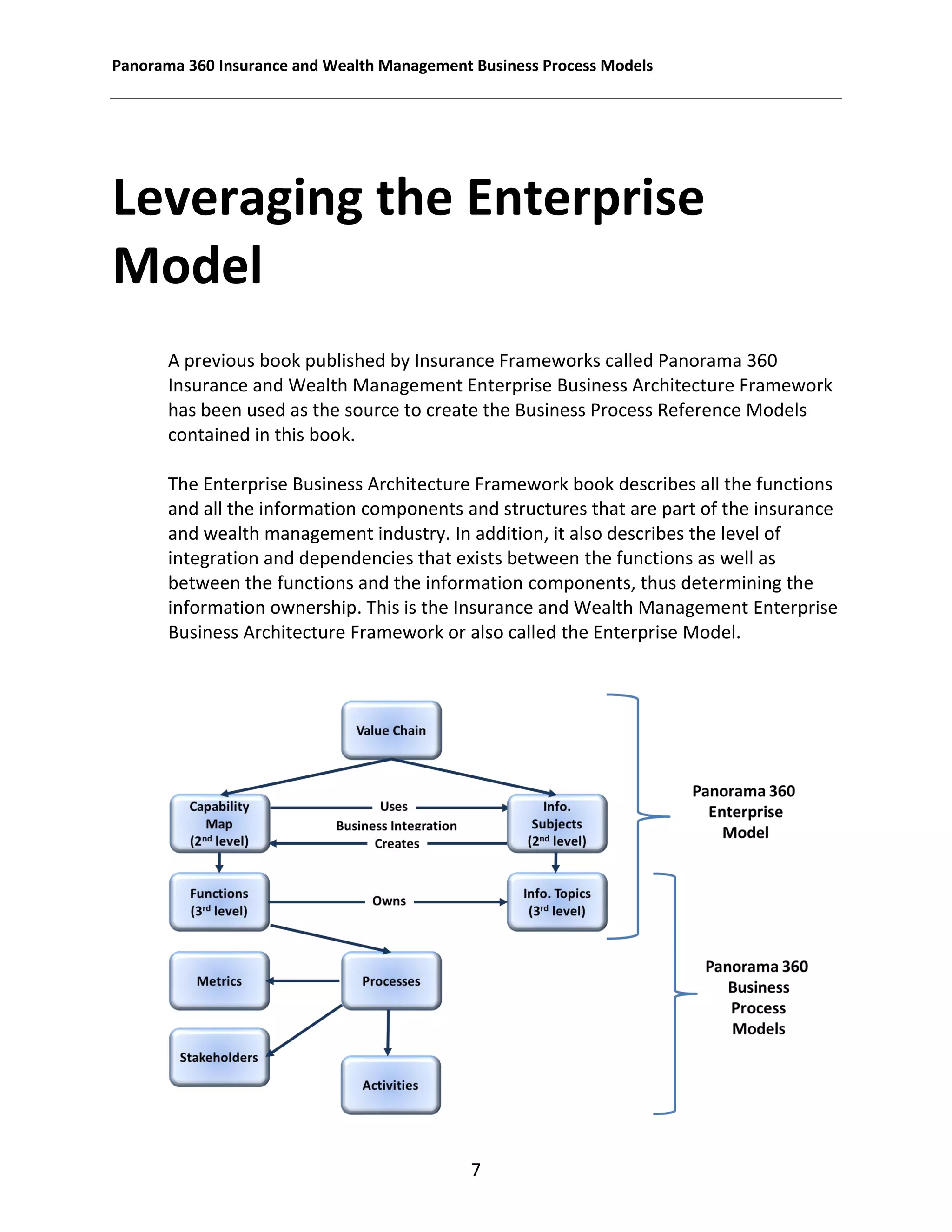

The document outlines the Panorama 360 Insurance and Wealth Management Business Process Models, serving as a comprehensive framework for designing, implementing, and transforming business processes within the industry. It details various business functions, processes, and methodologies to enhance operational efficiency and customer service in insurance and wealth management organizations. Additionally, it emphasizes the importance of a structured approach to business architecture to ensure effective integration and management of processes across different domains.