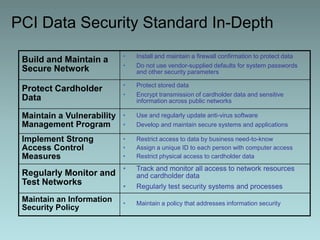

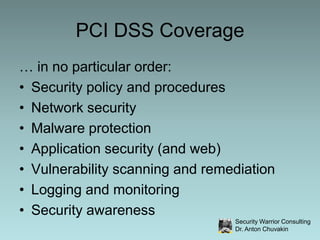

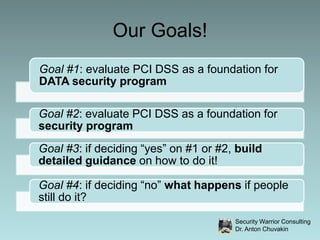

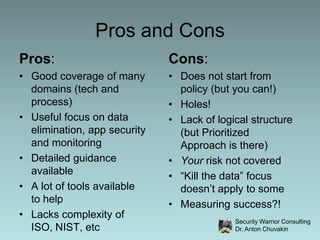

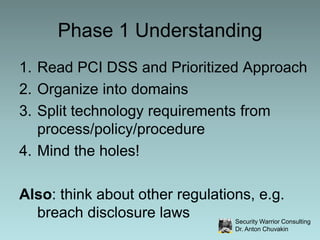

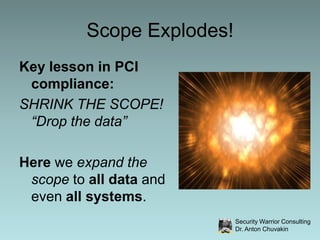

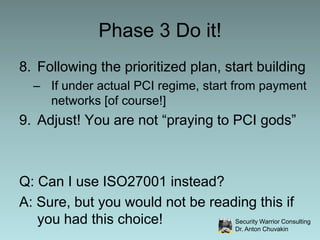

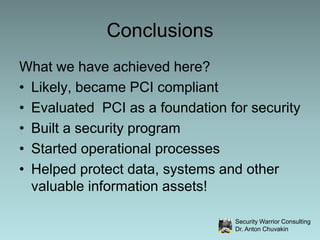

This document provides an overview of using the Payment Card Industry Data Security Standard (PCI DSS) as the foundation for a company's overall security program, beyond just payment card data security. It discusses building a security program in phases, starting with understanding PCI DSS requirements, planning to address gaps, implementing solutions, and then ongoing management of the security program. While PCI DSS was created specifically for payment card data security, this document argues that its requirements can form a solid baseline for any organization to improve their overall security posture.

![Phase 3 Do it!Following the prioritized plan, start building If under actual PCI regime, start from payment networks [of course!]Adjust! You are not “praying to PCI gods”Q: Can I use ISO27001 instead?A: Sure, but you would not be reading this if you had this choice!](https://image.slidesharecdn.com/pcidss-as-frameworksecure3602010rel-100514123651-phpapp02/85/PCI-DSS-based-Security-Is-This-For-Real-by-Dr-Anton-Chuvakin-33-320.jpg)