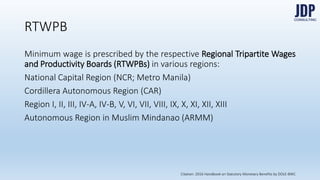

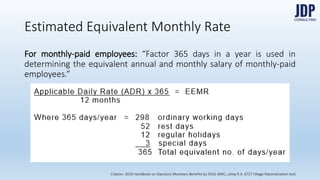

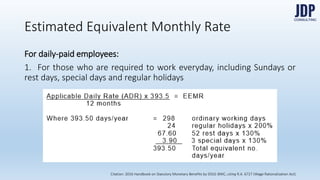

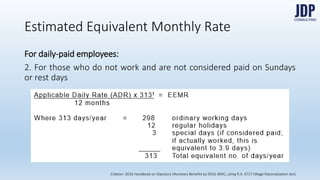

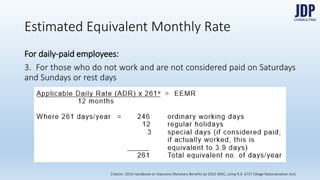

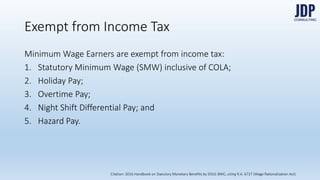

The document provides information on minimum wage laws in the Philippines, detailing regional wage orders, the coverage and exemptions for various employee categories, and the calculation of equivalent salaries for monthly and daily-paid employees. It highlights that minimum wage earners are exempt from certain income taxes and outlines the roles of employers and the government in distributing statutory monetary benefits. Additional resources and services related to human resource topics, including legal compliance and professional development training, are also mentioned.