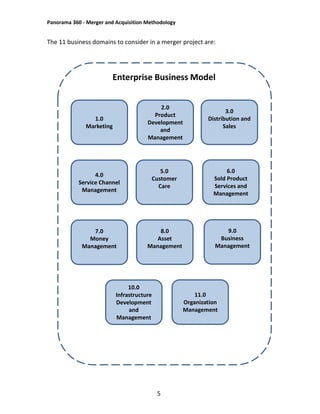

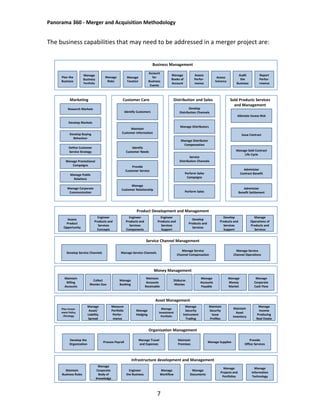

The document outlines the Panorama 360 methodology for managing mergers and acquisitions in the insurance and wealth management sectors. It provides a structured approach, featuring over 300 questions that aid project teams in identifying areas impacted by mergers, ensuring effective integration and change management. The methodology is organized into 11 business domains that require careful management during merger projects to achieve expected cost savings and synergies.