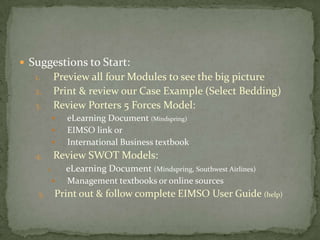

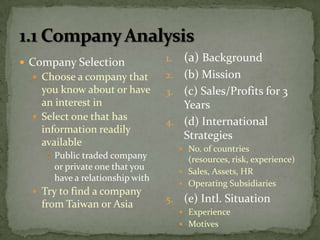

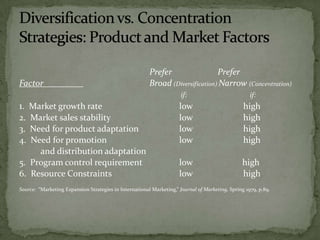

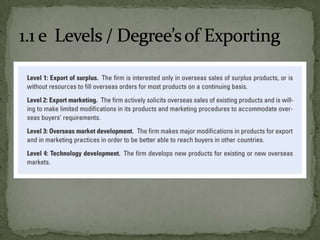

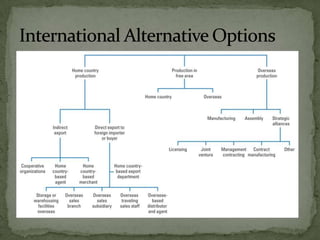

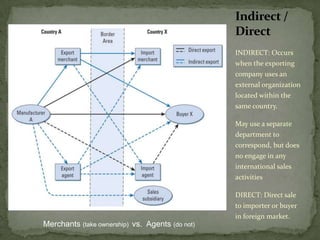

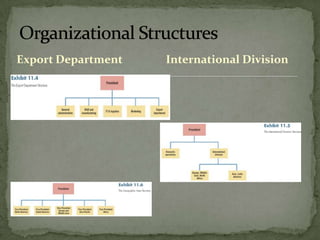

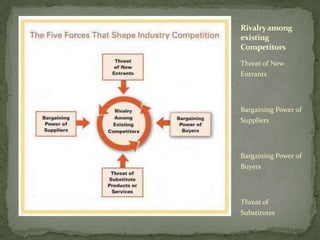

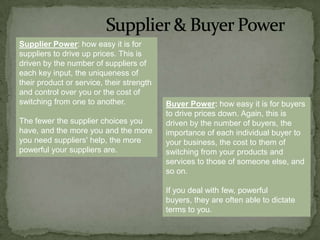

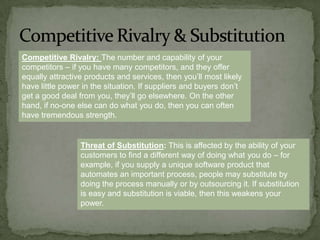

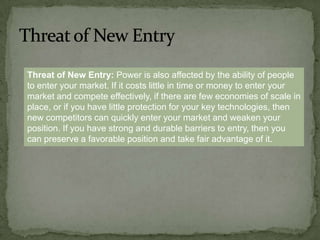

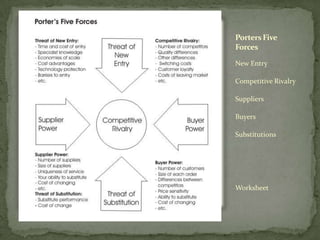

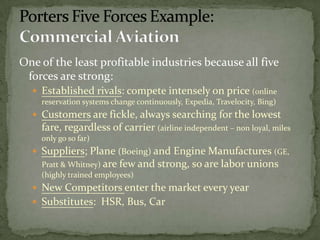

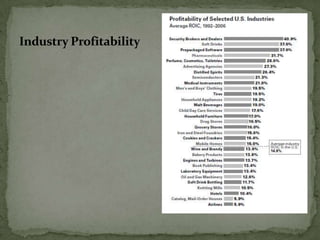

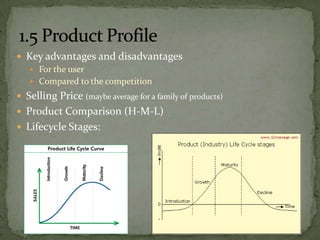

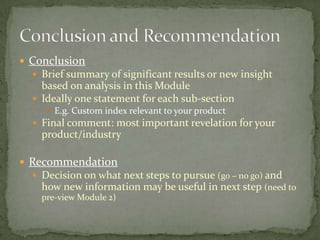

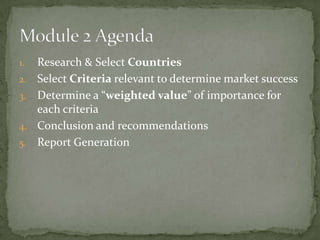

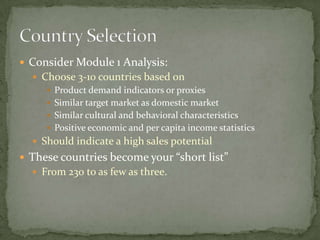

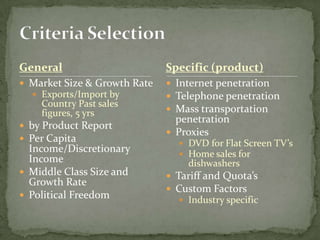

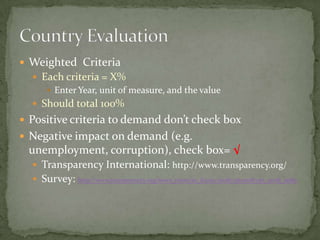

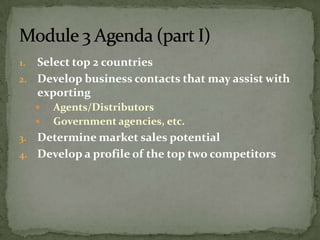

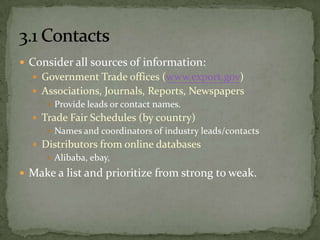

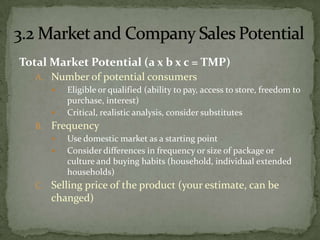

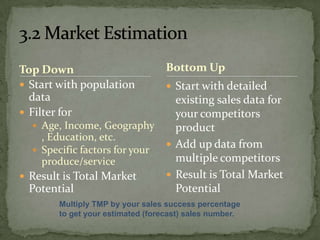

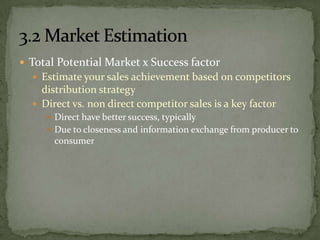

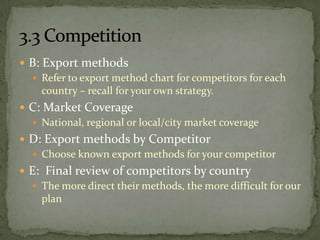

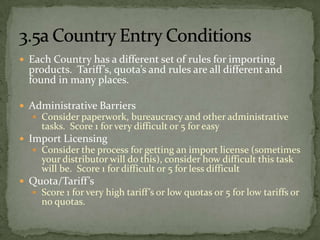

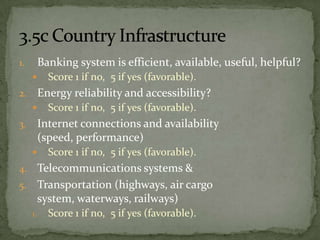

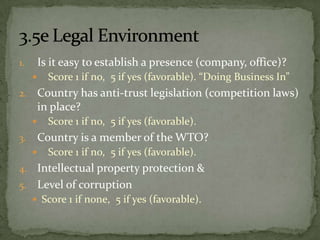

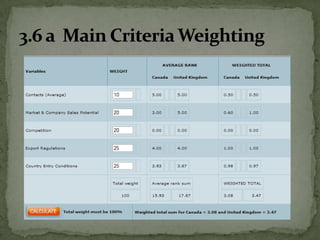

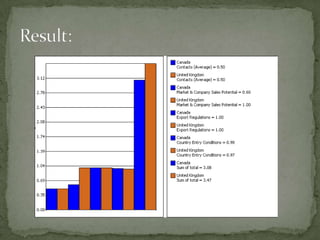

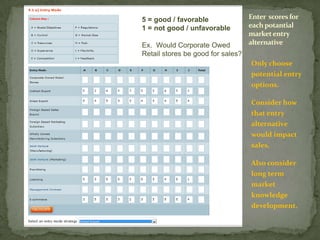

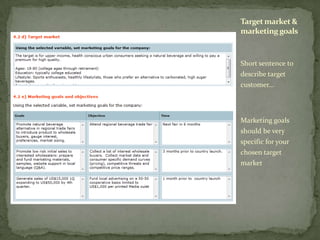

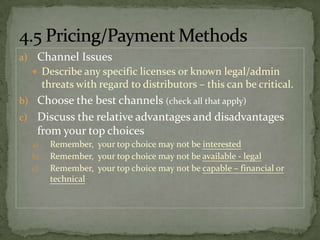

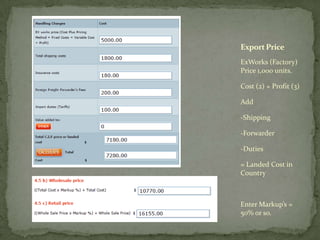

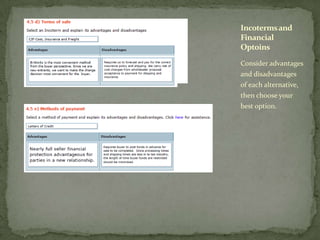

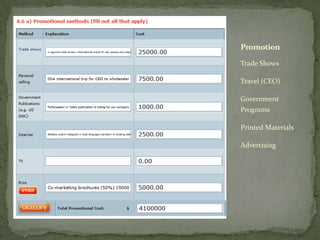

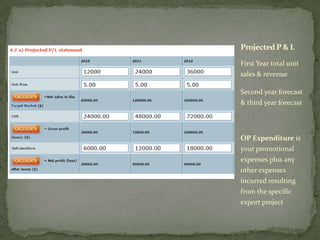

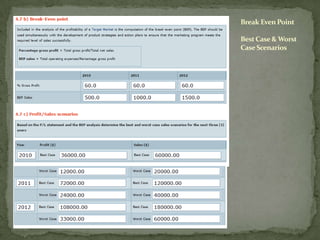

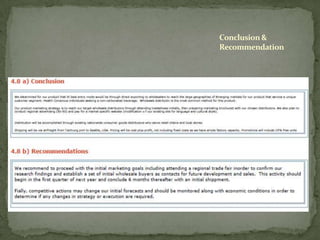

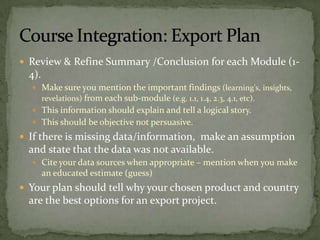

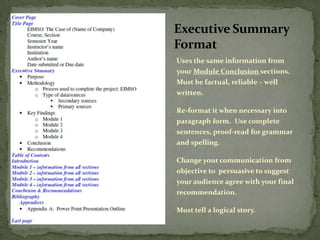

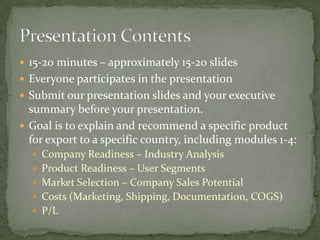

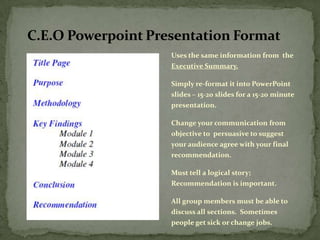

The document outlines an Export Management System developed for an international business course, detailing steps for analyzing a company's readiness for exportation including industry and company analysis, SWOT assessments, and market selection. It emphasizes strategic frameworks such as Porter's Five Forces and various entry strategies, while providing criteria for selecting target markets and evaluating export opportunities. The process culminates in developing an effective entry strategy and marketing plan based on comprehensive market research and analysis.