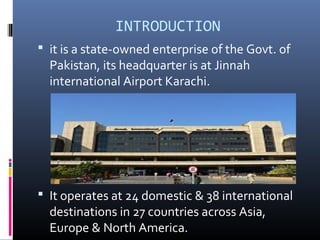

This document provides an overview of Pakistan International Airlines (PIA), including its objectives, importance, code sharing agreements, privatization plans, financial performance, problems and crises, solutions, and policy measures. PIA is the national airline of Pakistan, operating domestic and international flights. However, it has been facing financial losses for years due to issues like rising oil prices, currency devaluation, aging aircraft, overstaffing, and lack of maintenance. Solutions proposed include replacing old aircraft, improving management practices, and reducing political interference.