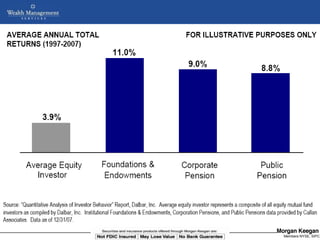

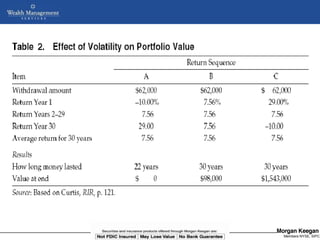

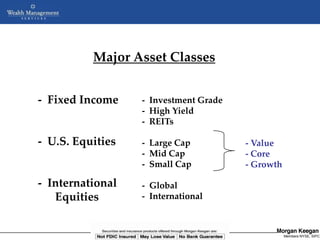

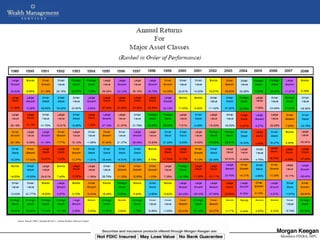

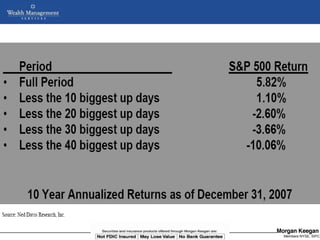

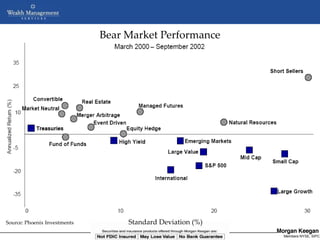

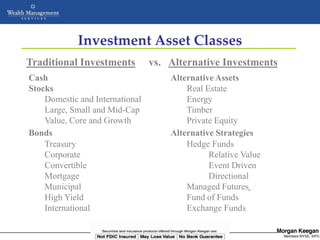

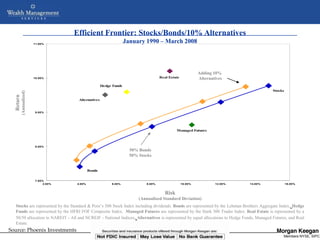

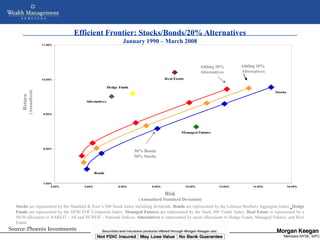

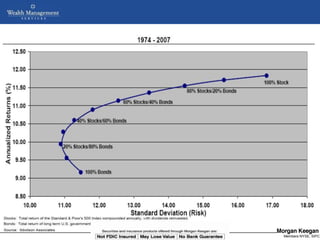

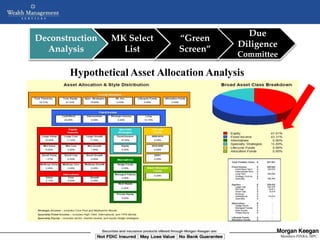

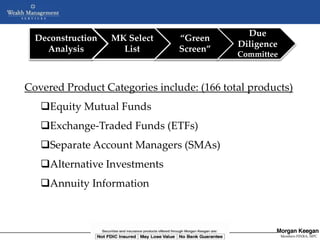

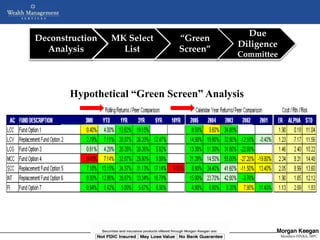

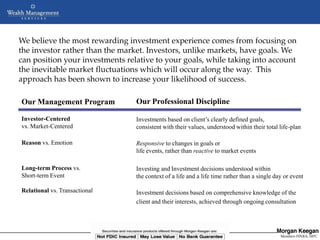

The document discusses why investors underperform in the market. It notes that individual investors are prone to behavioral biases and emotional decision making that cause them to make suboptimal investment choices. In contrast, institutional strategies focus on asset allocation across diverse asset classes and maintaining a consistent strategy over the long term, which has been shown to produce better risk-adjusted returns. The document advocates that investors should focus on asset allocation and maintaining a consistent strategy rather than reacting emotionally to short-term market fluctuations.