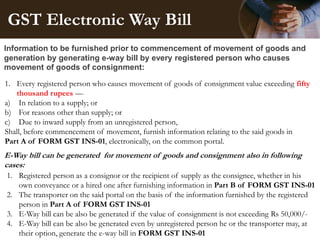

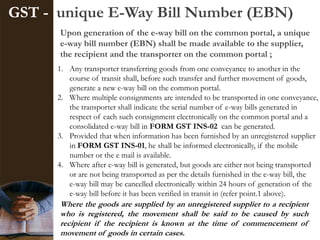

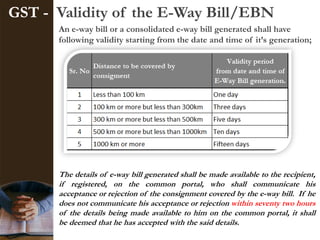

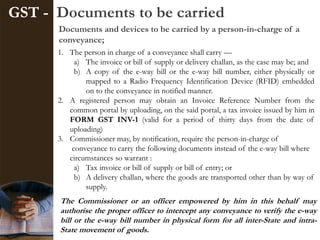

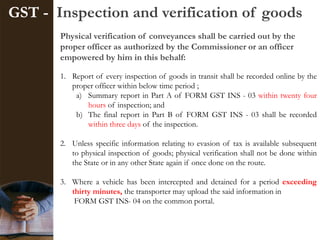

The document summarizes key aspects of the GST electronic way bill (e-way bill) system in India. It explains that under GST, an e-way bill must be generated prior to transporting goods over Rs. 50,000 in value, and provides details on who can generate e-way bills, the information required, validity periods, documents that must be carried during transport, and procedures for inspection and verification of goods in transit. Unique e-way bill numbers are issued electronically on the common GST portal to the supplier, recipient, and transporter. E-way bills can generally be generated by suppliers, recipients, and transporters using the GST portal.