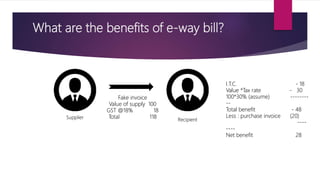

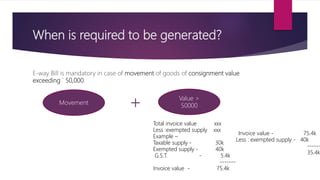

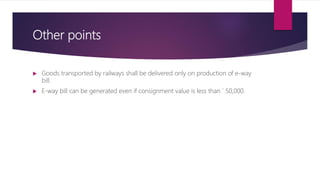

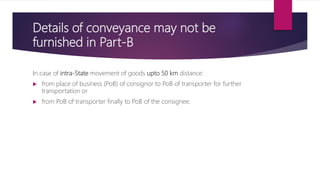

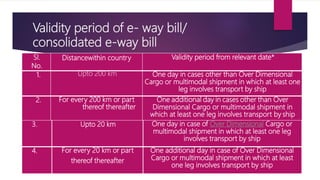

E-way bills are required for the movement of goods over Rs. 50,000 between states and union territories in India. They are electronic documents generated on the GST portal that must accompany goods in transit. E-way bills provide benefits like ensuring goods are reaching the recipient, preventing tax evasion through generation of fake invoices. They must be generated by the supplier, recipient, or transporter depending on who arranges the movement of goods. Various details must be provided in the e-way bill including the transporter details, goods description, and validity is dependent on distance of transport. E-way bills can be verified by tax officials during transit and cancelled if goods are not transported as described.

![Unique e-way bill number (EBN)

Upon generation of the e-way bill on the common portal, a unique e-way bill

number (EBN) shall be made available to the supplier, the recipient and the

transporter on the common portal [Rule 138(4)].](https://image.slidesharecdn.com/ewaybill-220315104450/85/E-way-bill-13-320.jpg)

![Cancellation of e-way bill

Where an e-way bill has been generated, but goods are either not transported

or are not transported as per the details furnished in the e-way bill, the e-way

bill may be cancelled electronically on the common portal within 24 hours of

generation of the e-way bill [Rule 138(9)].

However, an e-way bill cannot be cancelled if it has been verified in transit in

accordance with the provisions of rule 138B [First proviso to rule 138(9)].

Further, unique EWB number generated is valid for a period of 15 days for

updation of Part B [Second proviso to rule 138(9)].](https://image.slidesharecdn.com/ewaybill-220315104450/85/E-way-bill-16-320.jpg)