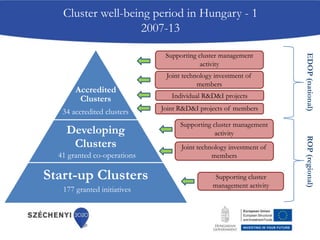

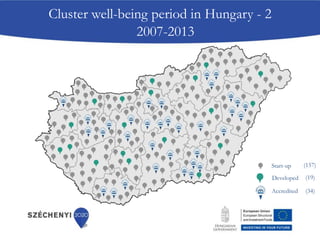

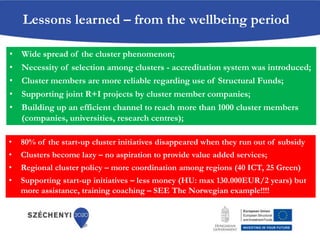

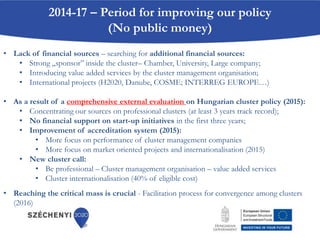

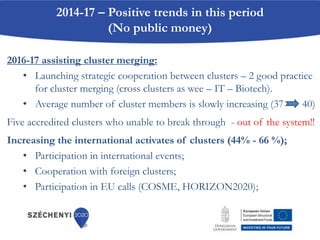

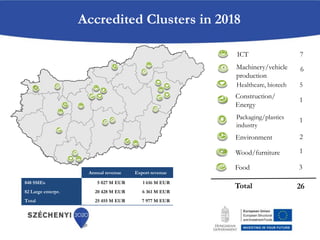

The document summarizes Hungary's cluster development policy and initiatives between 2007-2017. It notes that 34 clusters were accredited in the initial 2007-2013 period, but 80% of startup clusters disappeared without ongoing subsidies. The 2014-2017 period saw no direct public funding, requiring clusters to seek other funding sources. An evaluation led to prioritizing support for more established clusters with track records. The goals for 2017-2020 include concentrating resources on 10-15 top clusters with international partnerships and market-oriented innovation projects, as well as establishing a foundation of regional clusters focused on local strengths.