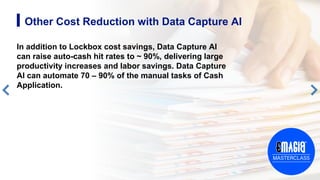

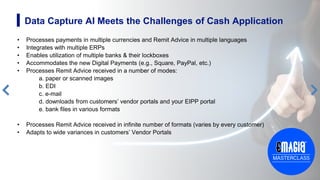

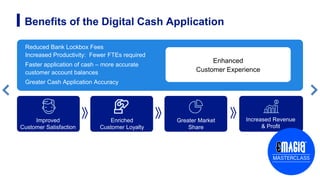

The document discusses how Data Capture AI can significantly reduce lockbox fees by automating the extraction and processing of remittance data from various sources. It highlights the technology's ability to improve accuracy, speed, and productivity while lowering costs associated with traditional lockbox services. A case study illustrates its successful implementation, increasing auto-cash hit rates from 30% to 70% and significantly reducing resolution times for deductions.