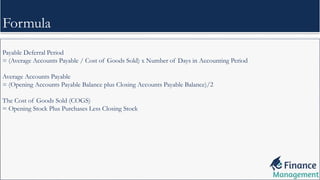

The payable deferral period is a financial ratio that measures the average time a company takes to pay its accounts payable, reflecting cash flow management. A high deferral period suggests effective use of cash, while a low period may indicate poor negotiation with suppliers. It is important to compare this ratio within the same industry for accurate interpretation.