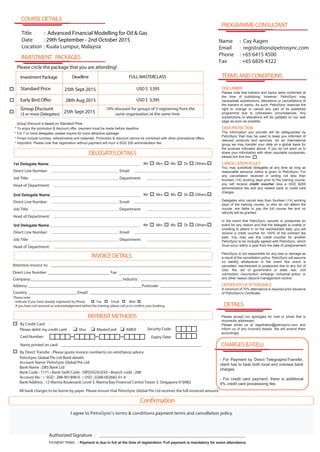

The document discusses a financial modeling training course led by Dr. Michael Rees, focusing on advanced financial modeling techniques specifically for the oil and gas sector. Participants will enhance their Excel skills and learn best practices for model design, analysis, and decision-making through hands-on exercises. The course aims to provide valuable insights and practical knowledge, with testimonials highlighting its effectiveness and the trainer's extensive experience in the field.