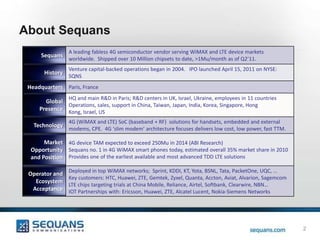

The document discusses connected devices and Sequans, a leading 4G semiconductor company. Sequans provides 4G chipsets for WiMAX and LTE devices worldwide, shipping over 10 million chips to date. They have operations in Paris and other locations. The market for 4G devices is growing rapidly, especially in the US as carriers like Verizon and AT&T deploy LTE networks. Several high-end LTE phones and tablets are already available, though prices remain high and battery life low currently. The document analyzes the potential for 4G connectivity in various device types like tablets, eReaders, M2M, and gaming.