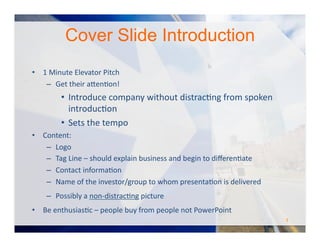

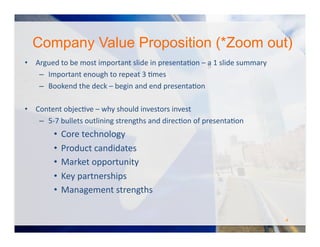

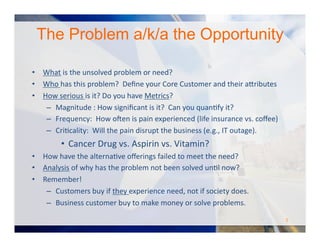

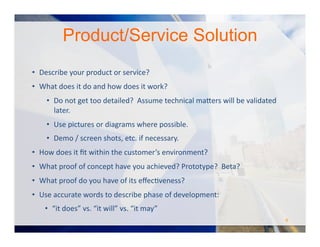

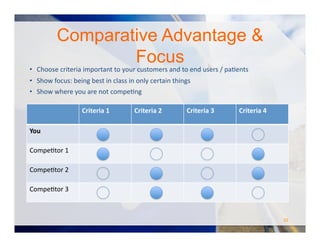

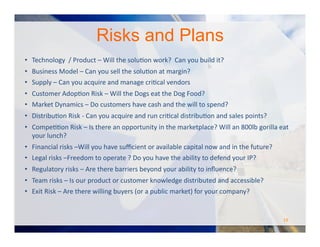

The document outlines guidelines for creating effective presentation decks aimed at pitching business plans to investors, covering essential elements such as problem definition, product description, competitive advantage, revenue model, and exit strategy. It emphasizes the importance of clear communication, engaging visuals, understanding the investor's perspective, and avoiding common presentation pitfalls. Additionally, it provides advice on managing investor interactions and refining presentation skills to effectively convey value propositions.