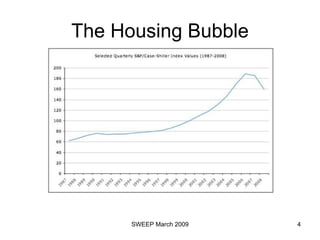

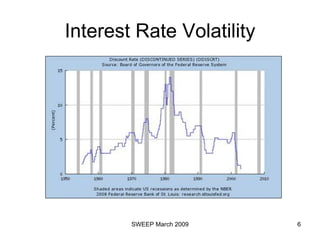

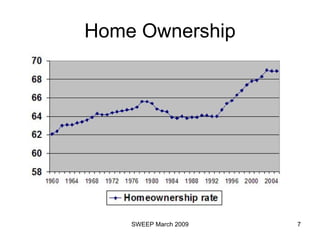

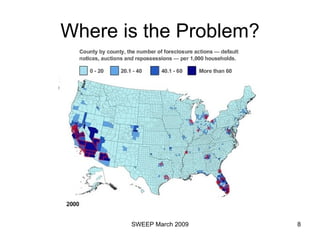

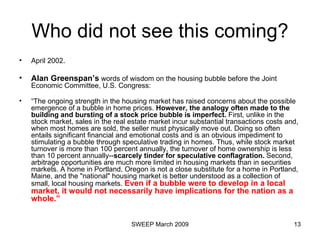

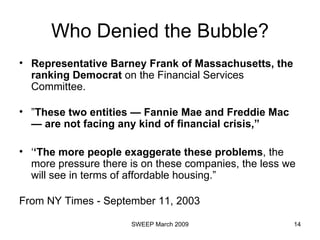

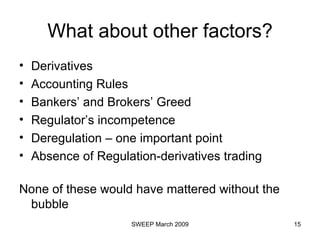

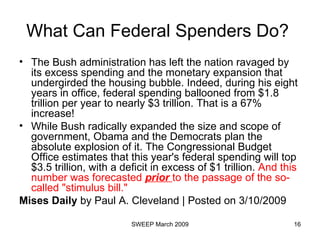

The document discusses the housing bubble and its causes. It argues that loose monetary policy and government policies promoting homeownership led to a misallocation of resources and artificial inflation of housing prices. This created a bubble that has now burst, leading to an economic recession. In the long run, there is a concern that the government failures that caused the crisis will not be admitted and more power will be given to the same mechanisms that caused the problems.