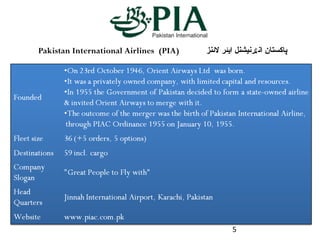

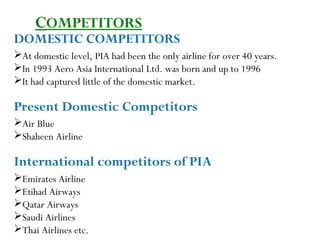

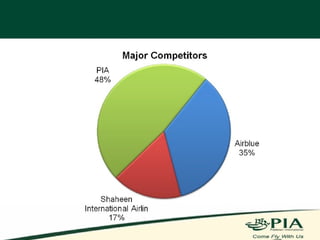

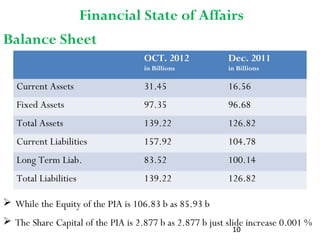

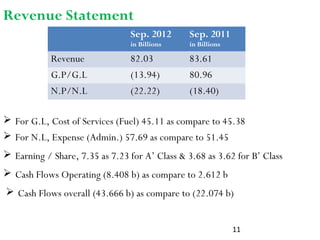

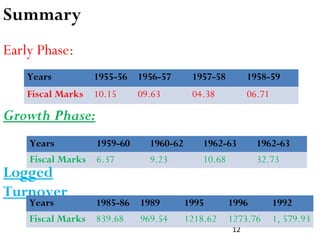

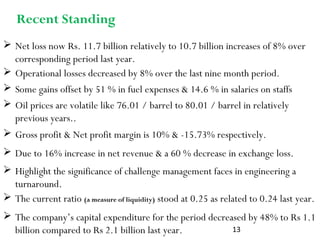

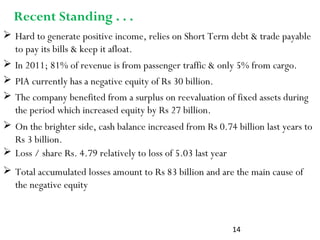

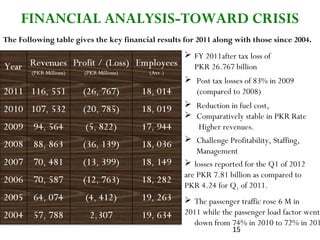

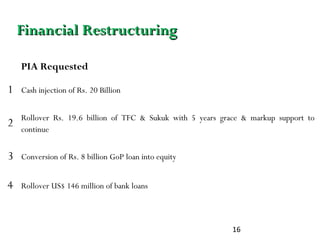

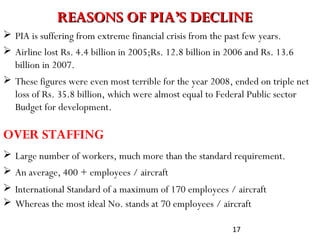

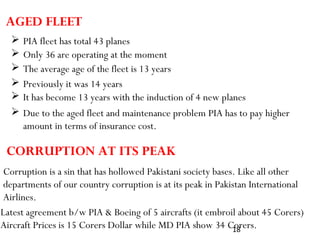

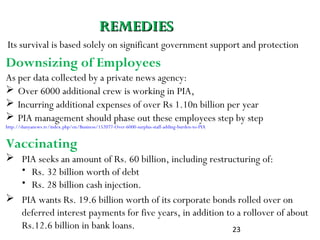

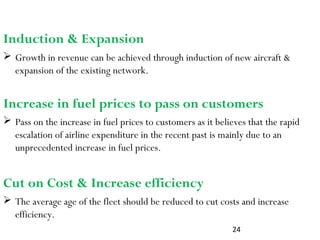

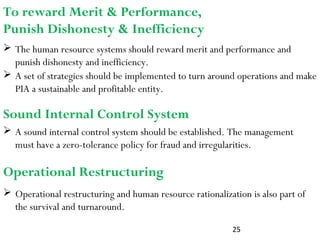

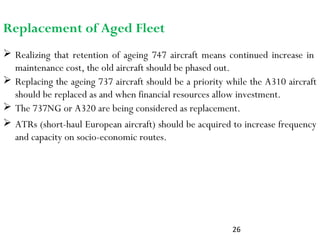

The document provides a comprehensive overview of Pakistan International Airlines (PIA), detailing its company profile, financial decline, reasons for its crisis, and suggested remedies. PIA has faced extreme financial challenges, significant operational losses, and issues such as overs staffing and management inefficiencies. To survive, the airline needs government support, operational restructuring, fleet modernization, and a focus on controlling costs and improving service quality.