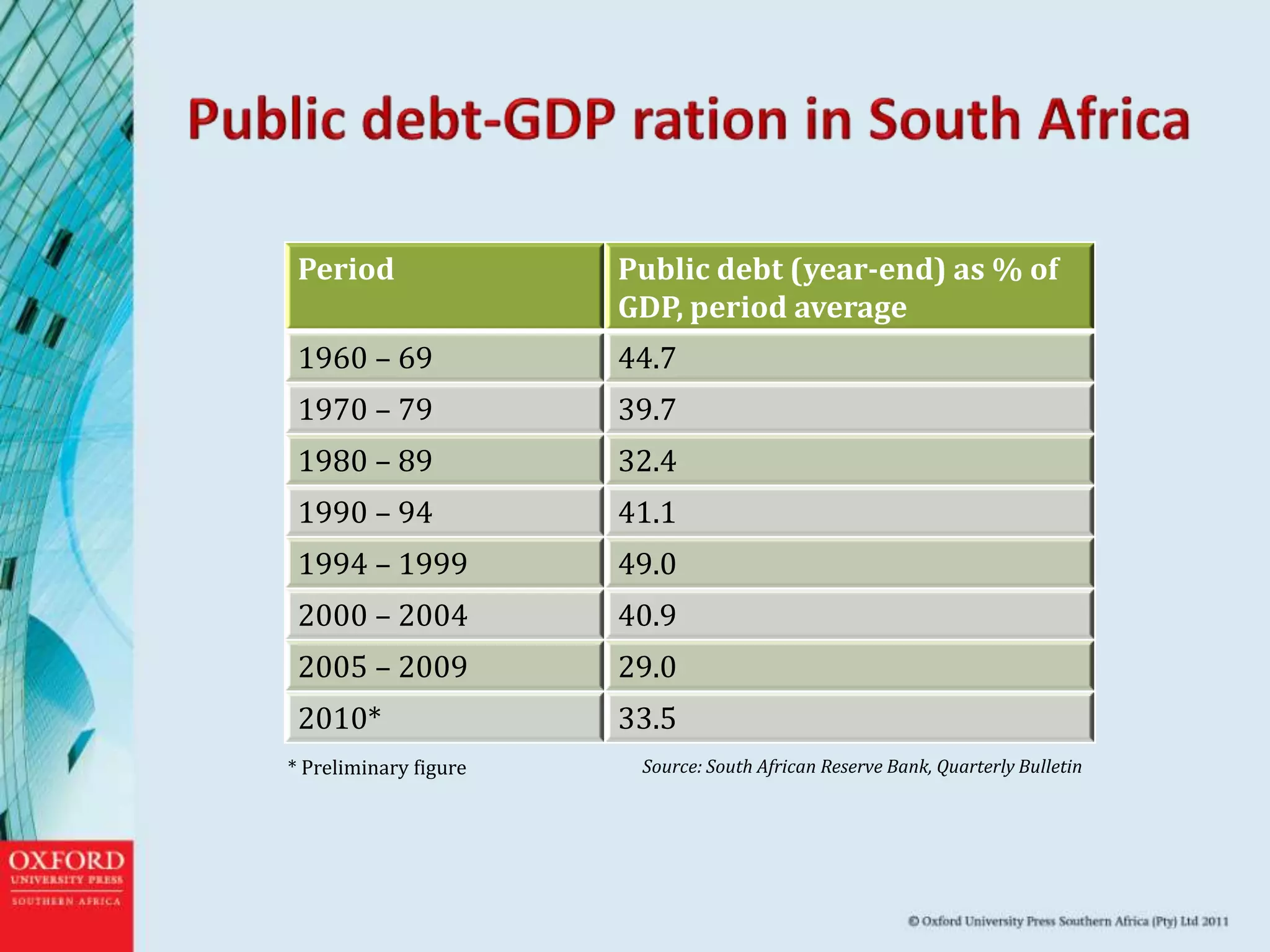

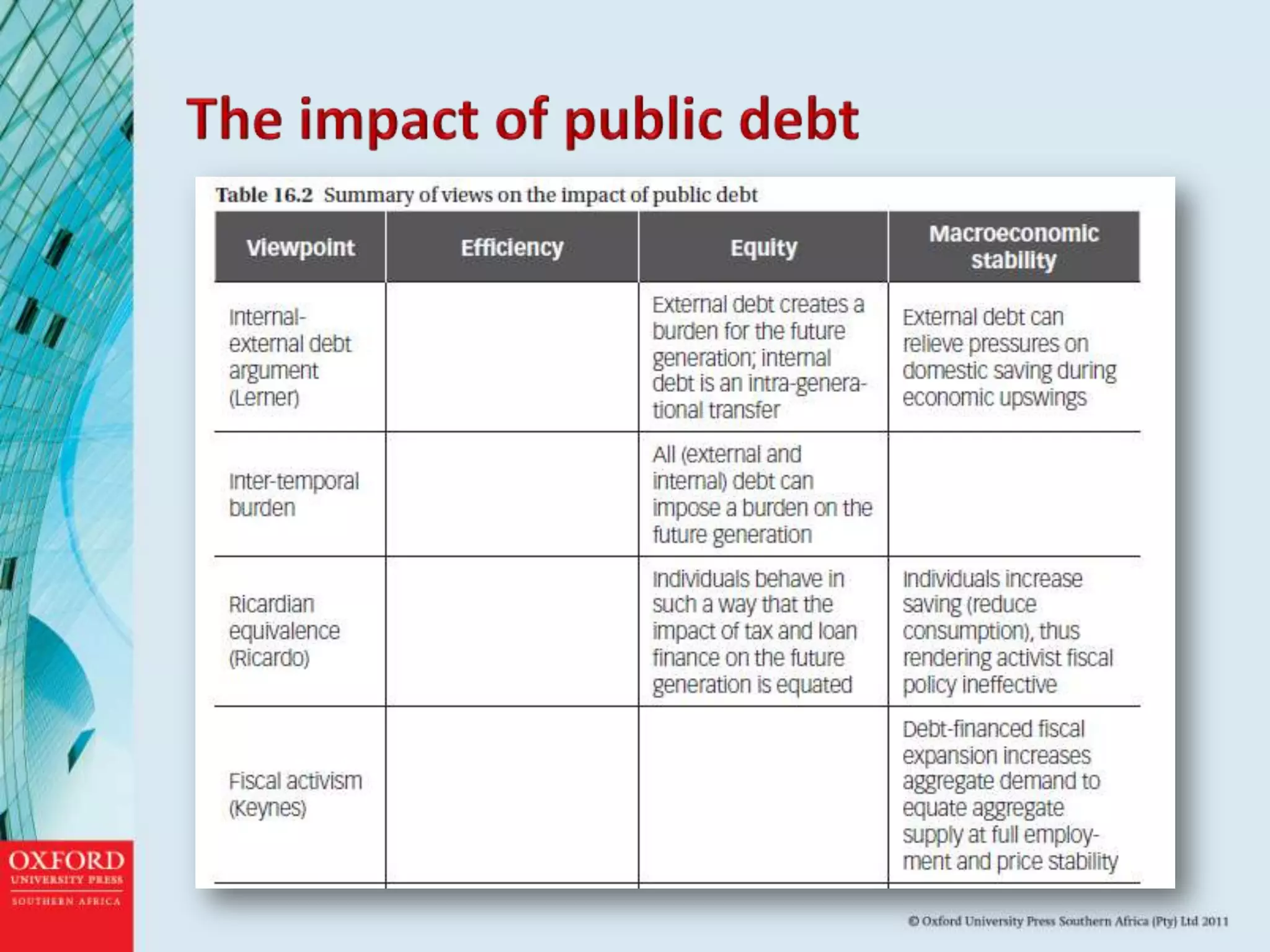

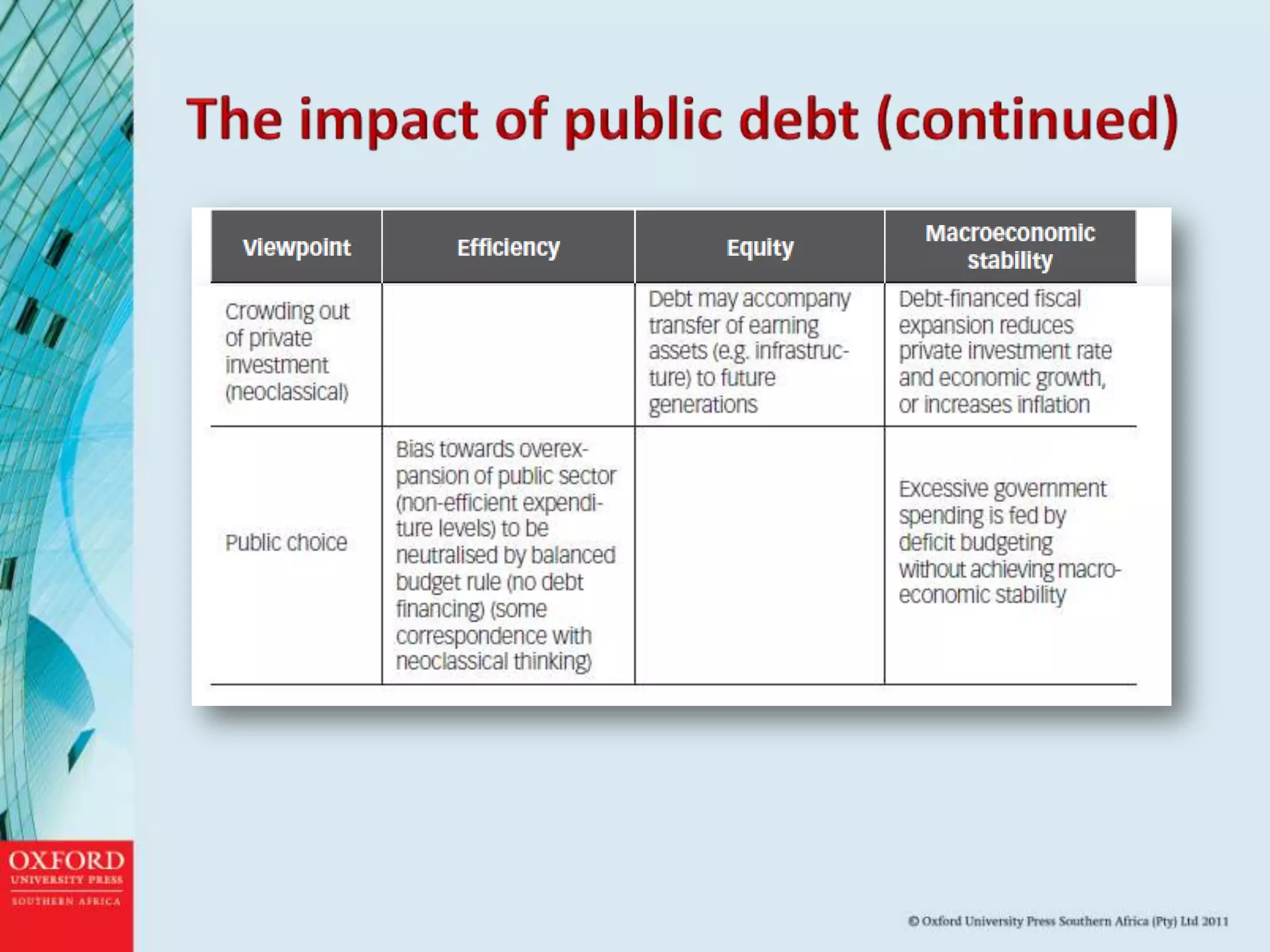

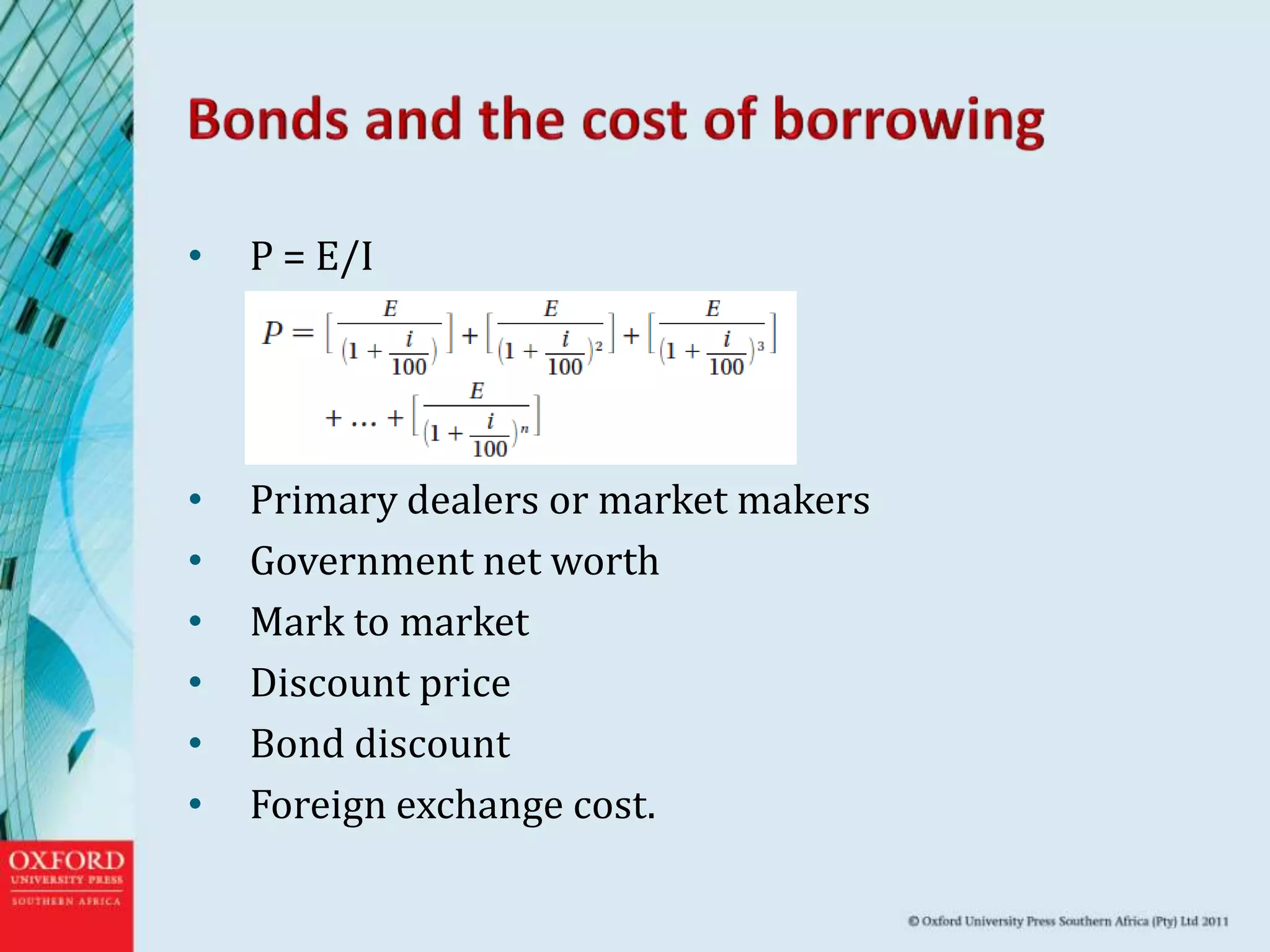

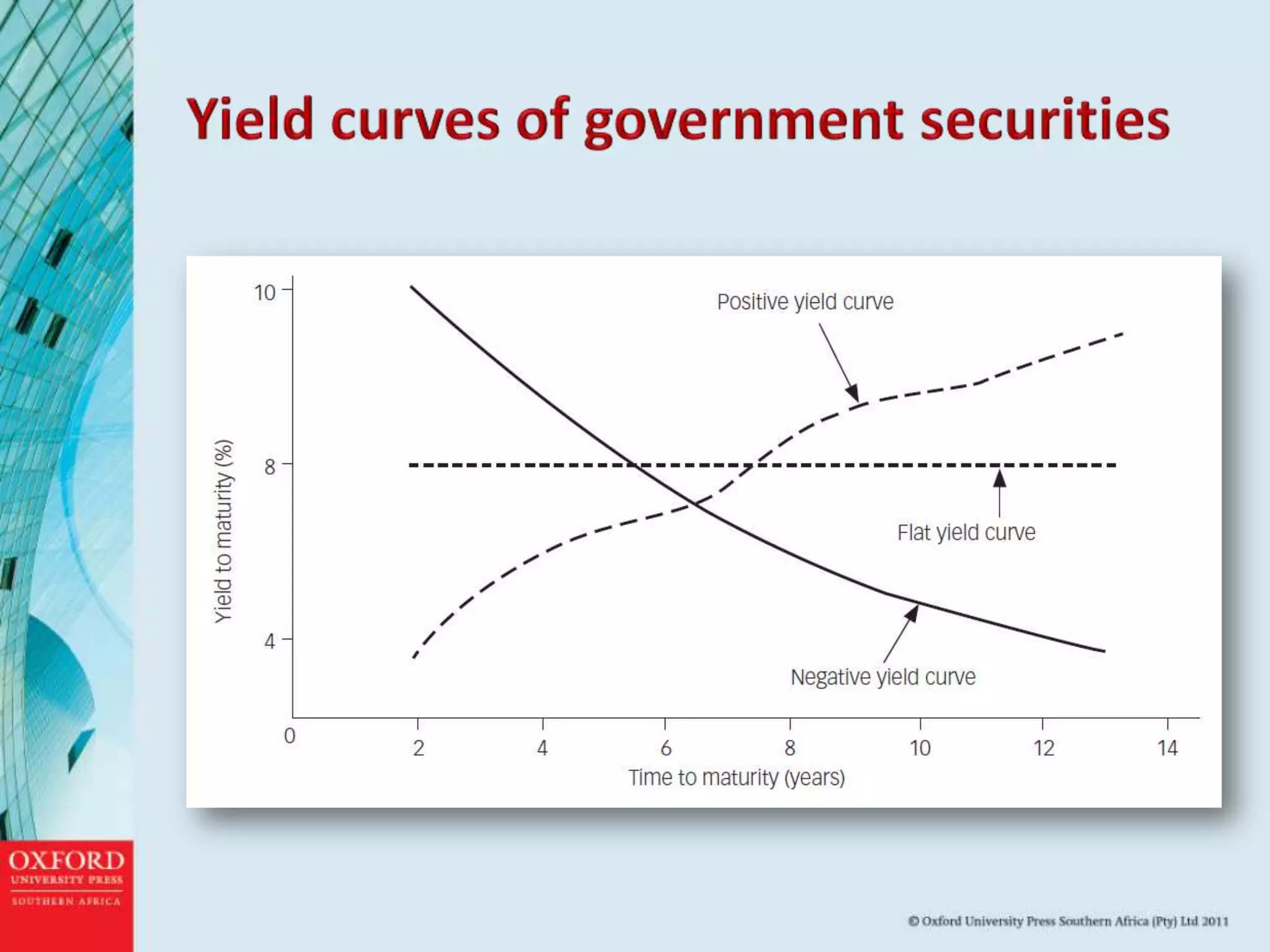

This document discusses public debt in South Africa. It defines public debt and describes the size and composition of South Africa's public debt over time. It explains different theories of public debt and costs associated with public debt management. It identifies the goals of public debt management in South Africa as minimizing debt costs, maintaining macroeconomic stability, and developing domestic financial markets.