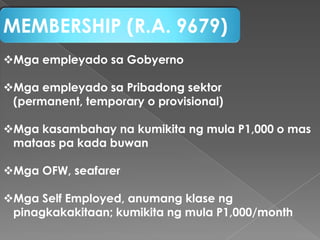

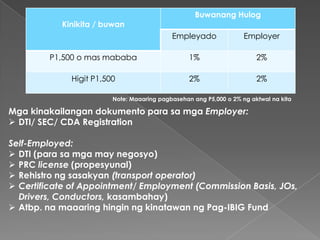

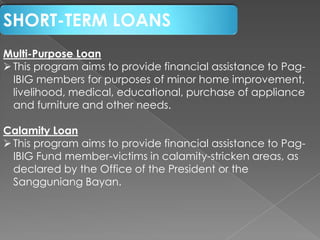

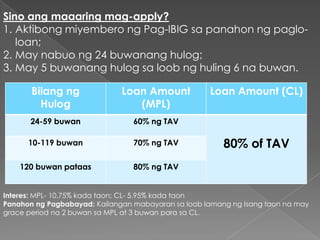

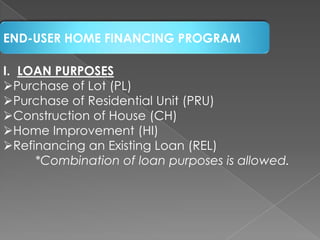

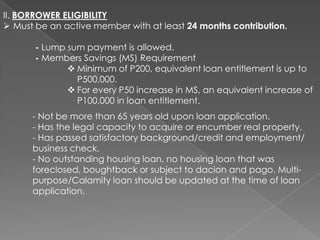

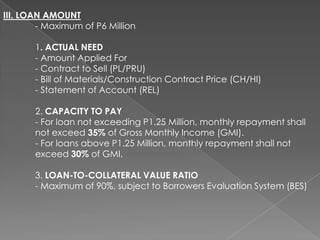

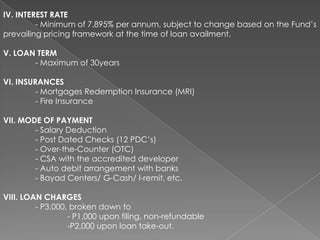

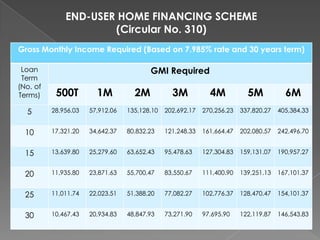

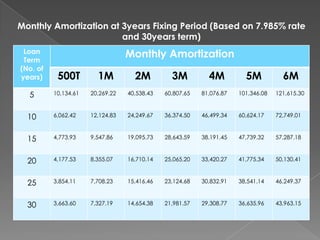

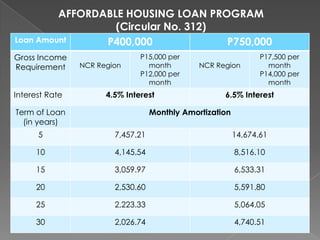

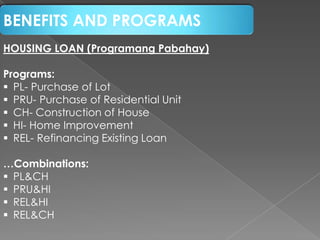

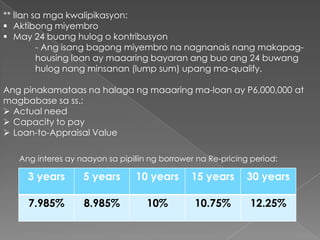

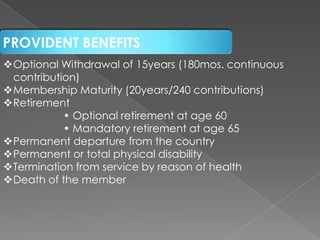

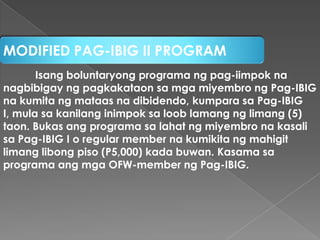

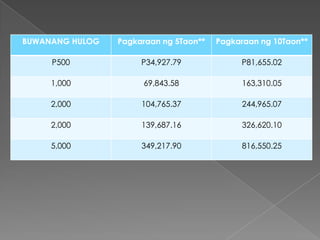

This document summarizes the Pag-IBIG Fund membership programs and benefits in the Philippines. It discusses (1) the mandatory membership coverage which includes government employees, private sector employees earning PHP1,000 or more per month, OFWs, and self-employed individuals; (2) the monthly contribution rates of 1-2% for employees and employers; (3) the short-term loan programs for multi-purpose and calamity loans; (4) the end-user home financing program requirements and loan terms; and (5) the provident benefits available such as optional and mandatory withdrawals, retirement, and death benefits.