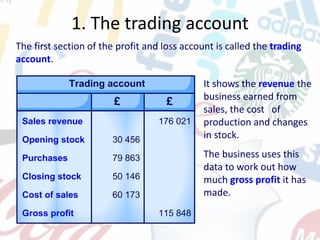

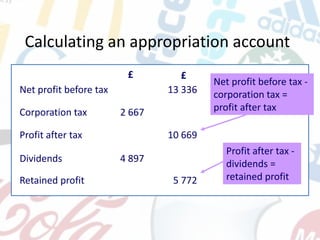

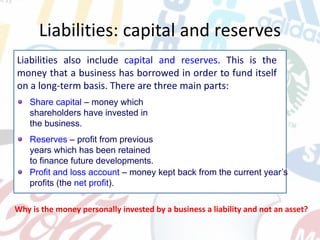

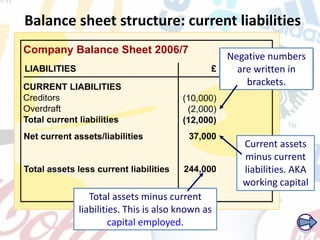

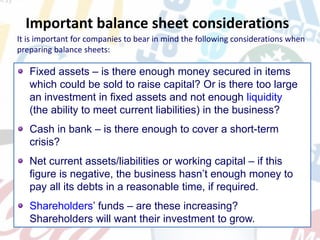

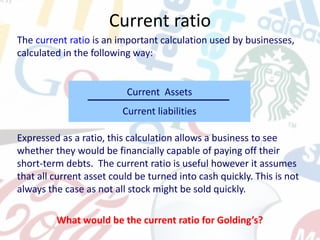

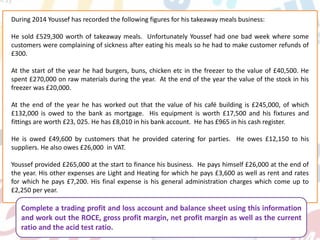

The document details the importance of accounting records for various stakeholders such as shareholders, creditors, the government, and managers. It describes the profit and loss account, its components including gross and net profit, and emphasizes the need for businesses to maintain accurate financial records to assess performance and inform decision-making. Additionally, it explains balance sheets, their structure, key financial ratios, and the significance of liquidity and profitability measures for business health.

![ROCE: (199,450/464,450) x 100 = 42.94%

Gross profit margin: (238,500/529,000) x 100 = 45.09%

Net profit margin: (199,450/529,000) x 100 = 37.7%

Current ratio: (349,075/38,150) 9.15:1

Acid test ratio: [(348,075-290,500)/38,150] = 1.54:1](https://image.slidesharecdn.com/accountspresentationnotes-240430140111-7e2ed3bd/85/accounts_presentation_notes-management-business-53-320.jpg)