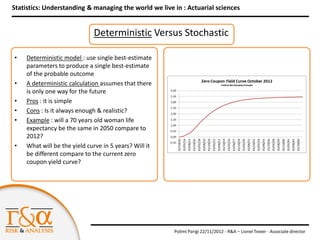

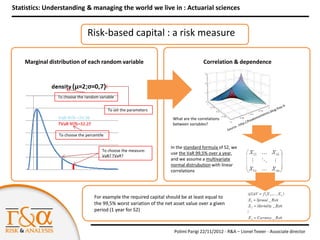

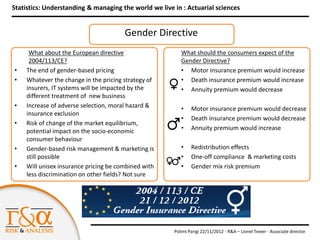

This document discusses the role of actuaries and statistical modeling. It explains that actuaries at R&A use both deterministic and stochastic models to analyze insurance portfolios, assess risks, set prices, and ensure sufficient capital reserves. Deterministic models provide single estimates while stochastic models account for uncertainty through probability distributions. The document also summarizes the upcoming Solvency 2 regulation in Europe and the gender directive banning gender-based insurance pricing. It provides references for further reading on these actuarial topics.