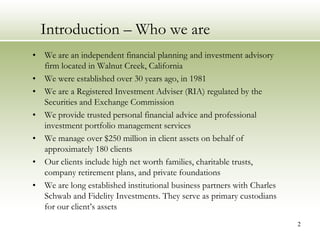

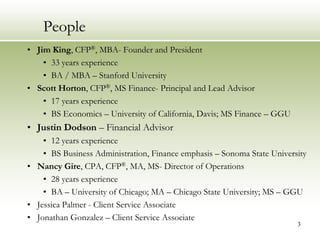

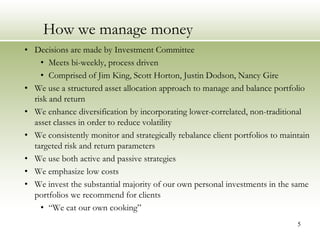

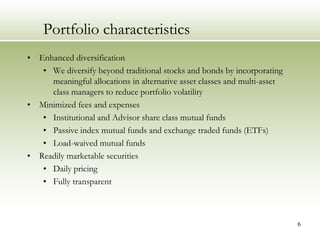

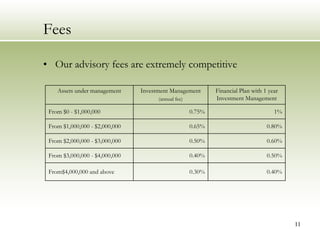

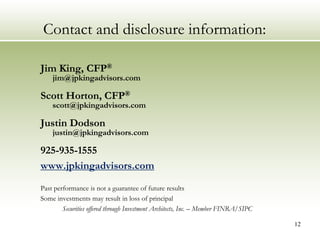

JP King Advisors is an independent financial advisory firm located in Walnut Creek, California that has been in business for over 30 years. They provide personalized financial planning and investment management services to approximately 180 high net worth clients, managing over $250 million in total assets. Their experienced team draws on decades of expertise to offer clients fiduciary investment advice, comprehensive financial planning, and low-cost portfolio management.