OZM Initiation

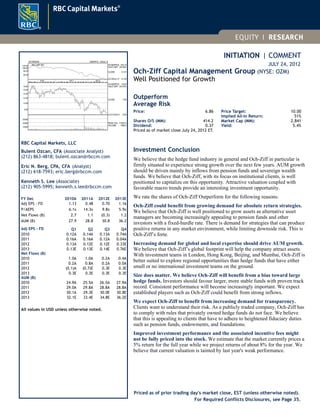

- 1. INITIATION | COMMENT JULY 24, 2012 Och-Ziff Capital Management Group (NYSE: OZM) Well Positioned for Growth Outperform Average Risk Price: 6.86 Shares O/S (MM): 414.2 Dividend: 0.37 Price Target: 10.00 Implied All-In Return: 51% Market Cap (MM): 2,841 Yield: 5.4% Priced as of market close July 24, 2012 ET. Investment Conclusion We believe that the hedge fund industry in general and Och-Ziff in particular is firmly situated to experience strong growth over the next few years. AUM growth should be driven mainly by inflows from pension funds and sovereign wealth funds. We believe that Och-Ziff, with its focus on institutional clients, is well positioned to capitalize on this opportunity. Attractive valuation coupled with favorable macro trends provide an interesting investment opportunity. We rate the shares of Och-Ziff Outperform for the following reasons: Och-Ziff could benefit from growing demand for absolute return strategies. We believe that Och-Ziff is well positioned to grow assets as alternative asset managers are becoming increasingly appealing to pension funds and other investors with a fixed-hurdle rate. There is demand for strategies that can produce positive returns in any market environment, while limiting downside risk. This is Och-Ziff’s forte. Increasing demand for global and local expertise should drive AUM growth. We believe that Och-Ziff’s global footprint will help the company attract assets. With investment teams in London, Hong Kong, Beijing, and Mumbai, Och-Ziff is better suited to explore regional opportunities than hedge funds that have either small or no international investment teams on the ground. Size does matter. We believe Och-Ziff will benefit from a bias toward large hedge funds. Investors should favour larger, more stable funds with proven track record. Consistent performance will become increasingly important. We expect established players such as Och-Ziff could benefit from strong inflows. We expect Och-Ziff to benefit from increasing demand for transparency. Clients want to understand their risk. As a publicly traded company, Och-Ziff has to comply with rules that privately owned hedge funds do not face. We believe that this is appealing to clients that have to adhere to heightened fiduciary duties such as pension funds, endowments, and foundations. Improved investment performance and the associated incentive fees might not be fully priced into the stock. We estimate that the market currently prices a 5% return for the full year while we project returns of about 8% for the year. We believe that current valuation is tainted by last year's weak performance. Priced as of prior trading day's market close, EST (unless otherwise noted). 125 WEEKS 12MAR10 - 23JUL12 8.00 10.00 12.00 14.00 16.00 18.00 M A M J J A S O N 2010 D J F M A M J J A S O N 2011 D J F M A M J J 2012 HI-30APR10 18.50 HI/LO DIFF -64.54% CLOSE 7.00 LO-01JUN12 6.56 10000 20000 30000 PEAK VOL. 41263.4 VOLUME 1566.0 60.00 80.00 100.00 120.00 Rel. S&P 500 HI-09APR10 120.19 HI/LO DIFF -65.48% CLOSE 41.57 LO-20JUL12 41.49 RBC Capital Markets, LLC Bulent Ozcan, CFA (Associate Analyst) (212) 863-4818; bulent.ozcan@rbccm.com Eric N. Berg, CPA, CFA (Analyst) (212) 618-7593; eric.berg@rbccm.com Kenneth S. Lee (Associate) (212) 905-5995; kenneth.s.lee@rbccm.com FY Dec 2010A 2011A 2012E 2013E Adj EPS - FD 1.13 0.48 0.70 1.16 P/AEPS 6.1x 14.3x 9.8x 5.9x Net Flows (B) 2.7 1.1 (0.3) 1.2 AUM (B) 27.9 28.8 30.8 36.2 Adj EPS - FD Q1 Q2 Q3 Q4 2010 0.12A 0.14A 0.13A 0.74A 2011 0.16A 0.16A 0.12A 0.04A 2012 0.13A 0.12E 0.12E 0.33E 2013 0.13E 0.13E 0.14E 0.76E Net Flows (B) 2010 1.0A 1.0A 0.2A 0.4A 2011 0.2A 0.8A 0.2A 0.0A 2012 (0.1)A (0.7)E 0.3E 0.3E 2013 0.3E 0.3E 0.3E 0.3E AUM (B) 2010 24.9A 25.5A 26.5A 27.9A 2011 29.0A 29.8A 28.8A 28.8A 2012 30.1A 29.3E 30.0E 30.8E 2013 32.1E 33.4E 34.8E 36.2E All values in USD unless otherwise noted. For Required Conflicts Disclosures, see Page 35.

- 2. 2 Investment Summary We are initiating coverage of Och-Ziff Capital Management Group with an Outperform, Average Risk rating and a $10 price target. We believe that Och-Ziff, the only pure-play publicly traded hedge fund, will benefit from an increased demand for alternative strategies. We expect assets under management to grow 7% in 2012 and 18% in 2013. Our Outperform rating is based on the following expectations: Och-Ziff could benefit from a growing demand for absolute return strategies. We believe that the hedge fund industry in general and Och-Ziff in particular will be able to capitalize on a trend towards allocating an increasing amount of capital to alternative strategies. We expect demand for investment products that provide strong, positive returns while limiting down-side risk to increase. This is Och- Ziff‘s sweet spot, and we would anticipate the company to gather additional assets as it continues to promote its value proposition. We believe that pension fund flows into hedge funds and other alternative asset classes could increase. Fund managers, in search for higher yields that allow them to meet their hurdle rates, will have to evaluate their traditional asset allocation strategies. Hedge funds that can offer global and local expertise should attract a larger amount of assets. We believe that Och-Ziff, with investment teams in London, Hong Kong, Beijing, and Mumbai, is better suited to explore global opportunities than hedge funds that have either a few or no international offices. Local market knowledge and teams able to do due diligence on-site should generate superior performance. We also expect capital that was allocated to UCITS (Undertaking for Collective Investment in Transferable Securities) in Europe and Asia to return to traditional hedge funds as we expect UCITS to produce inferior investment results. We believe that Och-Ziff‘s global footprint will help the company attract assets. We expect larger funds to attract the bulk of assets - size does matter. We believe Och-Ziff will benefit from bias toward large hedge funds. Investors should favour larger, more stable funds with proven track records. This should result in strong inflows to established players, such as Och-Ziff. Consistent performance will become increasingly important given the change in client base with pension funds increasing their allocation. We think that the Employee Retirement Income Security Act (ERISA) rules and plan asset regulations, which govern investments by pension funds, favour larger hedge funds, such as Och-Ziff. Size permits larger hedge funds to offer more strategies than smaller funds by utilizing a broader range of resources which should ultimately lead to better performance. We expect Och-Ziff to benefit from increased demand for transparency. Clients increasingly want to understand their risk. As a publicly traded company, Och-Ziff has to comply with rules and regulations that privately owned hedge funds do not face. We believe that this is appealing to clients that have to adhere to heightened fiduciary duties such as pension funds, endowments, and foundations. There has been an ―institutionalization‖ in the hedge fund industry. With the importance of the high-net- worth client declining and more pension funds, endowments, and foundations allocating capital to hedge funds, risk management capabilities are becoming a key consideration when selecting funds. This is true especially with the backdrop of the financial crisis. Being a public company, Och-Ziff had to make risk management a priority. We believe that being compliant can provide additional comfort to potential investors. This should help attract assets. Improved investment performance and the associated incentive fees might not be fully priced into the stock. We estimate that the market currently prices a 5% return for full year 2012. We think that Och-Ziff will be able to generate returns of about 8% for the year. We arrive at our 5% implied performance estimate by referencing the current valuation of about $7. Historically, Och-Ziff has traded at a 5% discount the average P/E multiple of traditional asset managers. Assuming that this still holds true, one would expect Och-Ziff to earn about $0.50 for 2012 to justify current valuation. The company could get there if it generates performance of about 5%. So far, the performance has been north of 4.5% (9% annualized) and we believe that Och-Ziff can generate returns of close to 8% for 2012. Och-Ziff Capital Management GroupJuly 24, 2012

- 3. 3 Company Overview Och-Ziff Capital Management Group LLC is one of the larger institutional alternative asset managers in the world with offices in New York, London, Hong Kong, Beijing, and Mumbai. Och-Ziff provides asset management services to institutional investors globally through its hedge fund and other alternative investment vehicles. Och-Ziff‘s funds seek to generate consistent, positive, absolute returns across market cycles with low volatility compared to the equity markets, and with an emphasis on preservation of capital. Och-Ziff‘s multi-strategy approach combines global investment strategies, including convertible and derivative arbitrage, corporate credit, long and short equity special situations, merger arbitrage, private investments, and structured credit. Exhibit 1: Och-Ziff Snapshot Och-Ziff Headquarters New York, NY Total AUM $30.1 bn Major Brands Och-Ziff % retail funds AUM rated 4-5 stars by Morningstar n/a Signature Absolute return strategies Source: Company filings; RBC Capital Markets Valuation We value Och-Ziff on a ―one plus a half‖ methodology, which is a deviation from the valuation approach we have used for traditional asset managers. Under this method, earnings derived from asset management fees are valued using a peer multiple, while earnings attributed to incentive income are valued at a discount. Management fees earned by Och-Ziff are higher than that earned by traditional long only fund managers, potentially justifying a premium to peer P/E multiples. However, we believe that lack of scale offsets the benefits of higher fees. Thus, we are using the peer multiple to value peer asset management fees, as we do not think higher fees would result in higher margins for Och-Ziff. We apply a 50% discount to earnings related to incentive income. We believe a discount is justified as performance fees are more volatile than management fees. Our price target for Och-Ziff is $10. On average, Och-Ziff has traded at a 5% discount to traditional asset managers. We arrive at our price target using a price-to-earnings multiple of 11.7x on 2013 estimated management fee earnings of $0.54 per share. We value earnings based on management fees at $6.27. Furthermore, we value incentive income based on a price-to-earnings multiple of 5.8x and 2013E incentive income EPS of $0.63. The multiple of 5.8x represents a 50% discount to the management fee multiple. We value earnings based on incentive income at $3.65 per share. The sum of the two valuations leads us to our price target of $10 for Och-Ziff. Och-Ziff Capital Management GroupJuly 24, 2012

- 4. 4 Ownership Exhibit 2: Top 10 Holders Source: FactSet Ultimate Holder ('000) ($MM) % OS Government of United Arab Emirates 38,139 269 27.3 Ziff Investment Management LLC 7,123 50 5.1 T. Rowe Price Associates, Inc. 4,826 34 3.4 Thornburg Investment Management, Inc. 4,200 30 3.0 Credit Suisse Securities (USA) LLC (Broker) 4,188 30 3.0 Century Capital Management LLC 2,823 20 2.0 Morgan Stanley Investment Management, Inc. 2,697 19 1.9 The Vanguard Group, Inc. 2,611 18 1.9 Scoggin Capital Management 2,380 17 1.7 Addison Clark Management LLC 2,255 16 1.6 Och-Ziff Capital Management GroupJuly 24, 2012

- 5. 5 Investment Thesis & Analysis Och-Ziff Should Benefit from Growing Demand for Absolute Return Strategies We believe that the hedge fund industry in general and Och-Ziff in particular will be able to capitalize on a trend towards allocating an increasing amount of capital to alternative strategies. We expect demand for investment products that provide strong, positive returns while limiting down-side risk to increase. This is Och-Ziff‟s sweet spot, and we would anticipate the company to gather additional assets as it continues to promote its value proposition. We believe that pension fund flows into hedge funds and other alternative asset classes could increase. Fund managers, in search for higher yields that allow them to meet their hurdle rates, will have to evaluate their traditional asset allocation strategies. One of the implications of the financial crisis has been that investors, especially institutional investors with specific investment hurdle rates, have been forced to re-evaluate their traditional investment strategies. This is especially true for pension funds which have hurdle rates of around 8% per year. This should not come as a surprise considering that if you had invested $1 in the S&P 500 on January 1, 2000, you would have been left with $0.93 by May 31, 2012. Tremendous volatility experienced in the equity markets over the past four years has made it apparent that investors have to rethink their traditional asset allocation strategies. Exhibit 3 depicts this increase in volatility and shows the VIX, a volatility index designed to measure the 30-day implied volatility in the S&P 500. Exhibit 3: CBOE Market Volatility Index (VIX) 0 10 20 30 40 50 60 70 Jan-90 Jan-92 Jan-94 Jan-96 Jan-98 Jan-00 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-12 VIX Average VIX Level Source: FactSet There is data supporting the premise that this trend toward allocating more capital to hedge funds has already started. A study by Barclays Capital showed that allocation by US pension plans to hedge funds increased 80% since 2009, reaching $550 billion by 2011. For 2012, Barclays expects $40 billion of additional flows into hedge funds. Some pension plans have just started allocating capital to hedge funds. The Florida State Board of Administration (FSBA), which manages $154 billion in plan assets, has allocated $1 billion to hedge funds just as recently as 2011. The Florida state legislature approved a bill to increase the cap on alternative investments to 20% from 10%. Having allocated $6 billion to alternative investments in 2011, the FSBA would have an additional $24 billion to invest in alternative strategies. This is not a one off. The Teachers Retirement System of Texas has been approved to raise its allocation to hedge funds to 10% from 5%, thereby enabling it to invest $5.5 billion into hedge funds based on assets under management (AUM) of $108 billion. Not only that, but Texas Teachers has also paid $250 million for a non-voting equity stake in Bridgewater Associates, the largest hedge fund by AUM with over $120 billion in assets. Och-Ziff has already seen an increase in flows from pension funds and has today a client base that is different than what it had just four years ago. Och-Ziff Capital Management GroupJuly 24, 2012

- 6. 6 Exhibit 4: AUM by Investor Type 0% 20% 40% 60% 80% 100% 120% 1Q09 2Q09E 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Pension Funds Other Note: 2Q09 allocation is an RBC Capital Markets estimate. Source: Company reports, RBC Capital Markets Exhibit 4 shows unmistakably that the investor base at Och-Ziff has changed from March 2009 to March 2012. Specifically, pension funds assets, which used to make up 20% of total assets, constituted about 29% of total assets under management as per the company‘s most recent filings. We expect this shift in customer base to continue and pension funds to add to asset growth. Och-Ziff‘s value proposition is that it can produce positive returns in any market environment. This alone should be appealing to pension funds that are struggling to produce returns in a record-low interest rate environment. Traditionally, hedge fund investors have been chasing performance. They have moved assets from one fund to another in search of performance. While certain hedge funds are happy to serve these customers, we believe that this is not the client base Och-Ziff is targeting. Instead, it is looking for investors who are allocating assets to hedge funds as a means of reducing investment performance volatility. Och-Ziff‘s objective is to pursue consistent, positive, absolute returns across all strategies. In essence, using hedging strategies and relying on very little leverage, Och-Ziff aims at producing returns that have low correlation to the broader equity markets. This, in our view, will appeal to a growing number of pension funds. Pension funds want to invest in hedge funds, not just to ―beat‖ the markets, but also to control volatility and preserve capital. This assumption is supported by comments made by pension fund professionals. For instance, in an interview with Hedge Funds Review, Janet Cowell, the state treasurer of North Carolina said that her state‘s pension plan is ―looking to long/short equity managers to temper the volatility of the public equity allocation. A long/short manager should be able to reduce systematic market risk and deliver equity-like returns with lower volatility over market cycles.‖ Statistics presented by Och-Ziff seem to support its claims that it can produce strong investment results at a fraction of the volatility experienced by the markets. Exhibit 5 is based on data provided in the company‘s annual filing and shows that since inception, the OZ Master Fund was able to generate three times the return of the S&P 500 at one-third of the volatility. Och-Ziff Capital Management GroupJuly 24, 2012

- 7. 7 Exhibit 5: Net Annualized Return, Volatility and Sharpe Ratio 1 Year 3 Years 5 Years Since OZ Master Fund Inception (Jan. 1, 1998) Since OZ Multi- Strategy Composite Inception (April. 1, 1994) Net Annualized Return through Dec. 31, 2011 OZ Master Fund Composite (0.48%) 9.96% 4.50% 9.51% n/a Och-Ziff Multi-Strategy Composite (0.48%) 9.96% 4.50% 9.51% 13.27% S&P 500 Index 2.11% 14.11% (0.21%) 3.70% 8.05% MSCI World Index (4.96%) 9.96% (2.91%) 2.97% 5.65% Volatility - Standard Deviation (Annualized) OZ Master Fund Composite 3.82% 4.48% 6.15% 5.20% n/a Och-Ziff Multi-Strategy Composite 3.82% 4.48% 6.15% 5.20% 5.60% S&P 500 Index 15.94% 18.97% 18.88% 16.58% 15.72% MSCI World Index 14.25% 17.02% 17.81% 15.61% 14.74% Sharpe Ratio OZ Master Fund Composite -0.19 2.16 0.45 1.23 n/a Och-Ziff Multi-Strategy Composite -0.19 2.16 0.45 1.23 1.71 S&P 500 Index 0.12 0.73 -0.11 0.03 0.28 MSCI World Index -0.36 0.57 -0.26 -0.01 0.13 Note: The Och-Ziff Multi-Strategy Composite (the “Multi-Strategy Composite”) is provided by the company as supplemental information to the Master Fund Composite. The Multi-Strategy Composite represents the composite performance of all accounts that were managed in accordance with a broad multi-strategy mandate since the company’s inception on April 1, 1994 Source: Company reports The key takeaway is that Och-Ziff outperformed the S&P 500 index by 522 basis points since its inception in 1994. However, it did this with only 36% of the volatility experienced by the S&P 500. Outperformance with lower volatility should be attractive to pension funds. This is why we believe that pension plans present an opportunity for Och-Ziff. These plans are fighting on various fronts to generate acceptable returns; poor investment returns, low interest rates, and increasing longevity risk have increased pressure on pension funds to consider all of the available options to improve returns. Citi Prime Finance Research concludes that institutional pension fund allocation to alternative investments could grow from current levels by 43% and could reach $1.4 trillion by 2016. Citi‘s findings are consistent with work done by other researchers such as the 2012 SEI Global Hedge Fund Survey. SEI‘s fifth annual global survey of institutional hedge fund investors shows that institutional investors are increasing their allocation to hedge funds. Investors surveyed responded that they recognize the advantages of being able to access high-level investment talent and unique investment strategies via hedge fund investments. Some of the respondents even expressed the view that there has been ―brain drainage‖ with hedge funds attracting the best and brightest. This should not come as a surprise since the compensation structure is very attractive. Approximately 40% of the participants replied that they could not meet their return objectives without allocating assets to hedge funds. Institutional clients, especially pension funds, which have been extremely challenged in the current market environment to meet their hurdle rates, should agree. Alternative assets will become more important in meeting future obligations. Are there any alternatives for pension funds to investing in hedge funds? We do not believe that there are many options available to most pension funds. In our view, the only other solution available to pension fund sponsors would be to offload their pension liabilities, thereby giving up control over the assets; General Motors has done just that. It eliminated its US-salaried pension obligations by agreeing to pay a yet to be determined amount of $3.5 billion to $4.5 billion in cash for an immediate $1 billion underfunded relief. This transaction could result in a transfer of up to $29 billion in assets to Prudential Financial, the counterparty of this transaction. Och-Ziff Capital Management GroupJuly 24, 2012

- 8. 8 However, we would consider this transaction to be a one off for the following reasons. The current low interest rate environment could increase pension fund liabilities, thereby making it unattractive for most companies to defease the pension liability. We do not expect any changes in the short term. Given the status of the economy and comments made by the Federal Reserve Bank, investors should brace themselves for two years of low interest rates. Low interest rates mean that any company trying to do a similar transaction would have to pay more than it would in a higher interest rate environment for the following reason: cash outflows are discounted at low discount rates, resulting in higher liabilities than would be the case if interest rates were higher. Thus, there should be few companies willing to do a similar transaction and shed a few billion dollars in cash. Furthermore, General Motor‘s pension obligation was well funded at 92%, which makes a pension-liability transfer less painful. As a general rule, at a minimum, pension plans need to yield equal to the assumed discount rate to meet future pension liability obligations. However, underfunded plans would need to earn a return above the discount rate applied. We estimate that current return assumptions for most companies vary from 7.5% to 8.5%. GM‘s return assumption was much lower than that at just 6.2%. Our analysis indicates that the average pension fund is about 75% funded, i.e., there is only $0.75 of pension asset available to support $1 of projected pension liability. What does this mean for Och-Ziff? Low interest rates coupled with insufficient assets to meet future obligations and the need to pay large sums of cash to an insurer to take on the pension obligations do not make pension transfers a viable option for most pension fund sponsors. While a few potential candidates might have the cash, most will want to retain the cash for business purposes. In our view, the only attractive option to the pension plan sponsors is to invest in asset classes that should generate strong returns. This is why we believe we are going to see an increased demand by pension funds for alternative assets, which should benefit Och-Ziff based on its investment philosophy. Hedge Funds that Can Offer Both Global and Local Expertise should Attract Larger Amount of Assets We believe that Och-Ziff, with investment teams in London, Hong Kong, Beijing, and Mumbai, is better suited to explore regional opportunities than hedge funds that have either a few or no international offices. Local market knowledge and teams able to do due diligence should result in superior performance. We also expect capital that was allocated to UCITS (Undertaking for Collective Investment in Transferable Securities) in Europe and Asia to return to traditional hedge funds. We believe that Och-Ziff‟s global footprint will help the company attract assets. Another avenue of AUM growth for Och-Ziff could come from investors in Europe and Asia. Reduced risk appetite in Europe and Asia has resulted in outflows. Investors, concerned after the onset of the economic crisis and shaken by events such as the Madoff scandal, have fled the hedge fund industry. Some of the assets withdrawn have been re-allocated to more traditional asset classes while others have been re-directed into other alternative products that provide more transparency and liquidity than traditional hedge funds, such as mutual funds that mimic hedge funds and alternative UCITS (Undertaking for Collective Investment in Transferable Securities). Och-Ziff was not immune to this development, which resulted in a decline in AUM and a shift in the mix of Och-Ziff‘s investor base by geography. Consider that in 2008 and 2009, Och-Ziff experienced total outflows of $8.8 billion combined. Assets under management shrank to $23 billion in 2009 from $33 billion in 2007. Outflows could have accelerated by the fact that, unlike other hedge funds, Och-Ziff did not suspend or restrict redemptions in 2008 and 2009. It maintained its one-year lock-up period, and anyone wanting to withdraw funds within the lock-up period could do so by paying a penalty, and no gate provisions were enacted based on a conversation that we had with management. While we believe that outflows at Och-Ziff were broadly based in 2008 and 2009, it is safe to assume that the company has seen disproportionately high outflows of non-North American assets after 2009. While in 2009, European and Asian investors contributed 43% to total assets under management, their contribution has declined to 28% of total assets as of the first quarter of 2012. Expressed in absolute dollar terms, its holdings shrank to $8.4 billion by the first quarter of 2012 from $9.9 billion in 2009. Och-Ziff Capital Management GroupJuly 24, 2012

- 9. 9 This does not seem to be an Och-Ziff specific event. Based on a report published by Towers Watson in 2012 titles Hedge Fund Investing – Opportunities and Challenges, European investors contributed lopsidedly to the $300 billion of global outflows for hedge fund industry in 2008 and 2009. Where did the capital move? We believe that investors allocated their assets to traditional asset classes, ETFs, and alternative UCITS if they wanted to have exposure to hedge funds. A research report by Alix Capital, a Geneva-based provider of alternative UCITS indices, indicated that AUM of UCITS hedge funds increased 375% from March 2009 to the first quarter of 2012. UCITS are open-ended retail investment funds that can be distributed throughout the European Economic Area. These funds address concerns that investors had post-financial crisis. The UCITS regulations set by the European Union (EU) established uniformity in regulations, no matter in which EU country the fund is domiciled. The transparency, liquidity, and regulatory oversight required to be a UCITS helped fund sponsors gather assets. One of the features that make this product appealing to these investors is that a UCITS must redeem its units at the request of the unit holder, with the minimum frequency being at least twice a month. A UCITS can only have a gate of 20% maximum per month. Not only have European investors shown interest in alternative UCITS but also Asian investors. We believe that investors were attracted to them because UCITS are tightly controlled—our thinking is that this product provides added transparency, liquidity, diversification, and risk control when compared to a traditional hedge fund. Based on a survey released by Naisscent Capital in late 2011, the number of alternative UCITS funds available had exceeded 1,000 at the time the research was published, with 65% of these funds being launched after the 2008 financial crisis. Other research published by Towers Watson in 2012 titled Hedge Fund Investing indicated that the UCITS market had grown to about €5.6 trillion in 2011. About $115 billion of AUM was invested in alternative UCITS. How will this trend benefit Och-Ziff? We believe that assets invested in UCITS will eventually find their way back to traditional hedge funds. The advantages of having daily and weekly liquidity should be more than offset by the investment limitations imposed by the UCITS structure. Constraints on concentration and leverage limits effectively reduce the opportunity to add value. And not every hedge fund is willing to set up a UCITS structure. Some of the better performing investment strategies might not be available to investors who use UCITS exclusively. We believe that UCITS will most likely underperform traditional hedge funds. Investors that are disappointed by the performance of UCITS could reallocate assets to traditional hedge fund managers such as Och-Ziff. Likewise, investors who had allocated assets to other asset classes could increase their risk appetite and allocate assets to hedge funds in order to improve investment performance. There could be about $200 billion in assets that hedge funds could attract, if we were to assume that two-thirds of the $300 billion of outflows the hedge fund industry experienced in 2008 and 2009 should be re-allocated to hedge funds. European and Asian markets present growth opportunities for years to come for Och-Ziff and other hedge funds. While Och-Ziff does not deal with retail investors, it can attract funds from institutional investors who have invested in UCITS funds. How is Och-Ziff positioned to capitalize from this opportunity? While there has been a decline in demand for hedge fund products in Europe and Asia, we believe that demand will ultimately rebound and reward managers that have demonstrated a commitment to the markets and their clients. We believe that regions that have scaled back exposure to hedge funds over the past four years will contribute disproportionately to AUM growth at Och-Ziff over the long run. We would expect Asia to drive AUM growth. According to Preqin, a data and intelligence provider focused on alternative asset managers, 37% of Asia-Pacific investors want to increase their exposure to hedge funds while only 6% want to decrease their exposure in 2012. Based on this survey, the majority of flows will go to single-manager hedge funds rather than funds of hedge funds. Interestingly, 83% of the investors consider investing only in the Asia Pacific region because they are familiar with these markets. This should bode well for investment teams utilizing local talent. Och- Ziff could complement local teams with sophisticated infrastructure and strong risk management. Och-Ziff Capital Management GroupJuly 24, 2012

- 10. 10 Exhibit 6: Investors by Geography $30.1$28.8$27.9 $23.1 0% 10% 20% 30% 40% 50% 60% 70% 80% 4Q09 4Q10 4Q11 1Q12 $0.0 b $5.0 b $10.0 b $15.0 b $20.0 b $25.0 b $30.0 b $35.0 b North America Europe Asia and Other AuM Source: Company reports There is no free lunch, however. Hedge funds need to demonstrate consistency in performance and commitment to regions. We believe that funds that have investment teams on the ground around the globe on a consistent basis will attract assets. After all, investors will be reluctant to entrust money to managers who withdrew in the aftermath of the financial crisis. We believe that Och-Ziff fits this category and here are some statistics that will demonstrate the company‘s dedication to non-US markets: Och-Ziff opened its London office in December 1998 and its first Asian office in Hong Kong in December 2001; Och-Ziff offered its first European dedicated multi-strategy fund in April 2000 and launched its Asian-dedicated multi-strategy fund in February 2005. In September 2007, when the company went public, Och-Ziff had a staff of 60 running $5 billion out of the London office and a staff of 35 overseeing assets in excess of $3 billion in Asia—mostly out of the Hong Kong office. Today, Och-Ziff has 63 employees working out of the London office overseeing a mere $2.2 billion, and 47 employees are based in Asia managing $1.7 billion assets. While assets have declined, total head count has actually increased. We agree with the management assertion that it is important to have local talent in these important markets. Locally based investment managers should be able to attract more assets than hedge funds that operate out of the United States only. It is one thing to seek investment opportunities being embedded in a region and immersed in the culture, but it is another to make investment decisions across the pond. The OZ Master Fund duplicates the strategies implemented by the various international offices; it is at the discretion of the managers to allocate capital to the various geographies. Put differently, the overall exposure to Asia is nearly $5 billion and to Europe about $9 billion, if one were to disregard who allocated the capital to these regions. Ideas generated by local investment teams in these markets contribute to the performance of the OZ Master Fund. Any good idea gets capital allocated, irrespective of where the fund is managed geographically. To be sure, the past four years have been challenging with investors shying away from exposure to hedge funds. However, in the long run, managers with a global footprint should benefit from a potential recovery more than hedge funds that lack local talent. We believe that Och-Ziff, with investment teams in London, Hong Kong, Beijing, and Mumbai, is better suited to explore regional opportunities than hedge funds that have either a few or no ‗boots on the ground‘. Local market knowledge and teams able to do due diligence should result in superior performance. Och-Ziff Capital Management GroupJuly 24, 2012

- 11. 11 We Expect Larger Funds to Attract the Bulk of Assets - Size Does Matter We believe Och-Ziff will benefit from a bias toward large hedge funds. Investors should favour larger, more stable funds with proven track records, thereby directing flows to established players such as Och- Ziff. Consistent performance will become increasingly important. We think that the Employee Retirement Income Security Act (ERISA) rules and plan asset regulations, which govern investments by pension funds, favour larger hedge funds, such as Och-Ziff. Being larger permits hedge funds to offer more strategies than smaller funds, utilizing a broader range of resources. This should ultimately lead to better performance. One of the goals of the Dodd-Frank Wall Street Reform and Consumer Protection Act was to force investment and commercial banks to either spin off or to shut down their proprietary trading desks. Despite the fact that banks will have until July 2014 to comply with Volcker Rules, most investment banks have already started implementing these rules. While some banks have spun off their ‗internal hedge funds‘, others have moved proprietary traders into their asset management divisions. Yet the best and brightest, having anticipated these changes and being unsure if the new bank business model would provide them the compensation that they were looking for, took matters into their own hands. This has led to a departure of talent. Consequently, there has been a number of hedge fund start ups competing for assets against established hedge fund industry veterans. However, a large number of hedge fund start ups have not been able to raise capital in excess of $500 million. Exhibit 7: Number of Single-manager Funds by AUM - Globally 3,864 1,109 1,012 1,015 512 338 322 - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 < $25m $25-$50m $51-$100m $101-$250m $251m-$500m $501m-$1b >$1b Source: PertTrac Consultants and advisors seem to agree that if a fund cannot grow its asset base above $500 million, then it will eventually end up liquidating. An article published by Bloomberg on March 6, 2012 made the point that a number of hedge funds that were started after the onset of the financial crisis are now shutting down as investors are pulling their assets. Hedge funds with a limited track record are struggling to raise capital. There is academic research that suggests a higher closure rate for large funds. Yet recent experience seems to point to a different outcome. Based on this Bloomberg article, new start-up funds were expected to revive the hedge fund industry in Asia after the events of 2008. Instead, hedge funds with more than $5 billion in AUM have lured the bulk of allocations. We believe that one reason for this development could be that fund of funds are early stage investors into these start ups. However, fund of funds have been experiencing outflows as investors decided to cut the middle man and to invest directly into hedge funds. This could explain why smaller hedge funds are having a hard time raising capital and why larger hedge funds are benefiting. Investors are more concerned about risk management, as we discuss later. Och-Ziff Capital Management GroupJuly 24, 2012

- 12. 12 Investors want to understand in detail their risk exposure. Research published by Hedge Fund Research shows that hedge funds with AUM over $5 billion drew 70% of the net capital raised in 2011 and about 80% in 2010. Whereas various surveys indicate that investors are willing to allocate capital to smaller hedge funds, the reality is that this willingness just remains an intention—a plan most investors do not follow through on. While some smaller hedge funds can generate the best returns, smaller hedge funds also produce the some of the worst returns in the industry. Consequently, the dispersion of returns is much larger for small hedge funds than for large hedge funds. We believe that institutional clients prefer consistently good returns. We believe that Employee Retirement Income Security Act (ERISA) rules and plan asset regulations, which govern investments by pension funds, favor larger hedge funds, such as Och-Ziff. The plan asset regulations provide as a general rule that if the equity participation in the hedge fund exceeds 25%, then the assets of the hedge fund would be considered ‗plan assets‘, and the hedge fund manager‘s activities would be subject to the general fiduciary requirements of Section 404 of ERISA. Thus, the ‗25% limit‘ restricts the size of assets that a specific hedge fund is willing to accept from a pension plan. Hedge funds have an incentive not to exceed the 25% rule. If hedge fund assets were deemed plan assets, then the manager would have to comply with rules such as restrictions on how performance fee is calculated, restrictions on investments (ability to hold assets outside the US could be limited), reporting requirements (could be asked to file periodic reports with the Department of Labor), and potential risk of liability if the fund enters into ‗prohibited‘ transactions, limits on the use of soft dollars and so on. Very few hedge funds would want to be caught up in this regulatory maze. We believe that this bodes well for Och-Ziff, the fifth-largest hedge fund in the US. It could attract more absolute dollars from a pension fund without triggering the 25% limit. There are other benefits to being large—size can be helpful in exploring different strategies during various economic cycles. Och-Ziff offers six different strategies across three different regions. Having more assets under management allows a company to support a larger number of investment professionals to explore various opportunities and allocate capital to the most promising strategies. Furthermore, large hedge funds are less reliant on incentive fees to pay their employees while a few years of bad performance could lead to an exodus of the best people. Thus, large hedge funds have an edge over their smaller competitors in hiring and retaining talent, which should lead to better performance over time and to growth in AUM. Finally, with better access to company management teams and bankers, traders, and sell side analysts working for broker-dealers, larger funds should have an informational advantage over smaller hedge funds. This too will help generating investment ideas and strong performance. The importance of being in the ‗information flow‘ should not be ignored. Bloomberg published an article in April 2012 that made this apparent. Two former proprietary traders, Pierre-Henri Flamand and Morgan Sze, left Goldman in 2010 to start their own hedge funds. Mr. Flamand was the global chief of the Principals Strategies Group while Mr. Sze ran the principal strategies group in Asia before taking over as global head of principal strategies after Mr. Flamand‘s departure. Both of them had initially very little problem raising $1 billion as investors knew about their track record and accomplishments. Mr. Flamand‘s Edoma Capital Partners lost about 2.4% from the time of inception in April 2011 to February 2012. Mr. Sze‘s Azentus Capital Management lost about 4.8% since its April 2011 inception through February 2012. The article cites that other Goldman traders, such as Daniele Benatoff, Ariel Roskis, and Elif Aktug, have also lost money for their investors since leaving Goldman Sachs. This, in our view, shows the importance of being in the ‗information flow‘. It is hard to generate strong returns without being able to rely on relationships that one can develop at large institutions. Size does matter. Some investors believe that size is a hindrance to performance. They argue that as a fund becomes larger, it becomes increasingly difficult to generate strong returns. We believe that this might not be true as an absolute statement. Take the Pure Alpha II fund, with $53 billion in AUM and a return of 23.5%. It was the third-best performing fund in the first 10 months of 2011 (data for full year 2011 was not available). It was beaten by Renaissance Institutional Equities funds, which has $7 billion in AUM and returned 33.1%, and the $6 billion Tiger Global fund, which returned 45%. Och-Ziff Capital Management GroupJuly 24, 2012

- 13. 13 Exhibit 8: Performance of Top 3 Large & Mid-sized Hedge Funds Large Hedge Funds Performance Fund Management Firm Strategy 10 Mths 2011 2010 AuM ($b) Tiger Global Tiger Global Management Long/short 45.0% 18.0% $6.0 Renaissance Institutional Equities Renaissance Technologies Quantitative 33.1% 16.4% $7.0 Pure Alpha II Bridgewater Associates Macro 23.5% 44.8% $53.0 Mid-Size Hedge Funds Performance Fund Management Firm Strategy 10 Mths 2011 2010 AuM ($m) Red Kite Compass RK Capital Management Commodities 47.0% n/a $400.0 Quantitative Tactical Aggressive Quantitative Investment Management Long/short 32.1% 15.2% $564.0 Zais Opportunity Zais Group Asset backed 27.9% 110.7% $358.2 Source: Bloomberg Bottom line: While there might be some challenges in implementing an investment strategy if a fund grows too large, the benefits of having more resources to generate new investment ideas should more than offset the implementation challenges. This should lead to better performance over time with less volatility. Investment teams‘ time is better utilized by focusing on generating investment ideas and not having to worry about running a business. Large hedge funds have the infrastructure to do that while employees of smaller hedge funds might have to wear multiple hats. And larger hedge funds have the resources to evaluate various investment opportunities across asset classes. The ability to move among strategies and to allocate capital to the most promising strategies is an important part of the Och-Ziff value proposition. Being large allows hedge fund managers to have dedicated product teams that can create new offerings to fulfil anticipated needs and seek out new opportunities while smaller funds concentrate on their core-product offerings only. We Expect Och-Ziff to Benefit from Increasing Demand for Transparency with Transparency and Risk Management Continuing to be Top Concerns for Investors Clients want to understand their risk. As a publicly traded company, Och-Ziff has to comply with rules and regulations that do not apply to privately owned hedge funds. We believe that this is appealing to clients that have to adhere to heightened fiduciary duties such as pension funds, endowments, and foundations. There has been an “institutionalization” of the hedge fund industry. With the importance of the high-net- worth client declining and more pension funds, endowments, and foundations allocating capital to hedge funds, risk management capabilities are becoming a key consideration – especially with the backdrop of the financial crisis. Being a public company, Och-Ziff had to make risk management a priority. We believe that having a strong risk management culture can provide additional comfort to potential investors which should help attract assets. Och-Ziff, being the only pure publicly traded hedge fund, discloses more information to its investors and the public than its privately held competitors. We believe that this can be an advantage in attracting assets from pension funds, endowments, and investors who have allocated capital to alternative UCITS and mutual funds. One of the recent trends has been that hedge funds have become increasingly institutionalized, i.e., the investor base has changed with high net-worth clients becoming less relevant. SEI‘s latest hedge fund investor survey found that institutional investors are willing to increase their exposure to hedge funds. While down from 54% in the previous year, 38% of investors said that they anticipate increasing their allocation to hedge funds in 2012. Investors are demanding an increased amount of data to assess the risk to their overall portfolio when they allocate assets to hedge funds. A recent survey by Absolute Return + Alpha showed that transparency and infrastructure were top-four considerations for investors when deciding on allocating assets to a specific hedge fund in 2011. Interestingly, transparency had climbed to the third spot on the key factors from the fifth spot. Och-Ziff Capital Management GroupJuly 24, 2012

- 14. 14 The lack of transparency is probably one of the reasons why fund of hedge funds (FoF) have been losing market share. The SEI survey showed that while 48.5% of investors used fund of hedge funds in 2010, the percentage of investors using FoF had dropped to 29.9% with single managers being the beneficiaries of this trend. Transparency helps institutional investors understand their exposure to risk under various scenarios. Besides providing data, access to investment teams and open communication about the investment objective are essential to investors these days. Exhibit 9: Investors Demand for Transparency – What Investors Want 0% 10% 20% 30% 40% 50% 60% Leverage detail Valuation methodology Riskanalytics Sectorlevel detail Positionlevel detail Hedging positions Geographic exposure Counterparty exposure Source: SEI Hedge Fund Investor Survey While generating strong performance remains a key factor in attracting assets, we believe that having a strong risk management culture and a robust infrastructure are essential in retaining these assets. These require increases in investments in compliance and infrastructure to support the more rigorous client requirements. Larger hedge funds have an advantage over the smaller funds that do not have a strong risk management culture or sophisticated risk management tools. Och-Ziff, being a public company, provides an additional assurance in that respect. A 2011 survey conducted by Ernst & Young revealed that the main reason for not hiring a specific hedge fund was a lack of adequate risk management. Clearly, with more pension funds, endowments, and foundations allocating capital to hedge funds and with the backdrop of the financial crisis, risk management capabilities are a key consideration. Being a public company, Och-Ziff has made risk management a priority. For one, it has to comply with rules such as Sarbanes-Oxley that other private hedge funds do not have to worry about. As part of becoming Sarbanes-Oxley compliant, companies had to produce lengthy documents describing risks and internal controls to detect issues related to operations and financial reporting. During the process of becoming compliant, a large number of companies introduced new internal controls or modified existing controls that were not deemed sufficient by their consultants. We believe that being compliant can provide additional comfort to potential investors. Och-Ziff has made not losing money for investors its top priority, and this is an essential part of its investment process. The company has a Risk Committee that meets on a regular basis to assess the portfolios and suggest corrective measures. The annual filings show that stress testing is an integral part of the portfolio evaluation process. Portfolio managers and analysts meet on a daily basis to review each position in each fund to determine inherent risk. Furthermore, the duties of the Risk Committee include a review of operational risks. As Och-Ziff puts it, risk management is in the DNA of the firm. After all, the company‘s value proposition is that it can produce positive returns on a consistent basis with low volatility compared to equity markets. Och-Ziff Capital Management GroupJuly 24, 2012

- 15. 15 Improved Investment Performance and the Associated Incentive Fees might not be Fully Priced into the Stock Och-Ziff has passed its high-water marks, offsetting the „disappointing‟ performance posted in 2011. We believe that it is going to earning incentive fees in 2012 in excess of what might be priced in the stock. As an alternative asset manager, Och-Ziff earns a management fee based on the assets it manages and an incentive fee based on the investment performance that it generates. Incentive fees will be charged to clients as soon as Och-Ziff generates positive returns, absent of any high-water marks. Growth in AUM and strong performance should lead to revenue and earnings growth. While lower management fees are priced into the stock—management fees have come down to 1.7% as the company has expended its credit offering, which have lower management fees and longer lock-up periods—we believe that the market has not priced in the performance that the company could generate in 2012, and thus, the incentive fee that it could earn. Since 1994, the OZ Master Fund has had three years of negative performance—in 2002, 2008, and 2011. Last year, the fund was down 0.48% resulting in high-water marks, i.e., a headwind to incentive income. All funds passed their water marks in the first quarter of 2012, and OZ Master Fund‘s year to date performance has been about 4.83% as of the June 30, 2012. We believe that the market is pricing in a performance of about 5% for 2012 and we see upside potential. Exhibit 10 shows a sensitivity analysis. Our conclusion is that valuation could increase if the company holds on to the performance that it has generated year to date. Exhibit 10: Sensitivity Table – Fund Performance & Earnings 2012 E Performance Assumed 2012 EPS Avg. Peer P/E Assumed 2012 P/E Price Target 0.00% $0.24 14.3x 14.3x $3.45 0.50% $0.27 14.3x 14.2x $3.82 1.00% $0.30 14.3x 14.2x $4.19 1.50% $0.32 14.3x 14.1x $4.56 2.00% $0.35 14.3x 14.0x $4.93 2.50% $0.38 14.3x 14.0x $5.29 3.00% $0.41 14.3x 13.9x $5.66 3.50% $0.44 14.3x 13.8x $6.03 4.00% $0.47 14.3x 13.7x $6.39 4.50% $0.49 14.3x 13.7x $6.75 5.00% $0.52 14.3x 13.6x $7.12 5.50% $0.55 14.3x 13.5x $7.48 6.00% $0.58 14.3x 13.5x $7.84 6.50% $0.61 14.3x 13.4x $8.20 7.00% $0.64 14.3x 13.3x $8.55 7.50% $0.67 14.3x 13.3x $8.91 8.00% $0.70 14.3x 13.2x $9.27 8.50% $0.73 14.3x 13.1x $9.62 9.00% $0.76 14.3x 13.0x $9.97 9.50% $0.80 14.3x 13.0x $10.32 10.00% $0.83 14.3x 12.9x $10.67 10.50% $0.86 14.3x 12.8x $11.02 11.00% $0.89 14.3x 12.8x $11.37 Note: Peers include BLK, TRWO, IVZ, LM, BEN, WDR, JNS, EV, FII, AB, ART, AMG, CNS, CLMS, GBL, PZN as Och-Ziff has been trading in line with traditional asset managers based on average historical multiples. Pricing and consensus estimates based on FactSet data; Priced as of market close July 20, 2012 ET. Source: FactSet; RBC Capital Markets estimates Och-Ziff Capital Management GroupJuly 24, 2012

- 16. 16 We arrive at our 5% implied performance estimate by referencing the current valuation of about $7. Historically, Och-Ziff has traded at a 5% discount to the average P/E multiple of traditional asset managers. Assuming that this still holds true, one would expect Och-Ziff to earn about $0.52 for 2012. The company could get there if it generates performance of about 5% for the full year of 2012. So far, the performance has been north of 4.5% year to date (or roughly 9% annualized), and we believe that Och-Ziff can generate returns of about 8% for 2012. Assuming that the funds continue to perform well, incentive income could drive full-year 2012 earnings thereby resulting in higher stock valuation. Based on an 8% performance, the stock could be trading close to $9 by the end of the year. We arrive at $9 by applying $0.70 of estimated 2012 earnings a peer P/E multiple of 13.2x. Another way of looking at current valuation is that based on the current stock price of around $7, the implied P/E on earnings of $0.70 would be around 10x. Traditional asset managers are trading around 14.3x. Based on this approach, Och-Ziff would be trading at a discount of 30% to traditional asset managers. Och-Ziff Capital Management GroupJuly 24, 2012

- 17. 17 Financial Analysis Recent Results Och-Ziff executed on its promise to improve performance in the March 2012 quarter. The company reported that its flagship OZ Master Fund, the European and Asian funds, and the OZ Global Special Investments Master Fund were up 5% through April 30, 2012. This was welcome news as 2011 had been a difficult year for the company and the industry. Clearly, all funds were past their high-water marks in the March quarter, thereby putting the company back on path of earning incentive fees in the fourth quarter of 2012. Exhibit 11 below shows that 2011 was only the third time since inception that the company had negative returns. We estimate that the total return since inception is about 14% for the OZ Master Fund. Exhibit 11: Performance Since Inception Performance - OZM vs. S&P 500 (50%) (40%) (30%) (20%) (10%) 0% 10% 20% 30% 40% 50% 1994 1997 2000 2003 2006 2009 1Q12 OZ Master Fund S&P 500 Source: Company reports, FactSet We would argue that there are only two factors that matter in the hedge fund world today: fund performance and, more recently, size. According to data by eVestment, the first quarter of 2012 saw a bifurcation. Hedge funds that had more than $1 billion in assets under management received 78% of the net flows in the quarter. However, performance, once again, trumped size. Based on the data, about 60% of the funds that had negative performance in 2011 had outflows irrespective of size. This is probably why Och- Ziff had an aggregate $600 million of outflows in the first four months of the current year. The company disclosed that assets under management stood at $29.8 billion as of May 1, 2012. Had it not been for the strong performance, which added about $1.6 billion to assets, AUM would have decreased to $28.2 billion. Having said that, we would expect flows to improve as performance improves. The first quarter was a good start in that respect with a 5% return. And while the S&P 500 was up 11% for the same time period, Och- Ziff achieved its returns with 36% of the volatility of the S&P 500 index. This is the company‘s value proposition—generating returns while protecting investors from the down-side risk. Och-Ziff Capital Management GroupJuly 24, 2012

- 18. 18 Exhibit 12: Net Flows ($ millions) ($1,165) $4,569 $3,117 $4,135 ($722) $2,693 $1,116 ($63) $7,592 ($8,053) ($10,000) ($8,000) ($6,000) ($4,000) ($2,000) $0 $2,000 $4,000 $6,000 $8,000 $10,000 2003 2004 2005 2006 2007 2008 2009 2010 2011 1Q12 Net Flows Source: Company reports To be sure, recent flows have lagged what the company was able to generate from 2004 to 2007, the year it went public. However, given the size of Och-Ziff—it is the third-largest US hedge fund—we would expect flows to improve as performance improves. Nonetheless, there could be some headwinds in the short run. While Och-Ziff recorded outflows in January 2012, flows turned positive in February and March, thereby resulting in total net inflows of $902 million for the past four quarters ending in 1Q12. However, once again, flows turned negative in April of 2012. Management still has some heavy lifting to do in attracting assets and convincing clients that performance is picking up again. In the aftermath of the financial crisis, fund of hedge funds have been losing assets. This is a trend that we believe will continue given the increased focus on transparency. Instead of using fund of funds as an investment vehicle, entities such as pension plans, foundations, endowments, private banks, and family offices have started investing directly in hedge funds. In addition to targeting these clients, Och-Ziff is also shifting its focus and putting more capital to work in US-structured credit and Asian long/short strategies. Exhibit 13 shows the increase in funds being allocated to US structured credit. Exhibit 13: Asset Allocation by Strategy OZ Master Fund by Investment Strategy 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 Long/Short Equity Special Situation 30% 36% 40% 35% 22% 24% 37% Structured Credit 15% 17% 17% 19% 18% 18% 26% Convertible and Derivative Arbitrage 18% 17% 17% 16% 13% 14% 15% Corporate Credit / Credit 11% 12% 12% 15% 12% 13% 13% Private Investments 10% 7% 7% 7% 7% 6% 6% Merger Arbitrage 7% 6% 7% 2% 3% 4% 3% Cash / Other 9% 5% 0% 6% 25% 21% 0% Source: Company reports Fund flows follow performance. It will be critical for Och-Ziff to continue improving performance in 2012 to reverse the trend in flows we have seen in the first four months of 2012. Financial Projections We are expecting Och-Ziff to increase its total AUM at year end from $28.8 billion in 2011 to $30.8 billion in 2012 and $36.2 billion in 2013, driven by increasing secular client demand for absolute return strategies. We expect most of the increase to be within Och-Ziff's flagship OZ Master Fund, with AUM to increase from $20.2 billion in 2011 to $21.4 billion in 2012 and $25.2 billion in 2013. Och-Ziff Capital Management GroupJuly 24, 2012

- 19. 19 Exhibit 14: AUM Roll Forward Assets under management ($ in billion) 2010A 2011A 2012E 2013E Beginning of period balance $23.1 $27.9 $28.8 $30.8 Net flows 2.7 1.1 (0.3) 1.2 Market appreciation / (depreciation) 2.2 (0.3) 2.3 4.3 End of period balance $27.9 $28.8 $30.8 $36.2 Source: Company reports, RBC Capital Markets Estimate We are forecasting revenues (economic income basis) to increase from $0.6 billion in 2011 to $0.8 billion in 2012 and $1.2 billion in 2013, mainly due to expectations for significantly higher incentive income, as well as increased management fees. As a result of a higher portion of revenues being derived from incentive income, we believe pre-tax margins (economic income basis) will increase from 49.5% seen in 2011 to 55.6% in 2012 and 61.3% in 2013. We expect Och-Ziff to generate $434.1 million in economic income in 2012 and $738.5.1 million in 2013, compared to economic income of $273.8 million in 2011. Our distributable EPS estimate for 2012 and 2013 is $0.70 per share and $1.16 per share, respectively. This compares to distributable EPS of $0.48 in 2011. Valuation Valuation Methodology Och-Ziff has traded at a wide range of forward looking P/E multiples since the shares have floated. Exhibit 15 below shows the range since 2008. Exhibit 15: Och-Ziff Forward Looking P/E multiples 0x 5x 10x 15x 20x 25x 30x 35x 40x 45x 50x Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Source: Bloomberg; RBC Capital Markets On a relative basis, Och-Ziff has been trading at a premium to the S&P 500 in 2009. Lately, it has been trading at a discount to the S&P 500. Och-Ziff Capital Management GroupJuly 24, 2012

- 20. 20 Exhibit 16: Och-Ziff Forward Looking P/E Relative to S&P 500 Index 0.3x 0.8x 1.3x 1.8x 2.3x 2.8x Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Source: Bloomberg; RBC Capital Markets More recently, Och-Ziff has been trading in line with other alternative asset managers. Exhibit 17: Och-Ziff Forward Looking P/E Relative to RBC Alternative Asset Managers Index 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 5.0x Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Sep-10 Jan-11 May-11 Sep-11 Jan-12 May-12 Note: RBC Alternative Asset Managers Index includes APO, BX, KKR and FIG Source: Bloomberg; RBC Capital Markets We value Och-Ziff on a ―one plus a half‖ methodology, which is a deviation from the valuation approach we have used for traditional asset managers. Under this method, earnings derived from asset management fees are valued using a peer multiple, while earnings attributed to incentive income are valued at a discount. Management fees earned by Och-Ziff are higher than that earned by traditional long only fund managers, potentially justifying a premium to peer P/E multiples. However, we believe that lack of scale offsets the benefits of higher fees. Thus, we are using the peer multiple to value peer asset management fees, as we do not think higher fees would result in higher margins for Och-Ziff. We apply a 50% discount to earnings related to incentive income. We believe a discount is justified as performance fees are more volatile than management fees. Our price target for Och-Ziff is $10. On average, Och-Ziff has traded at a 5% discount to traditional asset managers. We arrive at our price target using a price-to-earnings multiple of 11.7x on 2013 estimated management fee earnings of $0.54 per share. We value earnings based on management fees at $6.27. Furthermore, we value incentive income based on a price-to-earnings multiple of 5.8x and 2013E incentive income EPS of $0.63. The multiple of 5.8x represents a 50% discount to the management fee multiple. We value earnings based on incentive income at $3.65 per share. The sum of the two valuations leads us to our price target of $10 for Och-Ziff. Och-Ziff Capital Management GroupJuly 24, 2012

- 21. 21 Exhibit 18: Valuation Valuation 2013 Management Fee EPS $0.54 P/E Multiple 11.7x Per Share $6.27 2013 Incentive Income EPS $0.63 P/E Multiple 5.8x Per Share $3.65 Price Target $10 Source: FactSet; RBC Capital Markets estimates Market Sensitivity Analysis Our EPS sensitivity analysis to equity market movements starts with our published estimates as the base case. Our base case assumes uniform market appreciation, with OZ funds generating returns of 13% in 2013. We believe these assumptions are in line with long-term historical average returns. For the bull case scenario, we assume OZ funds will generate returns of 19%. For the bear case, we zero returns for 2013 and no incentive income. Exhibit 19: EPS Sensitivity to Equity Market Movements Scenario Implied 2013 P/E 2013 Peer P/E (Discount)/ Premium 2013 EPS PT Base Case 8.6x 12.3x -30% $1.16 $10 Bear Case 12.3x 12.3x 0% $0.39 $5 Bull Case 7.7x 12.3x -37% $1.56 $12 Source: RBC Capital Markets estimate Och-Ziff Capital Management GroupJuly 24, 2012

- 22. 22 Exhibit 20: Valuation Matrix Market Current 52-week Div. Enterprise YTD YTD Company Ticker Cap ($m) Price High Low Yield Value ($m) 2012E 2013E 2012E 2013E 2011A 2012E 2013E EV/AuM P/AuM Price Perf. Total Return Traditional Asset Managers BlackRock BLK $24,213 $173.31 $209.37 $137.00 3.46% $33,397.86 $13.08 $14.59 13.2x 11.9x 9.2x 9.1x 8.2x 0.009x 0.007x (2.8%) (1.1%) T.Rowe Price TROW 15,681 61.47 $66.00 $44.68 2.21% $15,111.57 3.27 3.76 18.8x 16.3x 11.6x 10.4x 9.2x 0.027x 0.028x 7.9% 9.1% INVESCO IVZ 9,655 21.54 $26.94 $14.52 3.20% $10,680.89 1.82 2.10 11.9x 10.2x 9.2x 9.0x 8.0x 0.016x 0.014x 7.2% 8.6% Legg Mason LM 3,616 25.61 $32.58 $22.36 1.72% $3,499.53 1.67 2.27 15.4x 11.3x 7.3x 6.7x 6.1x 0.005x 0.006x 6.5% 7.2% Franklin Resources BEN 23,746 110.35 $135.21 $87.71 0.98% $19,075.69 8.92 9.74 12.4x 11.3x 6.7x 6.7x 6.2x 0.026x 0.033x 14.9% 15.4% Waddell & Reed WDR 2,457 28.46 $38.73 $22.85 3.51% $2,023.61 2.21 2.44 12.9x 11.6x 6.5x 6.2x 5.6x 0.022x 0.026x 14.9% 16.8% Janus Capital Group Inc. JNS 1,361 7.22 $9.70 $5.36 3.32% $1,401.99 0.57 0.68 12.7x 10.6x 4.0x 5.0x 4.6x 0.009x 0.008x 14.4% 16.1% Eaton Vance Corp. EV 3,054 26.43 $29.64 $20.07 2.88% $3,642.09 1.83 2.04 14.4x 13.0x 8.0x 8.7x 8.3x 0.018x 0.015x 11.8% 13.4% Federated Investors, Inc. FII 2,158 20.71 $23.89 $14.36 4.64% $2,115.35 1.64 1.76 12.6x 11.8x 7.7x 7.1x 6.7x 0.006x 0.006x 36.7% 40.0% AllianceBernstein AB 1,260 11.98 $18.76 $11.55 8.68% $1,220.60 1.04 1.17 11.5x 10.3x 2.5x 2.6x 2.5x 0.003x 0.003x (8.4%) (5.9%) Artio Global Investors ART 187 3.14 $11.22 $2.83 2.55% $164.13 0.16 0.04 19.8x n/m 1.2x 10.0x n/m 0.006x 0.007x (35.7%) (34.4%) Affiliated Manager Group AMG 5,528 107.63 $115.66 $70.27 0.00% $7,276.03 7.28 8.58 14.8x 12.5x 14.9x 13.3x 11.3x 0.020x 0.015x 12.2% 12.2% Cohen & Steers CNS 1,377 31.91 $40.93 $23.79 2.26% $1,242.58 1.63 1.93 19.5x 16.5x 15.3x 10.9x 9.5x 0.028x 0.031x 10.4% 11.7% Calamos CLMS 221 10.85 $14.66 $9.40 3.50% $113.22 0.92 0.89 11.9x 12.3x 0.7x 0.9x 0.8x 0.003x 0.006x (13.3%) (11.9%) GAMCO GBL 1,214 45.57 $52.98 $35.81 0.35% $1,169.06 3.13 3.30 14.6x 13.8x 9.2x 8.4x 7.8x 0.032x 0.033x 4.8% 5.6% Pzena Investment Mgmt PZN 266 4.11 $7.39 $3.18 2.92% $268.93 0.33 0.39 12.3x 10.5x 6.2x 6.8x 6.5x 0.018x 0.018x (5.1%) (1.3%) Mean 2.89% 14.3x 12.3x 7.5x 7.6x 6.7x 0.016x 0.016x 4.8% 6.3% Median 2.90% 13.1x 11.8x 7.5x 7.8x 6.7x 0.017x 0.015x 7.6% 8.9% Min 0.00% 11.5x 10.2x 0.7x 0.9x 0.8x 0.003x 0.003x (35.7%) (34.4%) Max 8.68% 19.8x 16.5x 15.3x 13.3x 11.3x 0.032x 0.033x 36.7% 40.0% Alternative Asset Managers Och-Ziff OZM $2,920 $7.05 $13.23 $6.56 5.67% $2,493.47 $0.48 $1.15 6.2x 5.4x 8.9x 3.6x 3.3x 0.083x 0.097x (16.2%) (14.8%) Apollo Global Manager APO 1,696 13.41 $17.94 $8.85 7.46% $7,415.10 (0.86) 2.22 6.0x 4.6x -24.3x 7.8x 6.1x 0.086x 0.020x 8.1% 14.9% Blackstone BX 6,727 13.15 $17.78 $10.51 3.04% $23,469.76 (0.57) 1.47 9.0x 6.4x 46.7x 38.3x 28.3x 0.123x 0.035x (6.1%) (4.0%) KKR KKR 3,253 14.00 $16.10 $8.95 4.29% $43,312.58 0.73 2.06 6.8x 6.4x 73.7x 156.8x 102.3x 0.695x 0.052x 9.1% 12.7% Fortress Investment Group FIG 1,950 3.79 $4.79 $2.67 5.28% $2,518.22 0.46 0.41 9.2x 6.9x 11.0x 10.4x 7.6x 0.054x 0.042x 12.1% 15.3% Mean 5.15% 7.4x 5.9x 23.2x 43.4x 29.5x 0.208x 0.049x 1.4% 4.8% Median 5.28% 6.8x 6.4x 11.0x 10.4x 7.6x 0.086x 0.042x 8.1% 12.7% Min 3.04% 6.0x 4.6x -24.3x 3.6x 3.3x 0.054x 0.020x (16.2%) (14.8%) Max 7.46% 9.2x 6.9x 73.7x 156.8x 102.3x 0.695x 0.097x 12.1% 15.3% S&P 500 SP50 $12,316,922 $1,362.66 $1,422.38 $1,074.77 2.21% $96.42 $104.26 14.1x 13.1x 8.4% 8.4% S&P 500 / Asset Mgmt & Custody Banks SPT30 134,632 120 138.27 94.63 2.53% 9.84 10.32 12.7x 12.1x 5.3% 5.3% S&P Comp. 1500 / Asset Mgmt & Custody Banks SPT29 154,759 131 149.00 102.23 2.59% 10.56 11.04 12.8x 12.3x 6.3% 6.3% S&P Mid Cap 400 / Asset Mgmt & Custody Banks SPT31 16,977 225 245.14 168.41 2.50% 16.40 16.85 14.0x 13.6x 14.7% 14.7% S&P 500 / Financials SP621 1,737,330 $193.42 215.37 151.85 2.07% 14.57 17.63 13.5x 11.2x 10.4% 10.4% CurrentP/EConsensus CY EPS EV/EBITDA Consensus Asset Management Research Source: FactSet (Priced as of market close July 20, 2012 ET); RBC Capital Markets Och-Ziff Capital Management GroupJuly 24, 2012

- 23. 23 Company Description Och-Ziff Capital Management Group (NYSE:OZM) is an international investment-management firm providing asset-management services primarily to institutional investors globally through its hedge funds and other alternative investment vehicles. Och-Ziff‘s goal is to deliver positive returns in any market with less volatility than that of the S&P 500 Index. The company prides itself on being one of the larger alternative asset managers in the world, and as of May 1, 2012, it had approximately US$29.8 billion of assets under management spread across long/short equity special situations, structured credit, convertible and derivative arbitrage, corporate credit, private investment, merger arbitrage, and real estate strategies. Och-Ziff is the only publicly traded, pure, hedge fund manager. The company was founded in 1994 by Daniel Och with an initial seed investment of $100 million from Ziff Brothers Investment LLC. Prior to founding Och-Ziff, Mr. Och had been with Goldman Sachs for 11 years working in the risk arbitrage department; he was later promoted co-head of US Equities Trading and head of Proprietary Trading at Goldman Sachs‘ equities division. Och-Ziff completed an initial public offering on November 14, 2007 and listed its shares on the NYSE at a price of $32. Och-Ziff was one of the few alternative asset managers to complete its IPO before the onset of the global financial crisis. As of December 31, 2011, Och-Ziff had 434 employees, including 131 investment professionals and 17 executive managing directors, working from its headquarters in New York and offices in London, Hong Kong, Mumbai, and Beijing. The company‘s London office houses its European investment team while the majority of the Asian investment team works out of the Hong Kong office. Och-Ziff has one reporting segment, the Och-Ziff Funds segment that offers asset management services to its hedge funds and other alternative investment vehicles. Other operations consists of a real estate business that offers asset management services to the company‘s real estate funds, and managing investments in businesses established to increase Och-Ziff‘s private-investment platform. Exhibit 21: Organizational Structure Och-Ziff Capital Management Group LLC (NYSE: OZM) Och-Ziff Corp Och-Ziff Holding OZ Management OZ Advisors I OZ Advisors II Source: Company reports Och-Ziff Capital Management Group LLC is the holding company listed on NYSE. Its main assets are the ownership interests in the Och-Ziff Operating Group entities, which are indirectly owned through Och-Ziff Corp. and Och-Ziff Holding, i.e., the general partners. The general partners control the business and affairs of the Och-Ziff Operating Group. Principal operations are conducted through Och-Ziff Operating Group. Och-Ziff Capital Management GroupJuly 24, 2012

- 24. 24 Share Structure Class A shares were issued to the public through an initial public offering (IPO) in November 2007 and are publicly traded on the New York Stock Exchange. Class A shares provide economic interest, i.e., pay dividends out of the holding company. In addition, Class A shares holders are entitled to one vote per share. Class B shares are held by the partners. Class B shares have no economic rights, i.e., holders of Class B shares do not receive dividends. Class B shares merely provide the partners with a voting interest in the management company. Group A units are held by the partners and the Ziff family. Prior to going public, partners and the Ziff family collectively owned 100% of the Och-Ziff Operating Group. As part of the initial offering, each partner and the Ziffs were issued Och-Ziff Operating Group A units. These Group A units provide economic interest, but in contrast to Class A shares, dividends are being paid at the operating group level (OZ Management, OZ Advisors I, OZ Advisors II). This structure was set up in order to minimize the tax impact on earnings of the partners and the Ziff family. Group A units are exchangeable to Class A shares after certain criteria have been met, including minimum retained ownership requirements by the partners. Economic Interest Class A shares represent approximately 31.9% economic interest in the Och-Ziff Operating Group entities (OZ Management, OZ Advisors I, OZ Advisors II) and 100% of economic interest at the holding company (Och-Ziff Capital Management Group LLC). Class A shares are entitled to 100% of any distribution declared by the board of directors for Och-Ziff Capital Management Group. Put differently, unlike Group A Unit holders, the publicly traded Class A shares receive their dividends at the holding company level. In contrast, the partners and the Ziff family who hold all Group A units receive distributions at the operating group level. This structure provides Group A Unit holders with tax benefits on the 68.1% of economic interest that they hold. The Class A shareholder and the partners receive distributions pro rata based on their equity ownership in Och-Ziff. Voting Rights The Class A shares hold 33.7% of the total combined voting power. Class B shares provide the partners with a voting interest in the management company commensurate with their economic interests in the business. Class B shares represent 66.3% of the total combined voting power as of December 31, 2011. Through a proxy granted by the partners to Mr. Och, he can control how all Class B Shares are voted. Thus, the partners and the Ziff family are on par with public shareholders for the following reason: Their Class B shares in combination with their Group A units, give them voting rights and economic interest in Och-Ziff. As of December 31, 2011, these Group A units represented 68.1% equity interest in the Och-Ziff Operating Group and provide the partners and the Ziff family with a 66.3% combined voting power. Och-Ziff Capital Management GroupJuly 24, 2012

- 25. 25 Fund Investors The company‘s global base of clients includes pension funds, fund of funds, foundations, endowments, corporations, other institutions, private banks, and family offices. Exhibit 22: Investors by Type, as of December 31, 2011Investors by Type (Dec 31, 2011) Pensions 28% Fund-of- Funds 18% Foundation and Endowment 14% Corporate, Institution al and Other 12% Private Banks 12% Related Parties 9% Family Offices and Individuals 7% Source: Company reports Exhibit 23: AUM Breakdown by Investor Type, as December 31, 2011 Institutional 93% Retail / HNW 7% Note: Retail includes family offices and individuals. Source: Company reports, RBC Capital Markets Och-Ziff Capital Management GroupJuly 24, 2012

- 26. 26 Exhibit 24: OZ Master Fund by Investment Strategy, as of December 31, 2011 Cash 21% Equities 24% Fixed Income 31% Alternatives / Other 24% Note: Represents AUM strategy breakdown for the OZ Master Fund, which represents 70% of AUM. Fixed Income includes structured credit. Alternatives/Other includes: private investments, merger arb, convertible and derivative arb. Source: Company reports, RBC Capital Markets The vast majority of Och-Ziff‘s clientele are domestic. About 72% of Och-Ziff‘s investors are based in North America versus 28% for the rest of the world. Exhibit 25: Investors by Geography, as of December 31, 2011 Asia 11% North America 72% Europe 17% Note: AUM breakdown by client domicile. Source: Company reports, RBC Capital Markets Och-Ziff Funds The company‘s funds are organized using a ‗master-feeder‘ structure. The feeder funds are structured to meet the needs of various groups of investors and are separate legal entities. These feeder funds enable various types of investors across the globe to invest in a hedge fund in a tax efficient manner. The feeder funds take into consideration the regulatory constraints of various types of investors. Och-Ziff‘s clients invest into these feeder funds, which in turn hold direct or indirect interest in a master fund. The master fund and its subsidiaries are the primary investment vehicle for the feeder funds, that is, it is the only vehicle to invest in the master fund. All funds are managed by the Och-Ziff Operating Group. The company currently manages four main investment funds representing about 87% of assets under management as of December 31, 2011. These funds invest across multiple strategies as outlined in the Investment strategies section. OZ Master Fund: This multi-strategy fund is Och-Ziff‘s flagship fund. As of December 31, 2011, assets under management were $20.2 billion representing 70% of the total AUM. The OZ Master Fund allocates capital in North America, Europe, and Asia with investments mirroring those made in the OZ Europe Och-Ziff Capital Management GroupJuly 24, 2012

- 27. 27 Master Fund and the OZ Asia Master fund. About 52% of assets were invested in the Americas while 31% were invested in Europe, the Middle East, and Africa (EMEA) and 17% in Asia and Australia. Exhibit 26: OZ Master Fund Allocation, as of December 31, 2011OZ Master Fund Allocation (Dec 31, 2011) Merger Arbitrage 4% Private Investment 6% Credit 13% Convertible and Derivative Arbitrage 14% Structured Credit 18% Cash 21% Long/Short Equity 24% Source: Company reports OZ Europe Master Fund: A multi-strategy fund with assets under management of $2.3 billion as of December 31, 2011. The OZ Europe Master Fund constituted 8% of the total AUM. The fund allocates capital between the convertible, credit, long/short equity, merger arbitrage, private investments, and structured credit strategies. Geographic exposure includes Europe, Africa, and the Middle East. OZ Asia Master Fund: A multi-strategy fund that allocates capital among the different investment strategies in Asia, Australia, and New Zealand. As of December 31, 2011, AUM of $1.6 billion represented 6% of total AUM. OZ Global Special Investments Master Fund: With $1 billion of AUM as of December 31, 2011, the fund constituted 3% of the total AUM. The fund has a higher concentration of longer-term investments than the investments that the company makes in other funds. This fund invests globally in private investments, the various investment strategies described below, and allocates capital to the private-investment platform that Och-Ziff is developing. The majority of capital in this fund has been contributed by the partners of the firm. Other: The remaining 13% of the total AUM as of December 31, 2011 comprised of real estate funds and other alternative investment vehicles managed by the company. The real estate funds invest in commercial and residential real estate in North America, including real property, multi-property portfolios, real estate related joint ventures, real estate operating companies, and other real estate related assets. As of December 31, 2011, Och-Ziff‘s other funds managed assets worth US$3.7 billion. Och-Ziff Capital Management GroupJuly 24, 2012