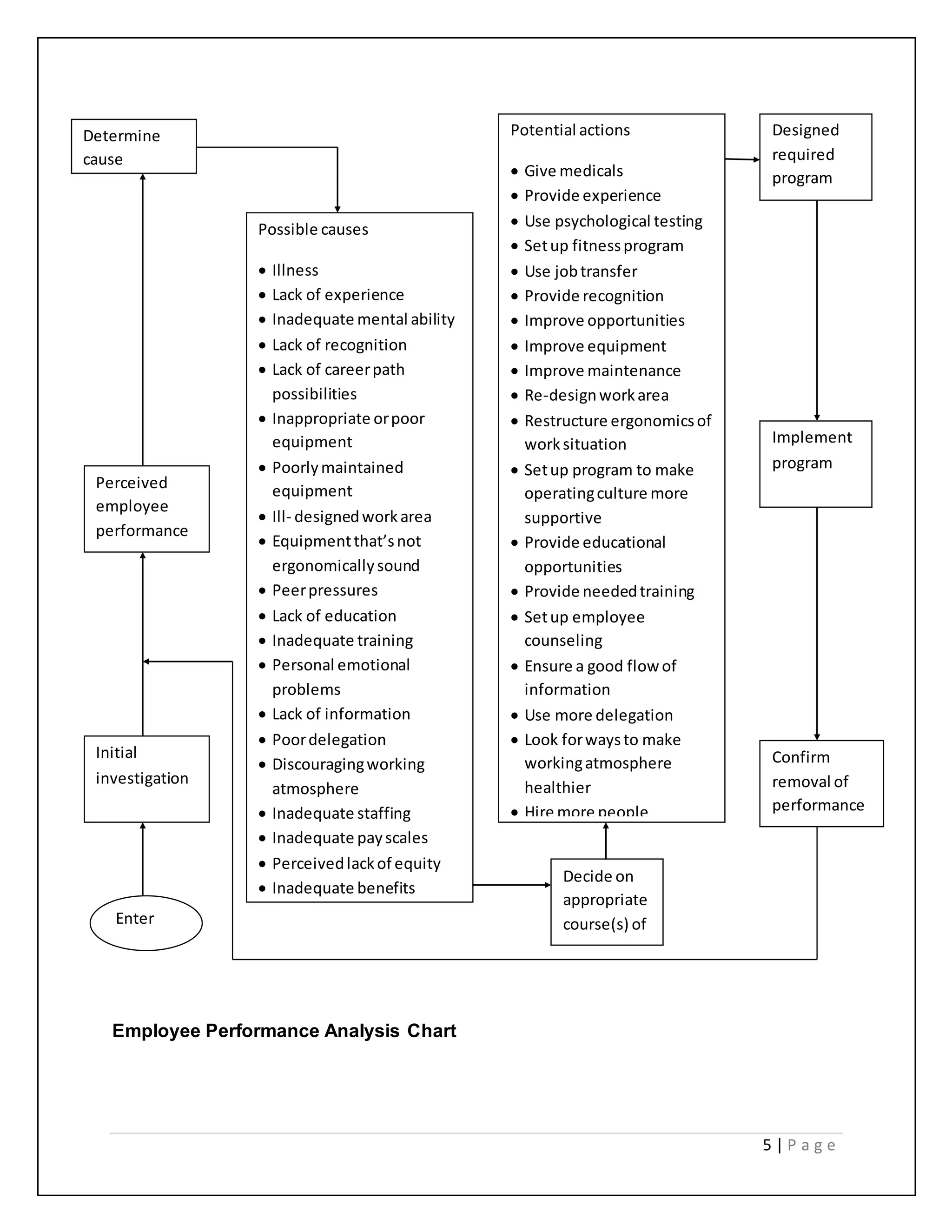

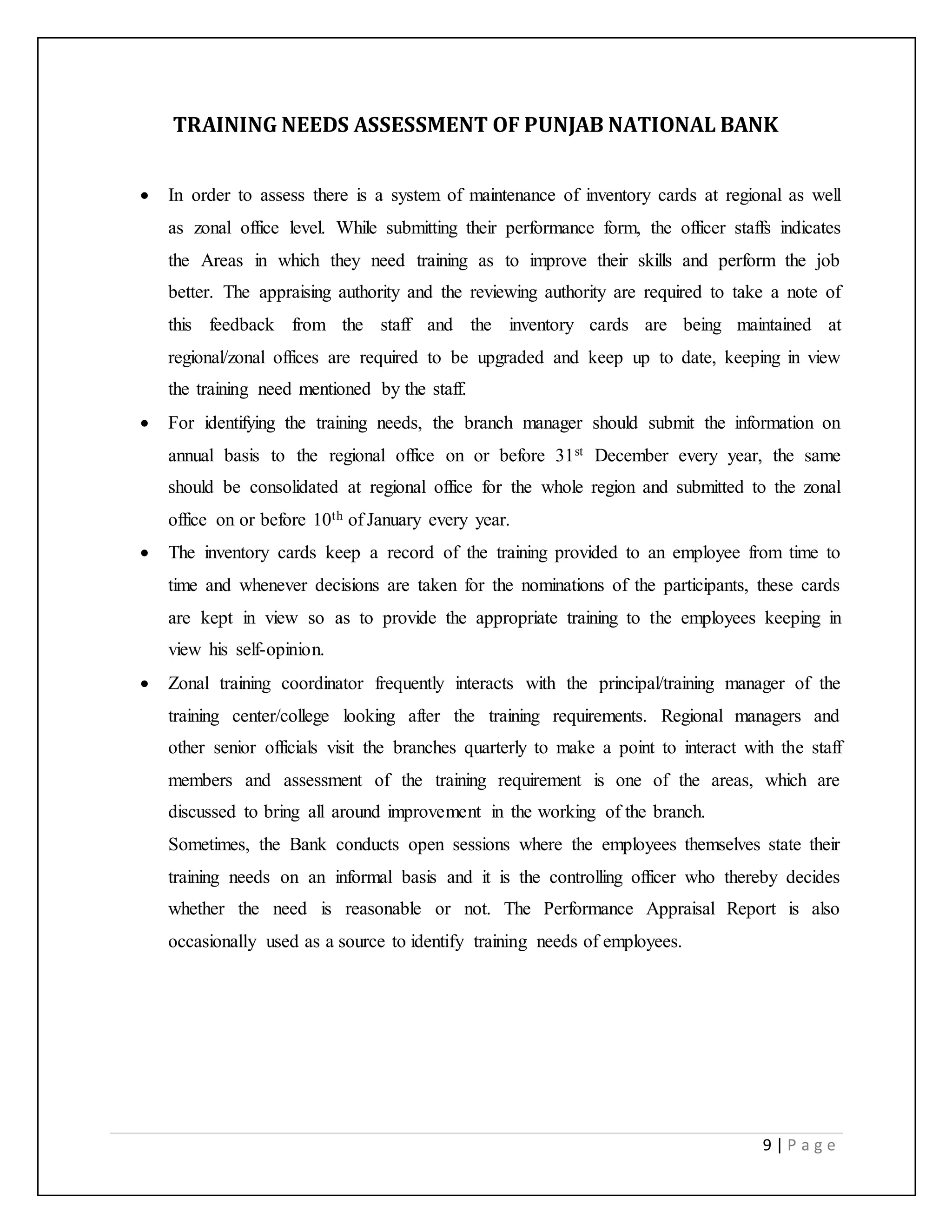

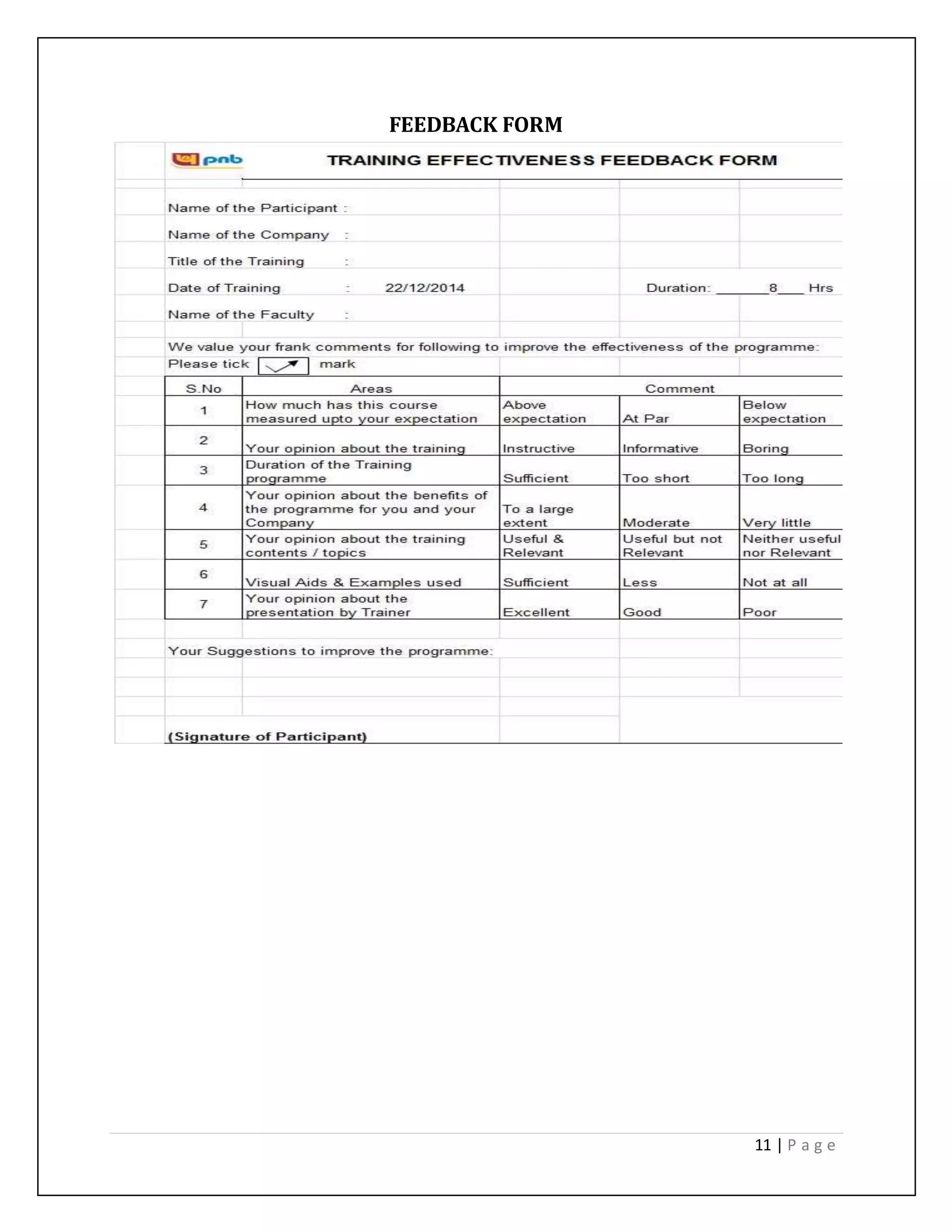

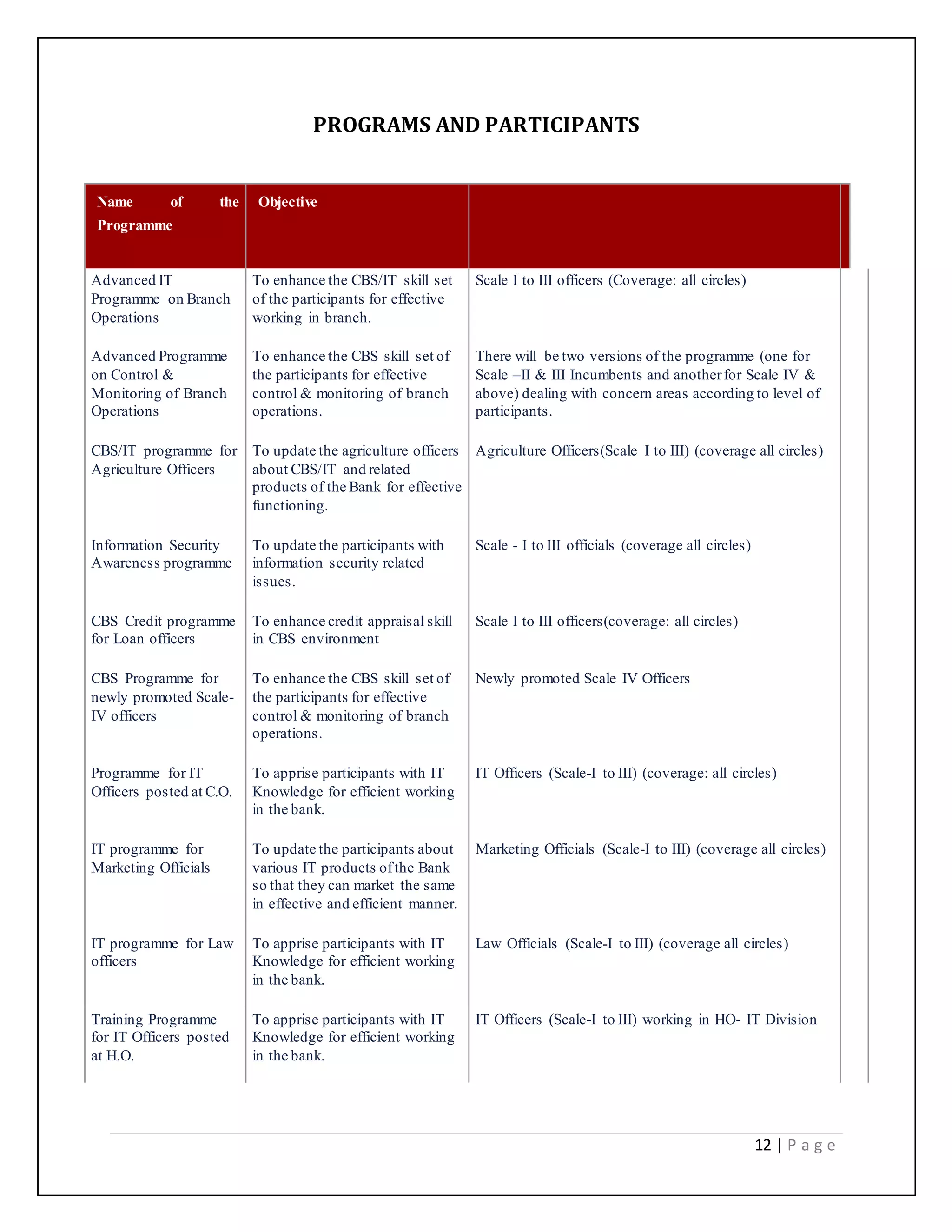

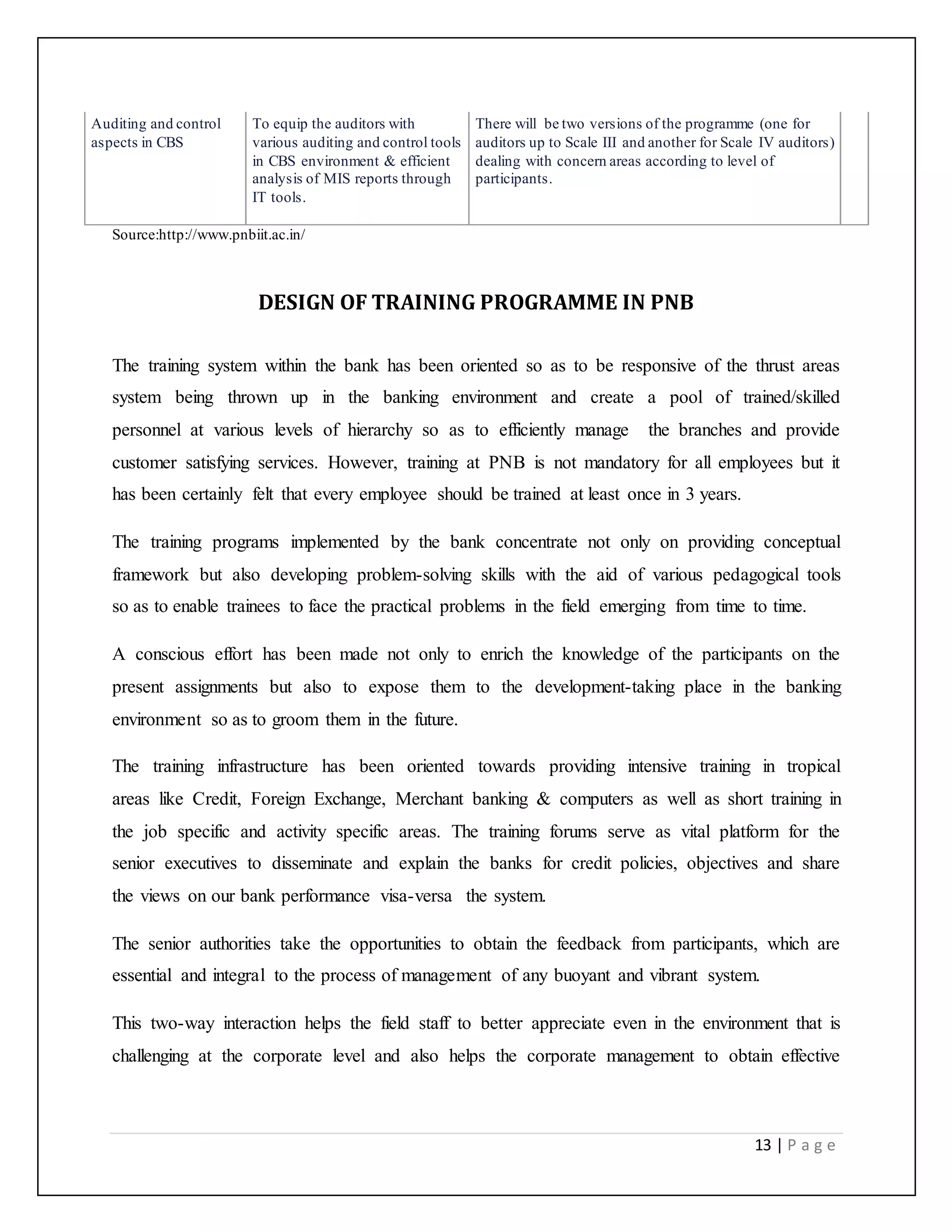

The document discusses the training programs at Punjab National Bank. It provides details of various training programs conducted by PNB for employees at different levels, including programs on branch operations, control and monitoring, agriculture, information security, credit appraisal, and auditing. It outlines the methodology used for assessing training needs, including feedback forms, interviews, and performance appraisals. The training programs aim to enhance skills of employees, update them on new technologies and products, and help them work more efficiently. The schedule of programs is designed keeping in view the objectives, level of participants, and need for a variety of teaching methods.