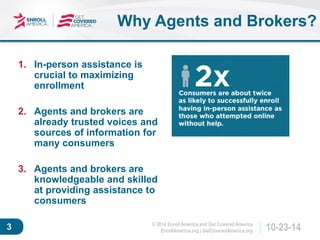

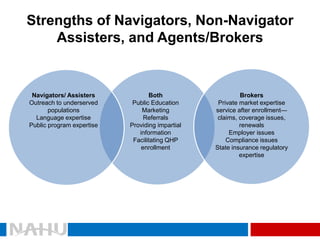

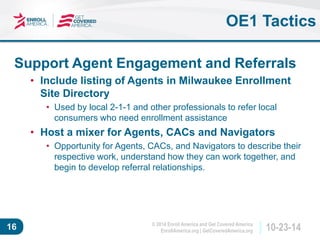

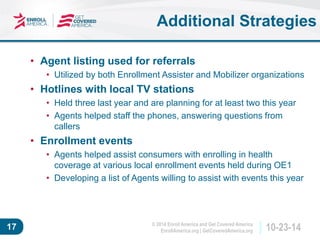

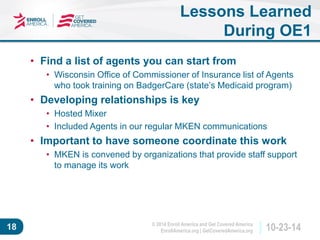

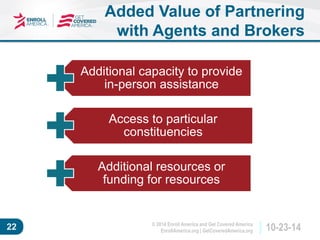

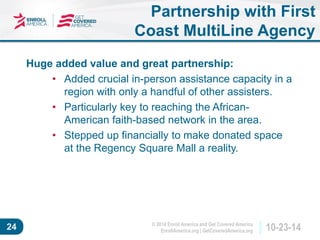

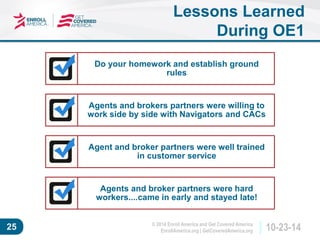

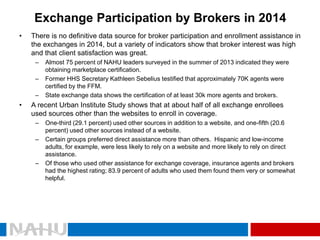

The document discusses the importance of in-person assistance through agents and brokers in health insurance enrollment, highlighting their role as trusted advisors who help consumers navigate their options. It outlines successful partnerships in regions like Milwaukee and Florida, emphasizing the value of collaboration between agents, navigators, and other assistive organizations to improve outreach and education efforts. Additionally, it addresses the opportunities and challenges faced by brokers in 2015's open enrollment period, noting the need for technological improvements and training to enhance service delivery.