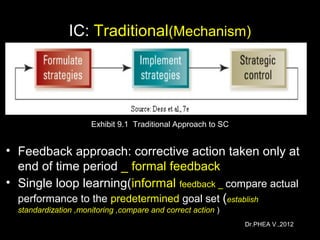

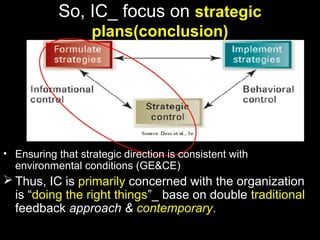

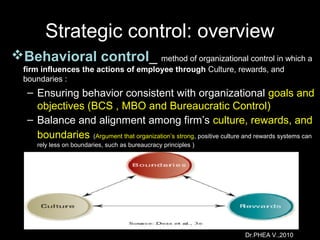

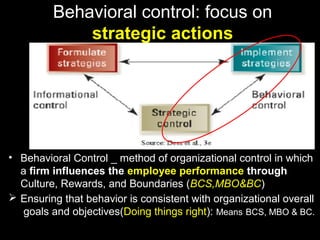

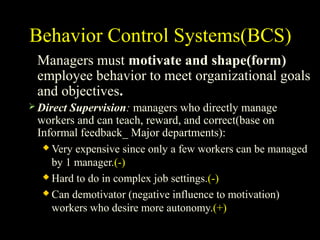

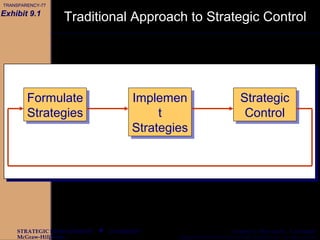

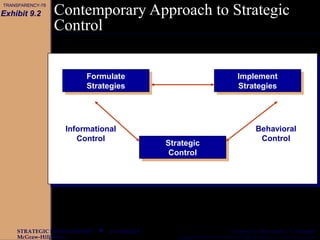

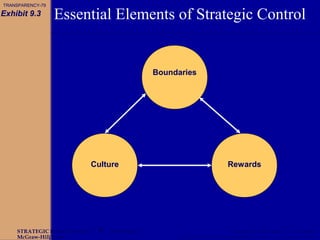

This document discusses strategic control and corporate governance. It describes strategic control as consisting of informational control, which involves ongoing monitoring of the external environment and strategy, and behavioral control, which ensures employee behavior aligns with goals through culture, rewards and boundaries. Corporate governance aims to align manager and shareholder interests through internal mechanisms like boards of directors and executive compensation, and external mechanisms like markets and regulations. The key is balancing the interests of managers, who control firms, with shareholders, who own firms but are separated from control.