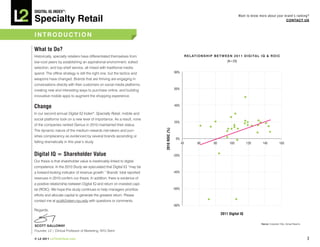

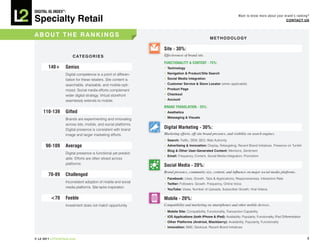

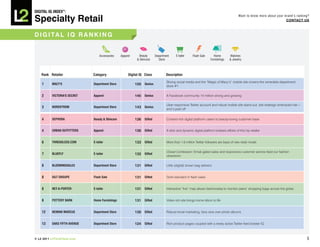

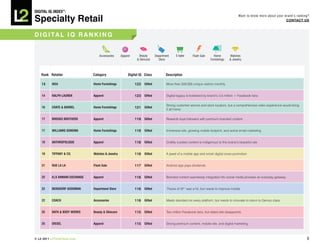

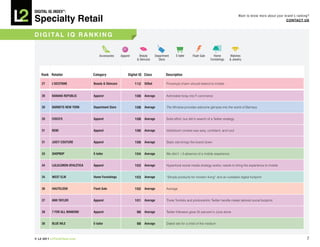

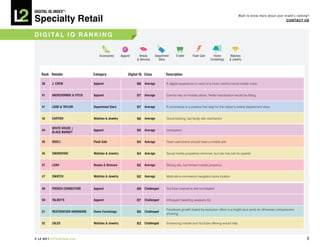

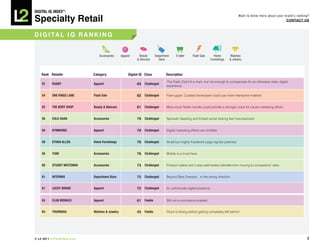

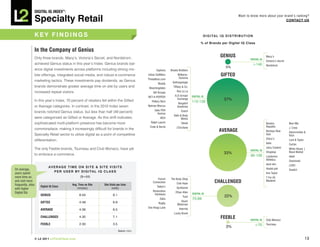

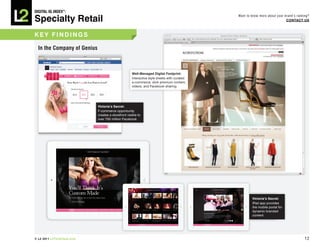

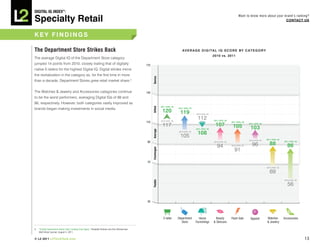

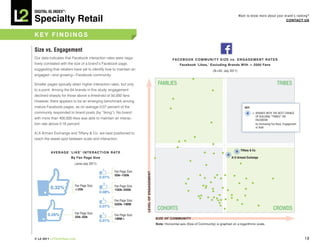

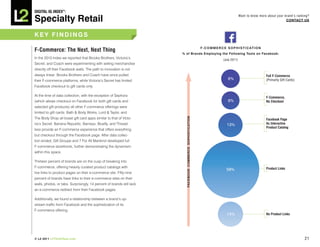

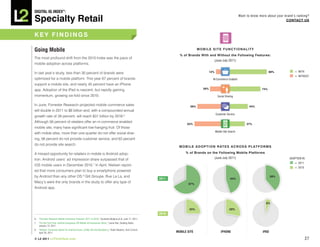

The document discusses the challenges and strategies for specialty retailers in adapting to the increasing influence of digital platforms on consumer purchasing decisions. It highlights the significant impact of social media and mobile technology, emphasizing that retailers need to engage customers directly online and innovate their digital presence to compete effectively. The report also features a ranking of retailers based on their digital IQ, revealing a shift in brand performance and the vital link between digital competence and financial success.