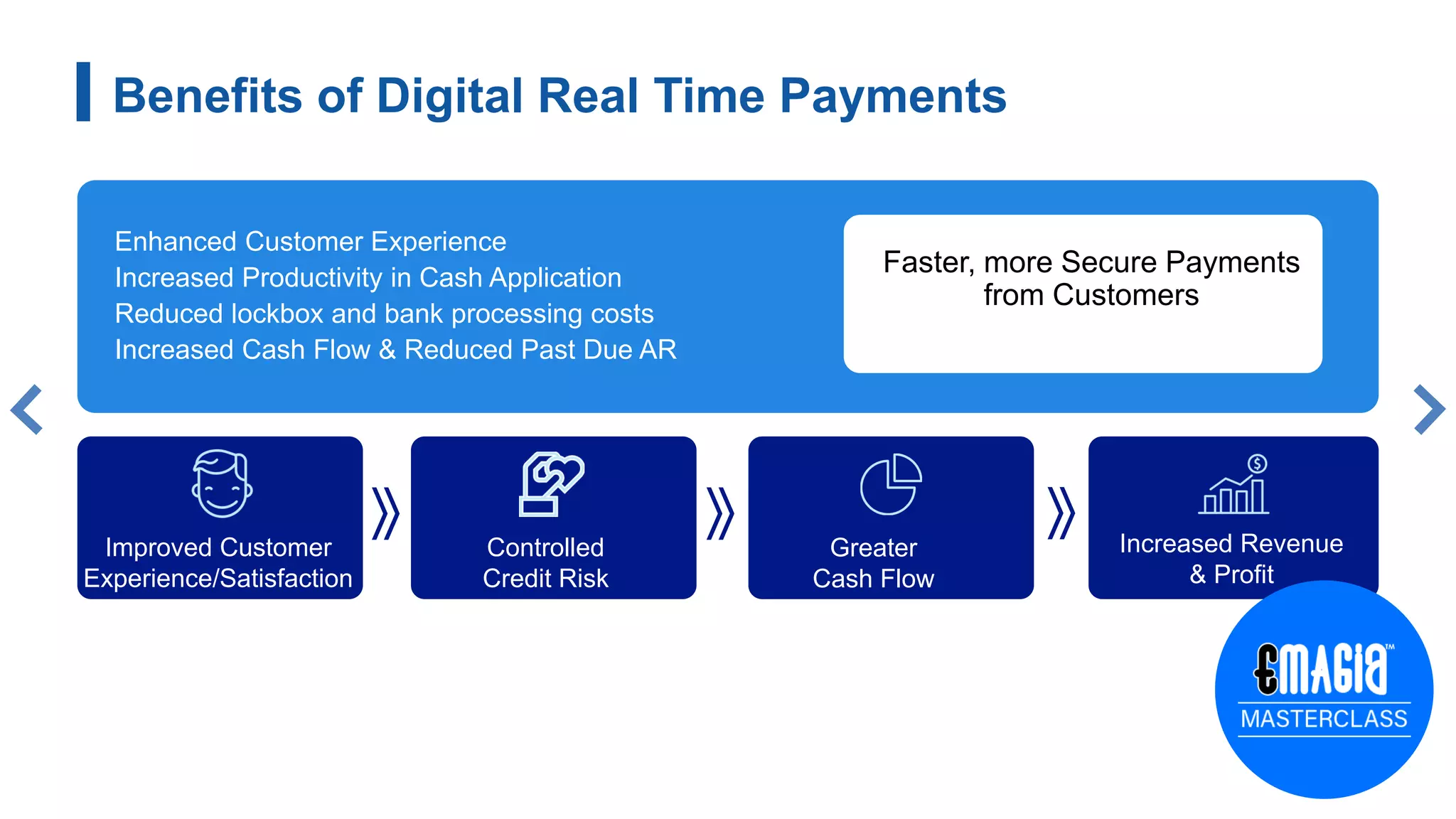

The document discusses the benefits of digital payments, including accelerated cash flow, reduced costs, and improved customer experience. It emphasizes the convenience of real-time payments for businesses, especially during remote work scenarios, and highlights a success story from a global water treatment solutions provider that saw substantial operational cost reductions and increased customer satisfaction. The conclusion advocates for the necessity of digital payments in modern transactions, particularly for businesses adapting to remote operations.