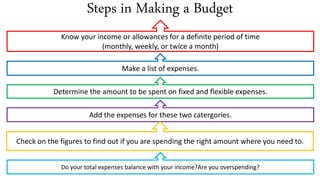

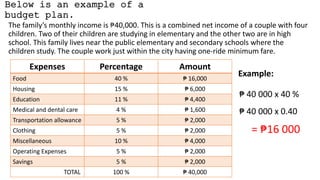

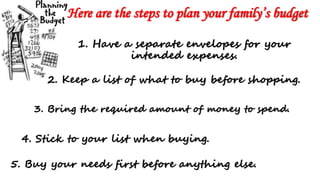

Planning and preparing a budget is important for good money management. It involves listing all expenses to balance income and expenditures and ensure needs are met before wants. The steps include determining monthly income, listing expenses, allocating amounts to fixed and flexible expenses, and checking if total expenses match income to avoid overspending. An example budget plan allocates percentages of monthly income to expenses like food, housing, education, and savings. Sticking to a budget requires keeping expenses in separate envelopes, making shopping lists, and only spending allotted amounts.