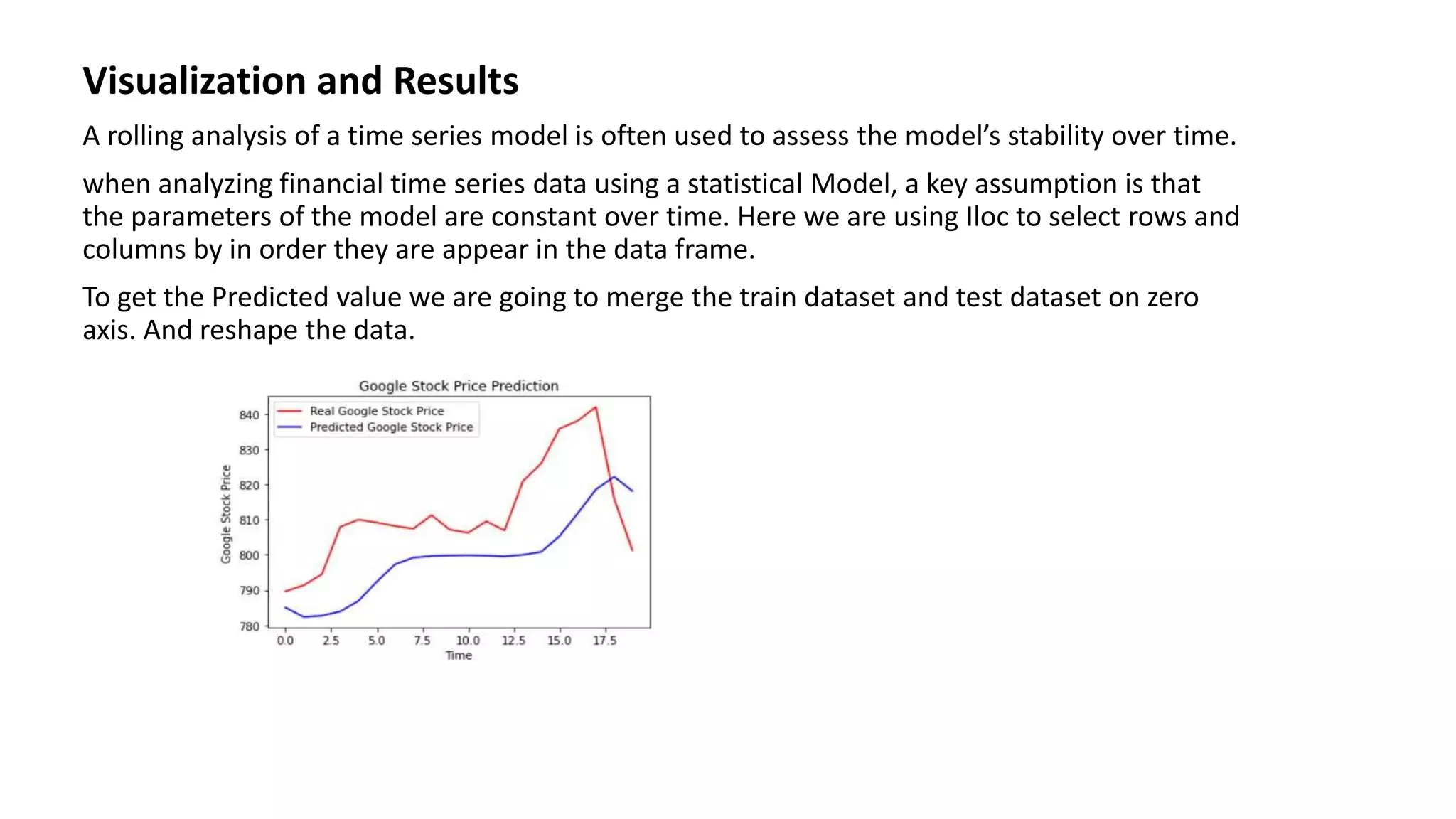

The document summarizes several predictive modeling projects including predicting diamond prices, gold prices, and stock prices using supervised machine learning techniques. For diamond price prediction, linear regression was used on a dataset of 54,000 diamonds. For gold price prediction, both multiple linear regression and KNN regression were applied to historical gold price data. Finally, recurrent neural networks and LSTM models were developed to predict Google stock prices based on previous stock values and trends in the data. The results showed the models could generate approximate forecasts of future prices based on patterns learned from historical data.