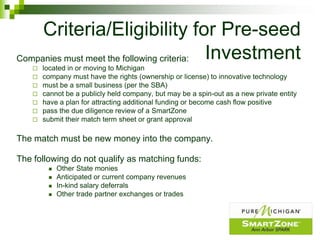

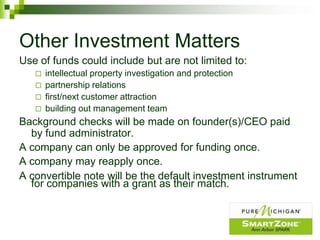

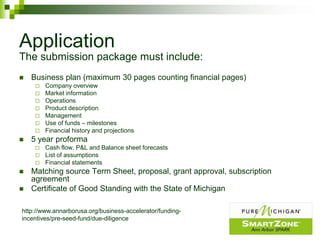

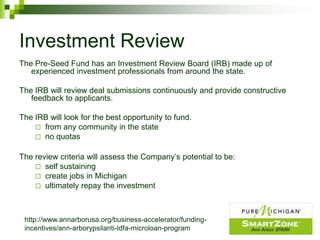

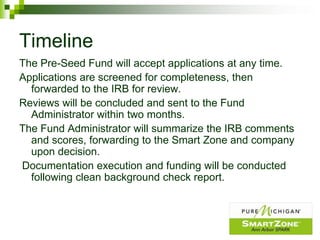

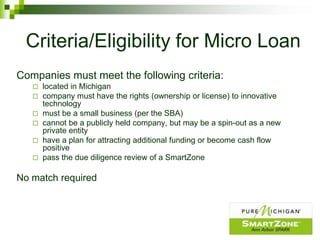

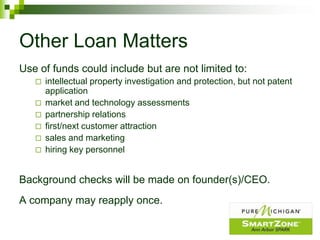

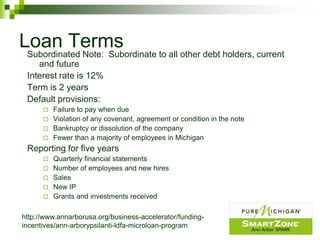

The Michigan Pre-Seed Capital Fund provides early-stage funding to high-tech startups located in or relocating to Michigan. It offers investments between $50,000-$250,000 that must be matched 1:1 by private funds. A separate Micro Loan Fund provides loans from $10,000-$50,000 without a match requirement. Both aim to accelerate company development and bring new technologies to market. Applications are reviewed by an investment board and should include business plans, financial projections, and evidence of support from a Michigan SmartZone.