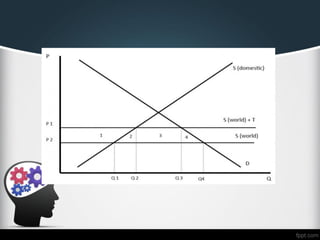

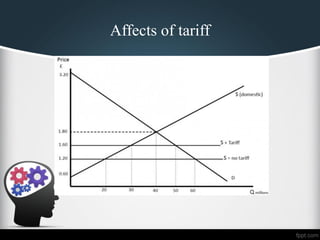

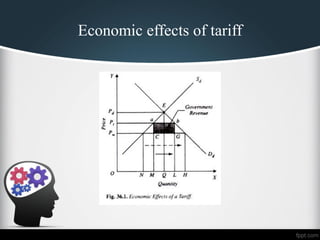

The document discusses tariffs and import duties, explaining their role as taxes applied to imported and exported goods, which can protect domestic industries and influence pricing. It outlines the economic effects of tariffs, highlighting how they can make imported goods more expensive and benefit local producers. There are also mentions of the costs and benefits of tariffs, emphasizing their impact on consumer prices and market competition.