This document discusses trends in online and mobile retail. Key points:

1) E-commerce is growing rapidly in the US, reaching $44.3 billion in Q1 2012 and expected to grow at 13.3% CAGR to $361 billion by 2016. Online sales are becoming increasingly important for traditional retailers.

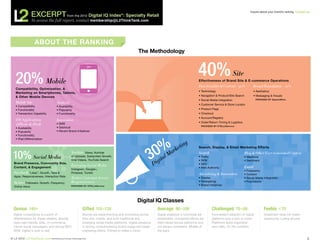

2) Larger retailers tend to have higher digital IQ scores, and the relationship is stronger when looking at the size of their online businesses specifically.

3) Department stores like Macy's and Nordstrom topped the 2012 Digital IQ Index for specialty retail, showing department stores can succeed by building strong digital presences.

4) Amazon remains the dominant online force and threat to