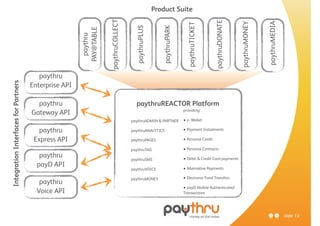

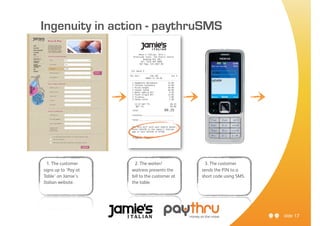

The document discusses the growth of mobile payments, with smartphone sales exceeding PC shipments in 2011. It notes that global mobile transactions were predicted to reach $241 billion in 2011 and over $1 trillion by 2015. "Generation M" is driving this growth through their high smartphone usage. The company paythru is presented as a payments platform that is network, method and device agnostic, providing secure one-click transactions for mobile via existing card and bank payment methods. Examples of paythru's mobile payment solutions including PAY@TABLE and paythruSMS are described, highlighting their convenience and ease of use.