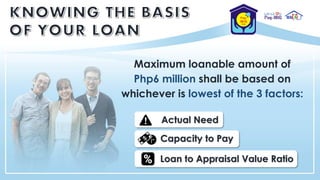

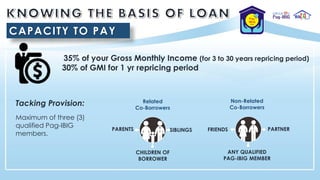

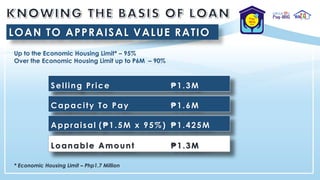

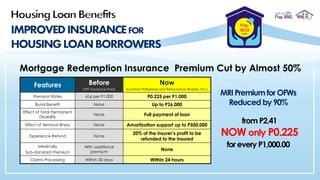

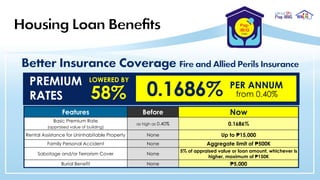

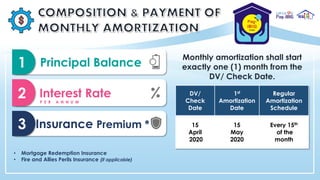

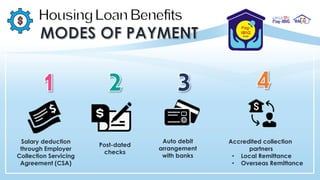

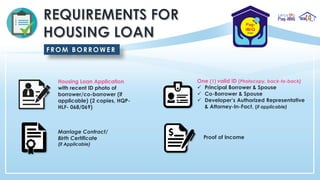

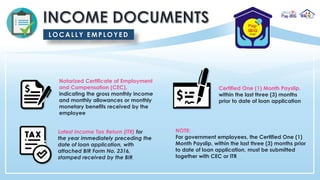

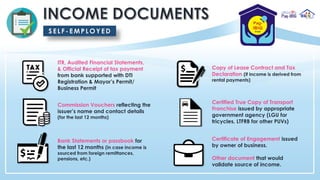

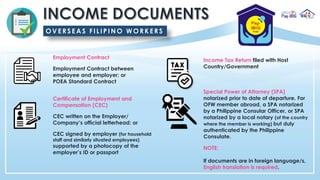

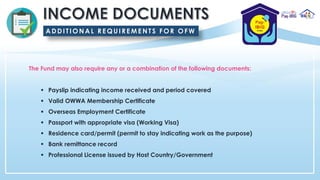

The document outlines the housing loan options provided by Pag-IBIG, detailing features such as loan amounts up to ₱6 million, varying interest rates based on loan terms, and eligibility criteria for borrowers. It includes information on processing fees, required documents for loan applications, and insurance options available for the loans. Additionally, it highlights special provisions for Overseas Filipino Workers (OFWs) and the benefits of the Pag-IBIG loyalty card.