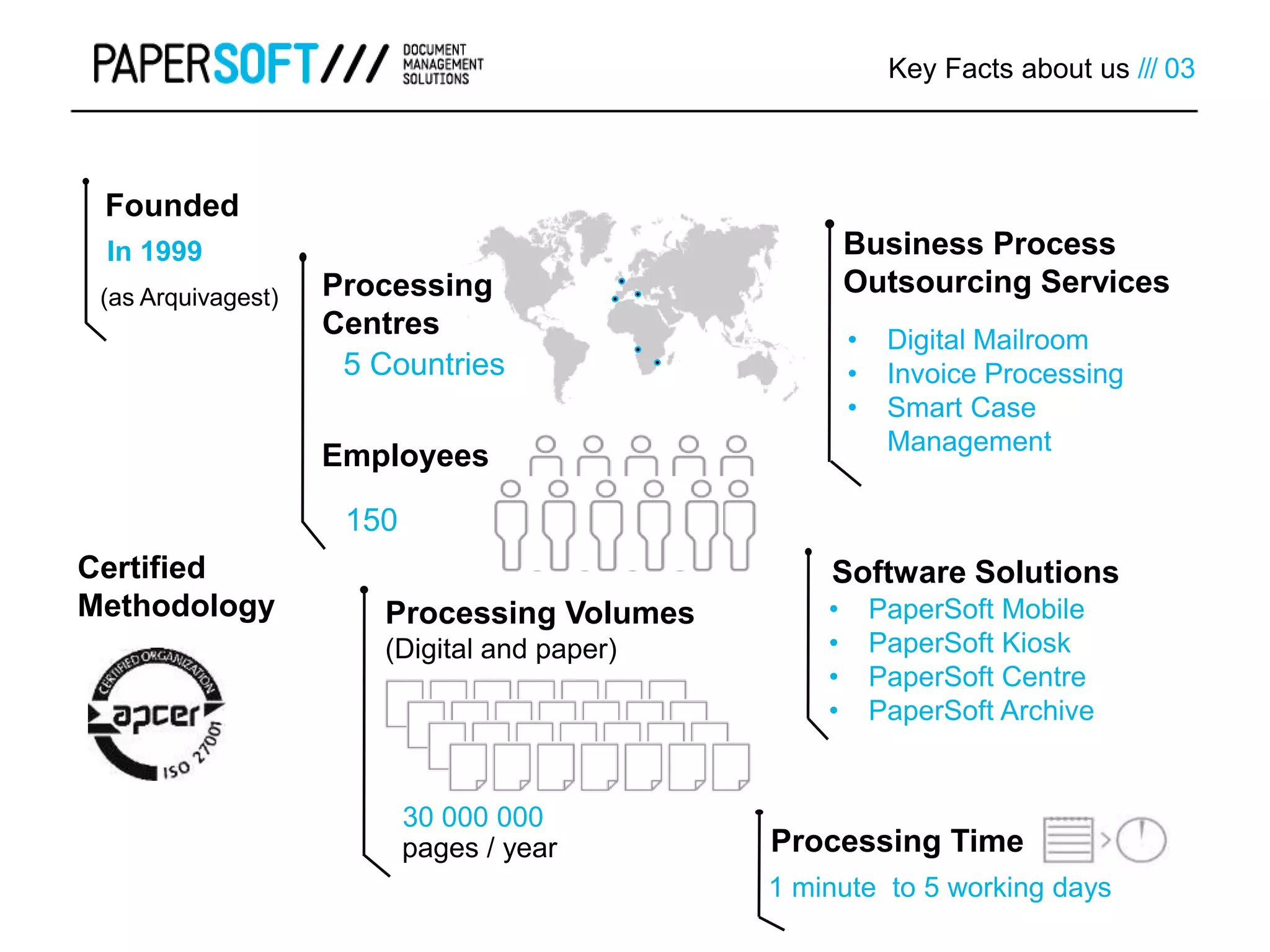

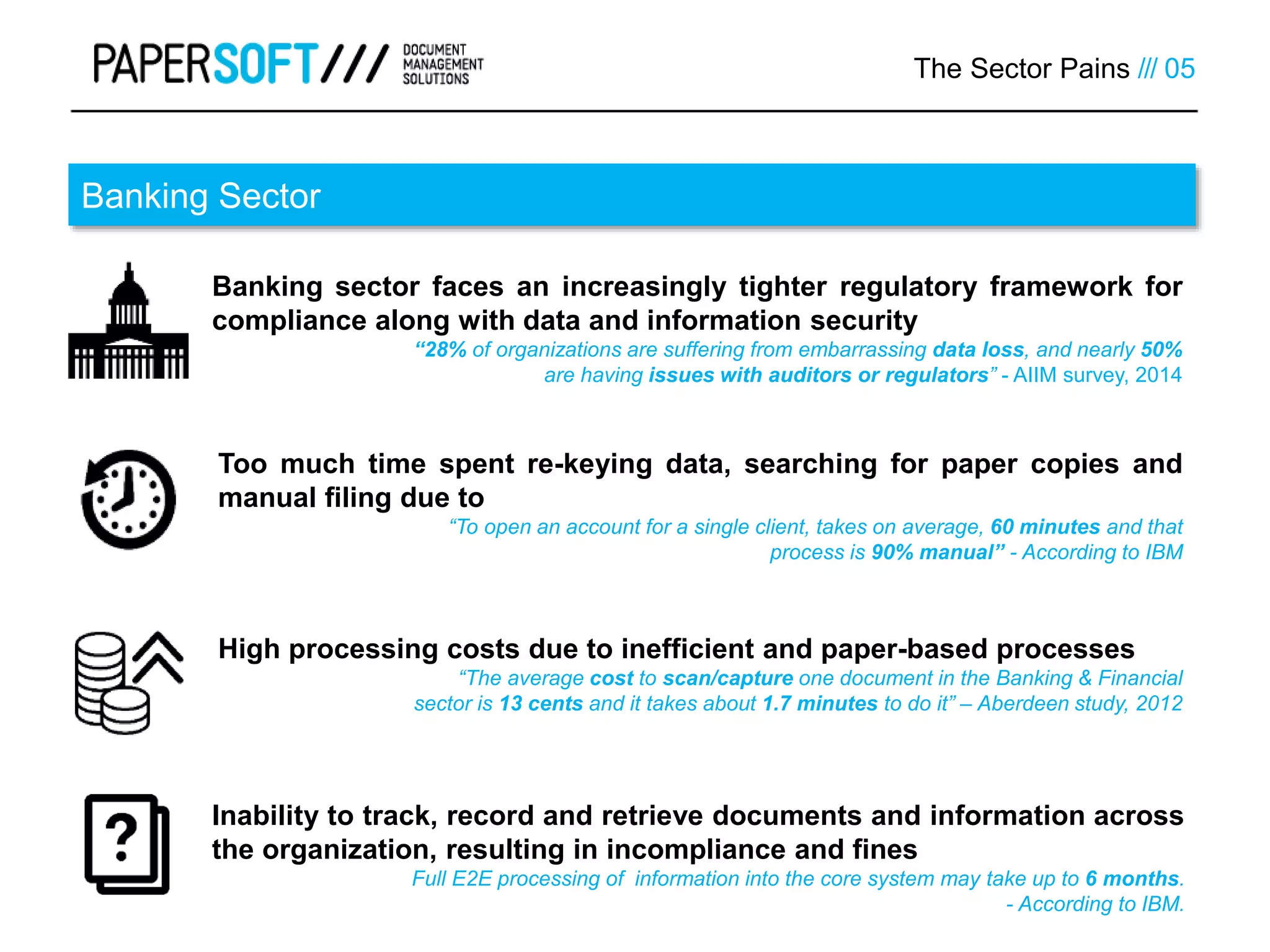

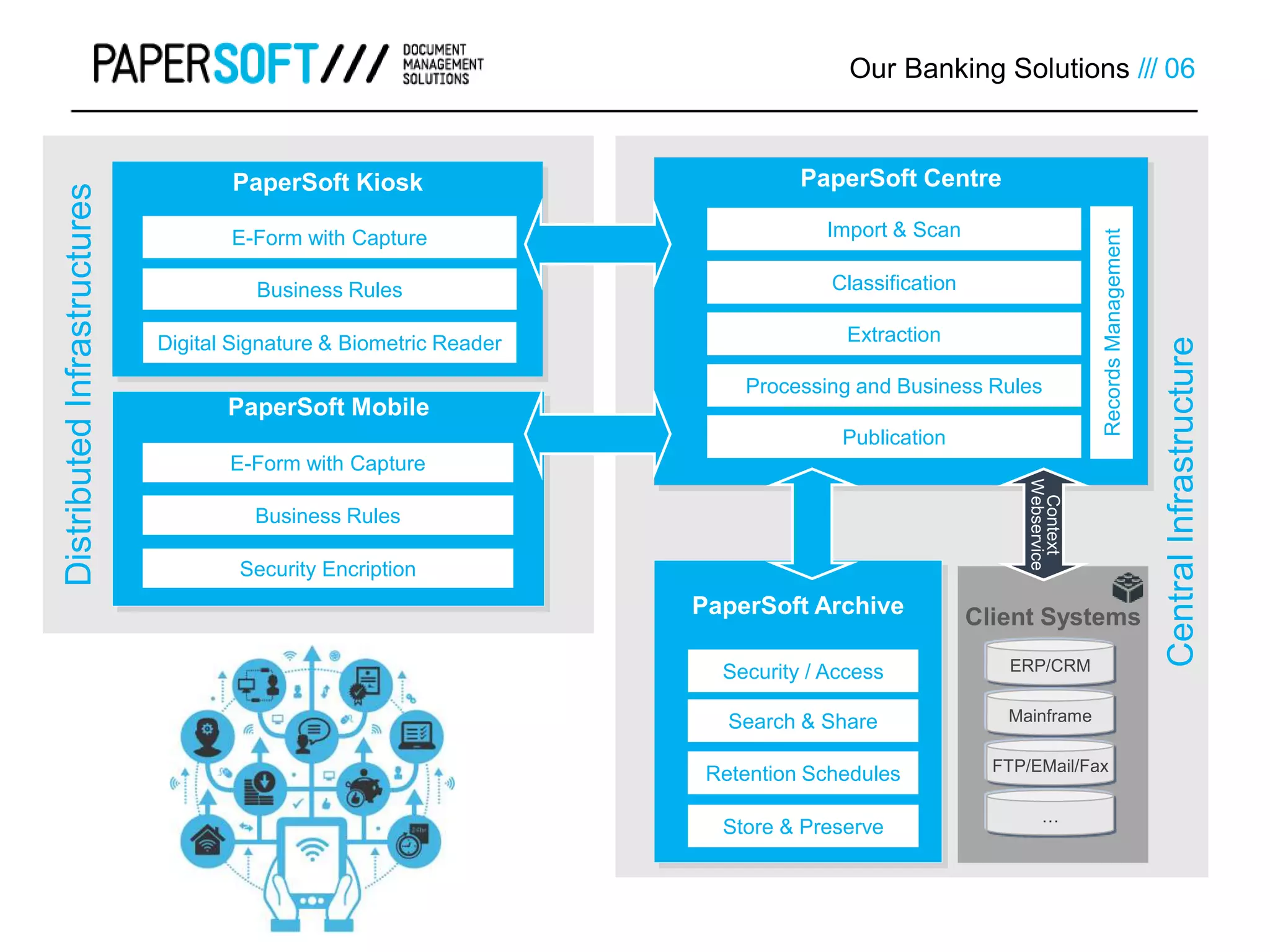

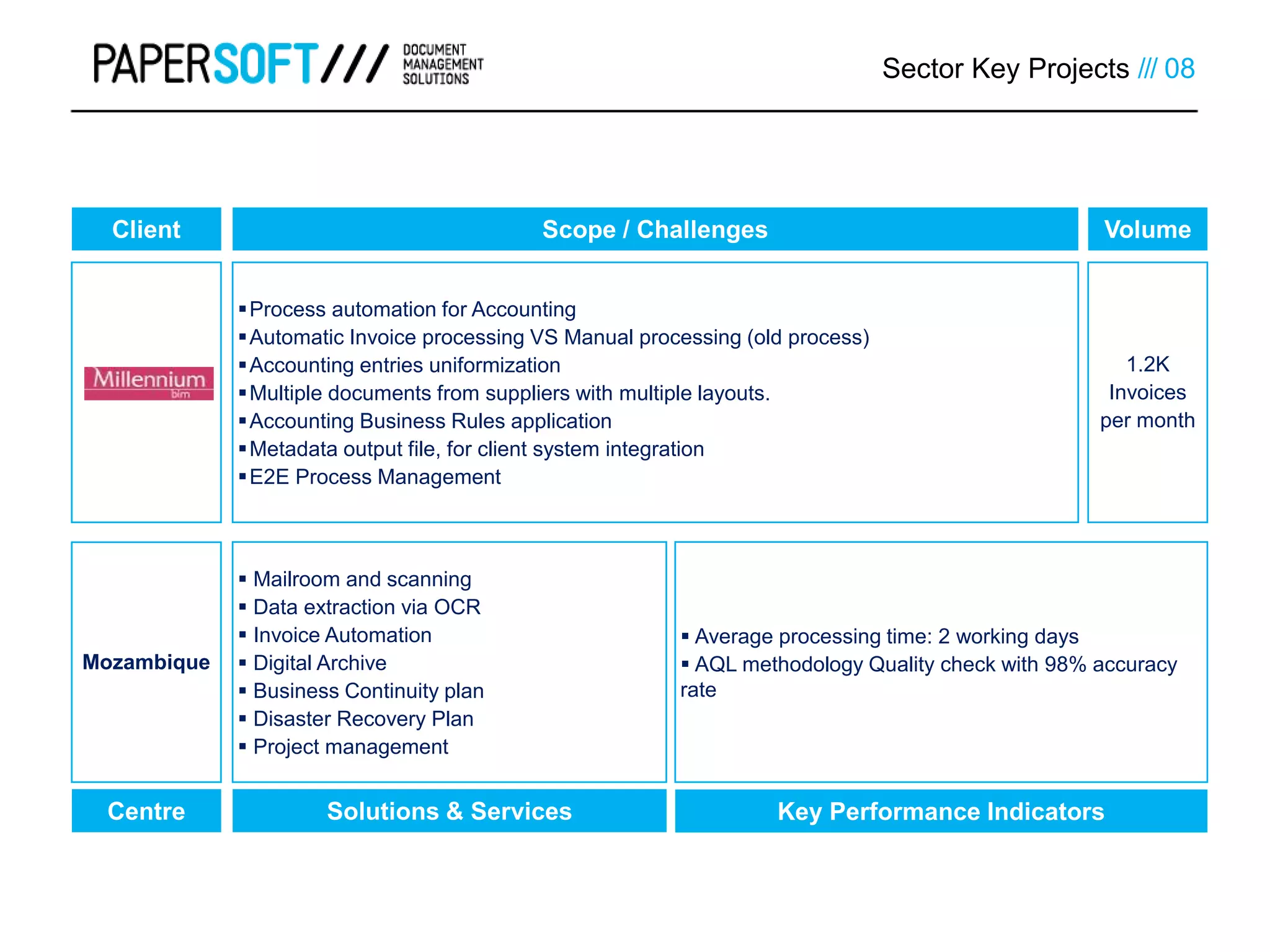

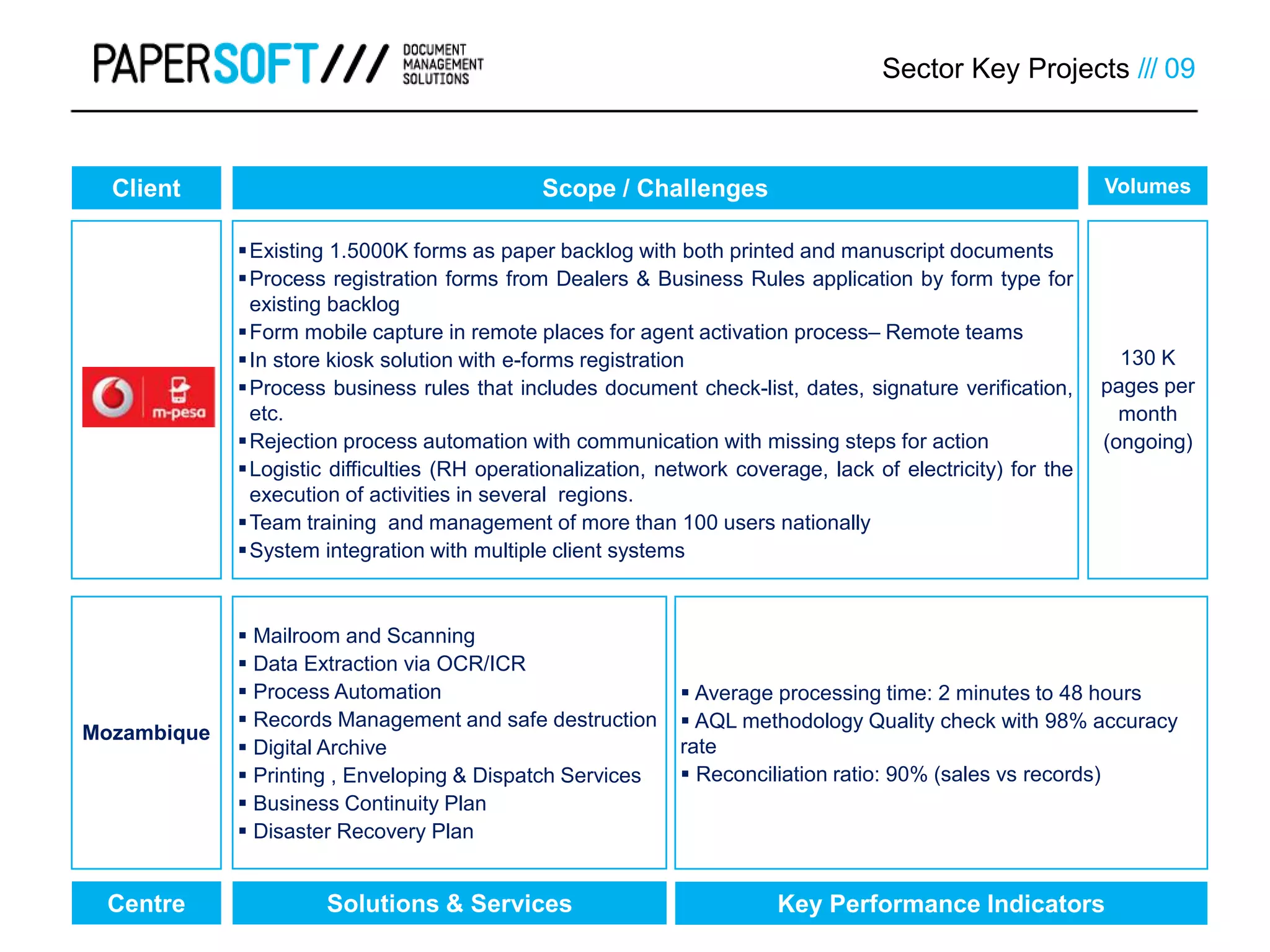

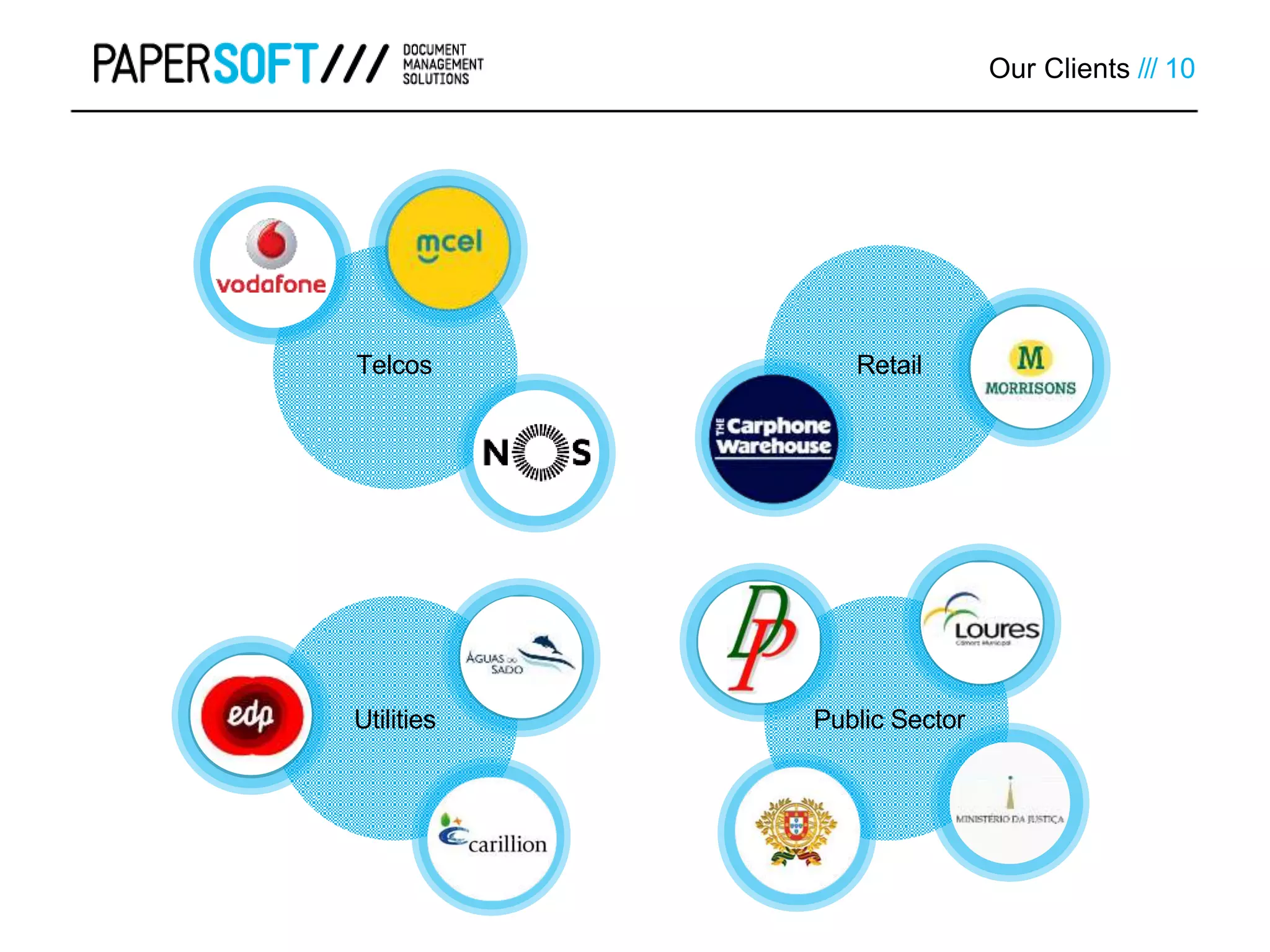

Papersoft, founded in 1999, offers document management solutions, specializing in process automation and information governance for the banking sector. The company addresses challenges such as regulatory compliance, data security, and inefficient manual processes, which can lead to high costs and data loss. Their solutions enhance data accuracy and processing efficiency, allowing banks to streamline operations and improve compliance.